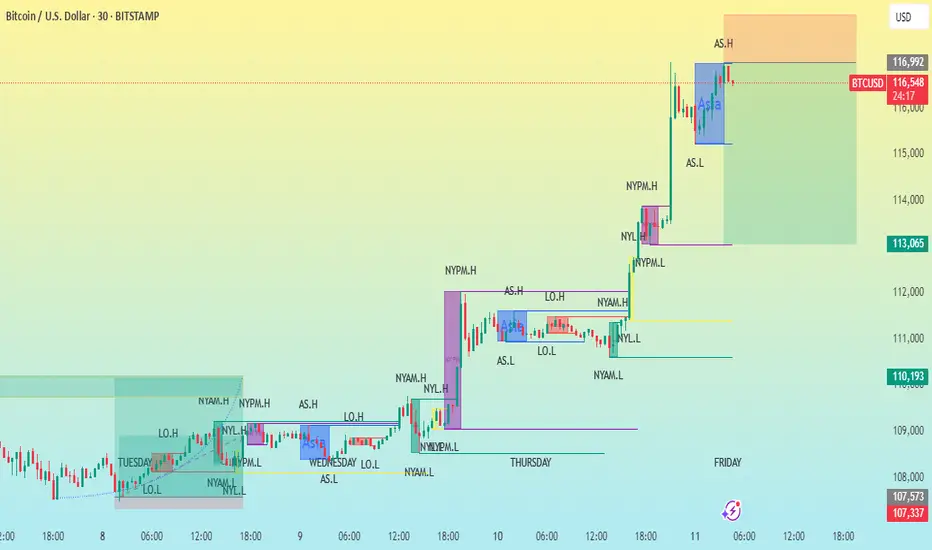

This chart shows the price action of Bitcoin (BTC/USD) on a 30-minute timeframe, with a variety of session-specific high and low labels and possible trade setup zones. Here's a breakdown of the key components and what they indicate:

---

1. Timeframe & Instrument

Instrument: Bitcoin vs. U.S. Dollar (BTC/USD)

Timeframe: 30-minute candles

Exchange: Bitstamp

Date Range: July 8–11, 2025

---

2. Session Labels

The chart includes key session high/low markers which are common in institutional trading analysis:

NYAM.H / NYAM.L: New York AM session High/Low

NYPM.H / NYPM.L: New York PM session High/Low

AS.H / AS.L: Asia session High/Low

LO.H / LO.L: London Open High/Low

NYL.H / NYL.L: New York Lunch High/Low

These session levels are often used to identify liquidity pools or areas where price might react due to prior institutional activity.

---

3. Trade Setup Zones

Orange box (top): Likely a sell-side liquidity or resistance zone, possibly a target for a long trade.

Green box (bottom): Likely a buy-side liquidity or support zone, possibly a stop loss or retracement target.

These zones often represent risk-reward blocks based on prior session data or imbalance fill areas.

---

4. Price

Current Price: ~$116,586

Recent High (AS.H): $116,992

Key Support Levels: $113,065 and $110,193 (from prior session lows)

---

5. Price Structure

The chart shows a clear uptrend, with higher highs and higher lows.

Breakouts followed by consolidations near session highs suggest bullish momentum.

Potential continuation of the uptrend unless the price breaks below the previous session low (marked NYPM.L or NYL.L).

---

Conclusion

This is a well-marked institutional-style price action chart, likely using ICT (Inner Circle Trader) or SMC (Smart Money Concepts) principles. It’s showing bullish strength with multiple liquidity grabs followed by expansions to the upside. Key levels for future movement include:

Break and close above AS.H → Potential continuation toward next liquidity zone.

Drop below NYPM.L or NYL.L → Potential reversal or retracement.

Let me know if you'd like help planning a trade based on this chart!

---

1. Timeframe & Instrument

Instrument: Bitcoin vs. U.S. Dollar (BTC/USD)

Timeframe: 30-minute candles

Exchange: Bitstamp

Date Range: July 8–11, 2025

---

2. Session Labels

The chart includes key session high/low markers which are common in institutional trading analysis:

NYAM.H / NYAM.L: New York AM session High/Low

NYPM.H / NYPM.L: New York PM session High/Low

AS.H / AS.L: Asia session High/Low

LO.H / LO.L: London Open High/Low

NYL.H / NYL.L: New York Lunch High/Low

These session levels are often used to identify liquidity pools or areas where price might react due to prior institutional activity.

---

3. Trade Setup Zones

Orange box (top): Likely a sell-side liquidity or resistance zone, possibly a target for a long trade.

Green box (bottom): Likely a buy-side liquidity or support zone, possibly a stop loss or retracement target.

These zones often represent risk-reward blocks based on prior session data or imbalance fill areas.

---

4. Price

Current Price: ~$116,586

Recent High (AS.H): $116,992

Key Support Levels: $113,065 and $110,193 (from prior session lows)

---

5. Price Structure

The chart shows a clear uptrend, with higher highs and higher lows.

Breakouts followed by consolidations near session highs suggest bullish momentum.

Potential continuation of the uptrend unless the price breaks below the previous session low (marked NYPM.L or NYL.L).

---

Conclusion

This is a well-marked institutional-style price action chart, likely using ICT (Inner Circle Trader) or SMC (Smart Money Concepts) principles. It’s showing bullish strength with multiple liquidity grabs followed by expansions to the upside. Key levels for future movement include:

Break and close above AS.H → Potential continuation toward next liquidity zone.

Drop below NYPM.L or NYL.L → Potential reversal or retracement.

Let me know if you'd like help planning a trade based on this chart!

t.me/+vT7LZx7w13BlNjI0

✅ XAUUSD SIGNALS

💯JOIN FREE TELEGRAM CHANNEL

t.me/+vT7LZx7w13BlNjI0

✔REGISTERED broker

partners.vantagemarkets.com/ib-cpa-register/?url=ib&affid=7264705

✔Referral code 72647

✅ XAUUSD SIGNALS

💯JOIN FREE TELEGRAM CHANNEL

t.me/+vT7LZx7w13BlNjI0

✔REGISTERED broker

partners.vantagemarkets.com/ib-cpa-register/?url=ib&affid=7264705

✔Referral code 72647

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

t.me/+vT7LZx7w13BlNjI0

✅ XAUUSD SIGNALS

💯JOIN FREE TELEGRAM CHANNEL

t.me/+vT7LZx7w13BlNjI0

✔REGISTERED broker

partners.vantagemarkets.com/ib-cpa-register/?url=ib&affid=7264705

✔Referral code 72647

✅ XAUUSD SIGNALS

💯JOIN FREE TELEGRAM CHANNEL

t.me/+vT7LZx7w13BlNjI0

✔REGISTERED broker

partners.vantagemarkets.com/ib-cpa-register/?url=ib&affid=7264705

✔Referral code 72647

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.