Generally, price action traders believe that price discounts every factor that may influence a security's price.

But you should Not Ignore Major (High Impact) Economic News Announcements like:

Interest Rate decisions, Non-Farm Payroll, FOMC, Crude Oil inventories, and so on...

REASON:

- If you did take a trade in line with the result of the economic news release you stand to make a lot more money in a very short period of time.

- But if your trade direction was against the news, you can walk away with all your profits wiped out or even a loss, and the loss can be huge because markets can move so fast during that period that your stop loss might not get triggered; so you end up losing much more of what you intended to lose.

WHAT TO DO?

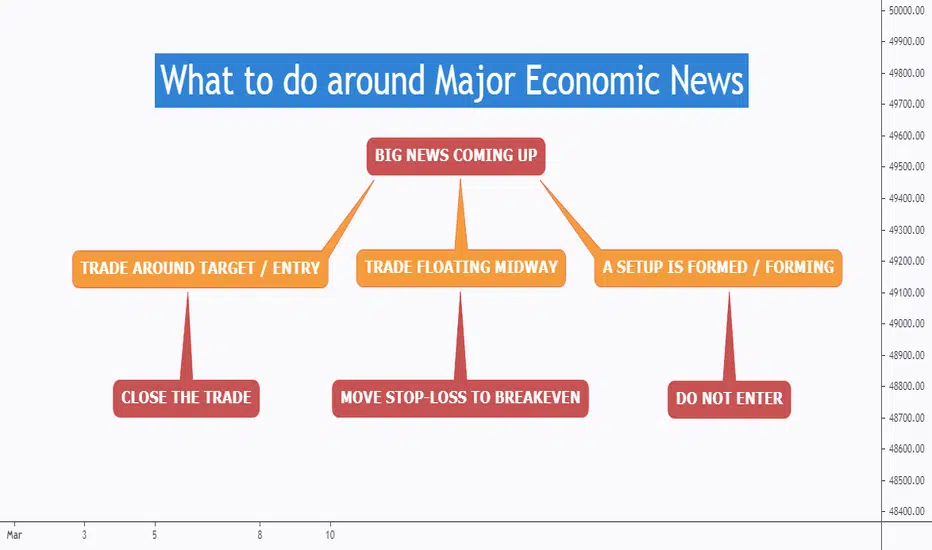

As per my trading plan, I check the news calendar every Monday, and before the news release, I follow the table as per the picture above.

Always think in terms of Risk vs Reward.

For example:

I always target (+2R) double the stop loss size and let's say my trade is floating around +1.8R

If the news was in my favor, I would earn that extra +0.2R

But if the news was against my trade direction, I would lose the 1.8R

In this particular example

Risk (losing 1.8R) >>> Reward (earning extra 0.2R)

so I close the trade before the news release and book that +1.8R

All Strategies Are Good; If Managed Properly!

~Rich

But you should Not Ignore Major (High Impact) Economic News Announcements like:

Interest Rate decisions, Non-Farm Payroll, FOMC, Crude Oil inventories, and so on...

REASON:

- If you did take a trade in line with the result of the economic news release you stand to make a lot more money in a very short period of time.

- But if your trade direction was against the news, you can walk away with all your profits wiped out or even a loss, and the loss can be huge because markets can move so fast during that period that your stop loss might not get triggered; so you end up losing much more of what you intended to lose.

WHAT TO DO?

As per my trading plan, I check the news calendar every Monday, and before the news release, I follow the table as per the picture above.

Always think in terms of Risk vs Reward.

For example:

I always target (+2R) double the stop loss size and let's say my trade is floating around +1.8R

If the news was in my favor, I would earn that extra +0.2R

But if the news was against my trade direction, I would lose the 1.8R

In this particular example

Risk (losing 1.8R) >>> Reward (earning extra 0.2R)

so I close the trade before the news release and book that +1.8R

All Strategies Are Good; If Managed Properly!

~Rich

Trade Made Simple

RichTL.com

Telegram

t.me/thesignalyst

CFD broker - Tickmill

cutt.ly/TickmillReal

Veles - Create Trading Bots

veles.finance/invite/thesignalyst

RichTL.com

Telegram

t.me/thesignalyst

CFD broker - Tickmill

cutt.ly/TickmillReal

Veles - Create Trading Bots

veles.finance/invite/thesignalyst

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade Made Simple

RichTL.com

Telegram

t.me/thesignalyst

CFD broker - Tickmill

cutt.ly/TickmillReal

Veles - Create Trading Bots

veles.finance/invite/thesignalyst

RichTL.com

Telegram

t.me/thesignalyst

CFD broker - Tickmill

cutt.ly/TickmillReal

Veles - Create Trading Bots

veles.finance/invite/thesignalyst

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.