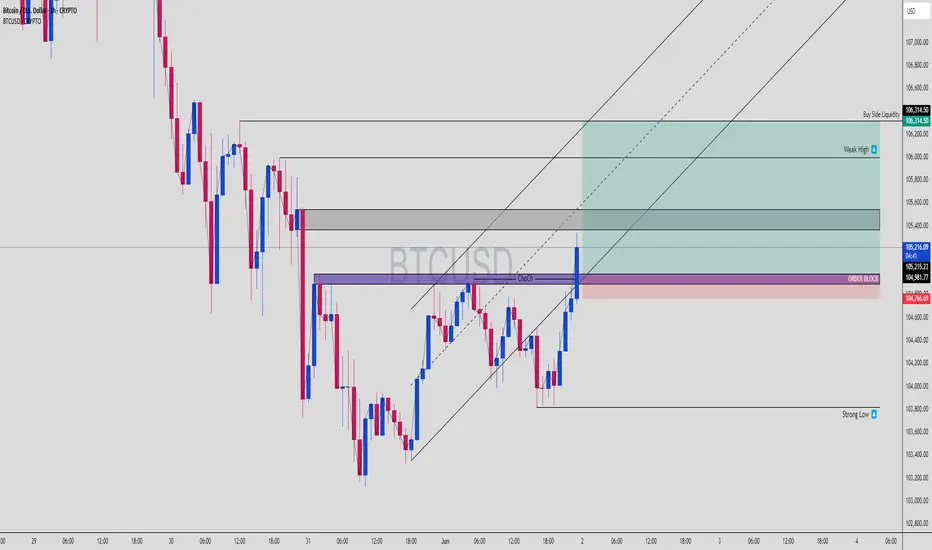

BTCUSD | 4H Chart Breakdown – FVG, Order Block, and Smart Money Confluence

Here’s a killer SMC-based short opportunity forming on BTCUSD. Let’s decode this clean setup:

⚙️ 1. Market Structure Snapshot

Change of Character (ChoCH) confirmed on lower timeframe

Price aggressively retraced into a premium zone

Now tapping a combo zone:

✅ Fair Value Gap

✅ Order Block

✅ Sell-side OB mitigation

✅ Sitting right below Buy-Side Liquidity

We’re in prime territory for a liquidity raid followed by a sharp rejection.

📊 2. Key Price Zones

📈 Current Price: ~105,257

🟪 OB + FVG Zone: 104,766 – 105,257

🟦 Weak High (Target for Raid): ~106,200

🔻 Sell Setup Activation: If price shows rejection at OB zone

📉 Sell Target: 103,800 (Strong Low + liquidity pocket)

This is textbook bearish structure after a sweep of weak highs — time to watch the market respond.

🧠 3. SMC Logic Breakdown

ChoCH marks the first sign of bullish intent

But price is now entering a premium zone above equilibrium

Liquidity lies just above the weak high

We expect:

Raid of the weak high / buy-side liquidity

Rejection at the OB + FVG

Sharp drop to take out the strong low

This pattern = a high-probability SMC trap short.

📉 4. Risk-Reward Plan

🛑 Stop Loss: Just above 106,314.50

🎯 Take Profit: Near 103,800 (Strong Low)

🔁 RR: ~1:3 to 1:4 if you enter after a M5 rejection

🧼 Partial TP: Midway at 104,200 to reduce exposure

🧩 5. Entry Strategy

Monitor M5–M15 around OB + FVG zone

Wait for bearish engulfing / BOS

Refine entry with tighter SL

Let it play toward sell-side liquidity

⚔️ 6. Trader Notes:

Don't short early. Wait for reaction and structure shift

This is liquidity engineering – smart money lures in longs before nuking

Pair this chart with volume divergence confirmation if available

💣 Type "Liquidity Trap 💀" in the comments if this setup matches your bias

🔁 Save this if you scalp or swing SMC-based setups

🔔 Follow ChartNinjas88 for clean smart money plays

Here’s a killer SMC-based short opportunity forming on BTCUSD. Let’s decode this clean setup:

⚙️ 1. Market Structure Snapshot

Change of Character (ChoCH) confirmed on lower timeframe

Price aggressively retraced into a premium zone

Now tapping a combo zone:

✅ Fair Value Gap

✅ Order Block

✅ Sell-side OB mitigation

✅ Sitting right below Buy-Side Liquidity

We’re in prime territory for a liquidity raid followed by a sharp rejection.

📊 2. Key Price Zones

📈 Current Price: ~105,257

🟪 OB + FVG Zone: 104,766 – 105,257

🟦 Weak High (Target for Raid): ~106,200

🔻 Sell Setup Activation: If price shows rejection at OB zone

📉 Sell Target: 103,800 (Strong Low + liquidity pocket)

This is textbook bearish structure after a sweep of weak highs — time to watch the market respond.

🧠 3. SMC Logic Breakdown

ChoCH marks the first sign of bullish intent

But price is now entering a premium zone above equilibrium

Liquidity lies just above the weak high

We expect:

Raid of the weak high / buy-side liquidity

Rejection at the OB + FVG

Sharp drop to take out the strong low

This pattern = a high-probability SMC trap short.

📉 4. Risk-Reward Plan

🛑 Stop Loss: Just above 106,314.50

🎯 Take Profit: Near 103,800 (Strong Low)

🔁 RR: ~1:3 to 1:4 if you enter after a M5 rejection

🧼 Partial TP: Midway at 104,200 to reduce exposure

🧩 5. Entry Strategy

Monitor M5–M15 around OB + FVG zone

Wait for bearish engulfing / BOS

Refine entry with tighter SL

Let it play toward sell-side liquidity

⚔️ 6. Trader Notes:

Don't short early. Wait for reaction and structure shift

This is liquidity engineering – smart money lures in longs before nuking

Pair this chart with volume divergence confirmation if available

💣 Type "Liquidity Trap 💀" in the comments if this setup matches your bias

🔁 Save this if you scalp or swing SMC-based setups

🔔 Follow ChartNinjas88 for clean smart money plays

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.