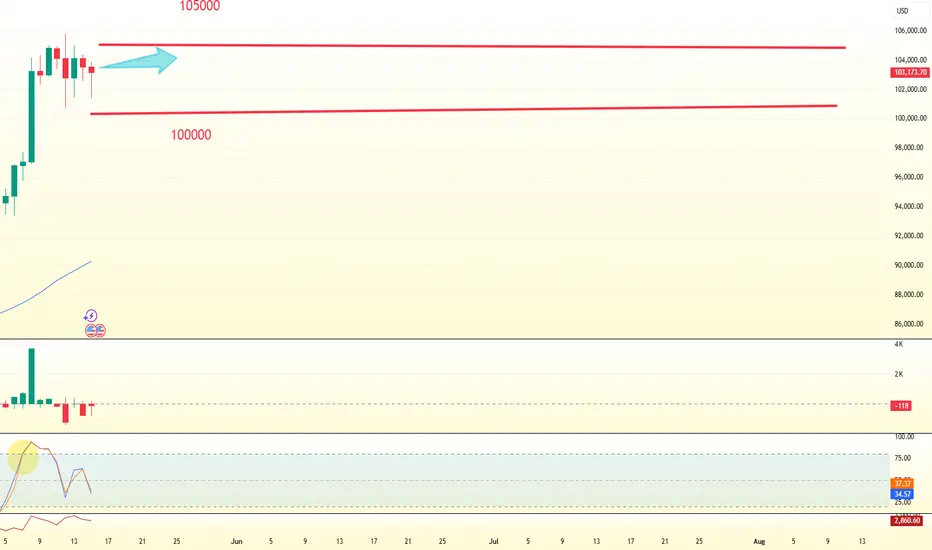

The price has rebounded above the 0.786 Fibonacci retracement support level at $102,400. The EMA trend indicators show upward divergence, with the EMA15 fast trend line continuing to act as support and extending higher, expected to provide underlying support for the candlesticks near $101,000. A bullish channel has formed on the Bollinger Bands, but the price is 受阻 (resisted) at the upper band pressure level of $106,300, increasing the probability of short-term sideways trading.

Candlestick patterns indicate the price has consistently traded at the top of the EMA trend indicators, with bullish momentum starting to contract and top-side pressure showing a clear downward shift. The MACD has continuously reduced trading volume while approaching the zero line, with DIF and DEA converging, signaling that a top divergence pattern has spread to the medium-term trend. During the Bollinger Bands' sideways phase, the upper band resistance is at $105,200, and the lower band support is at $101,800.

The latest U.S. inflation data came in below expectations, strengthening market expectations for Federal Reserve rate cuts—a factor typically boosting risk asset performance. Additionally, the initial progress in U.S.-China trade negotiations, where both sides agreed to reduce tariffs, has improved geopolitical conditions and provided further support for Bitcoin.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

Candlestick patterns indicate the price has consistently traded at the top of the EMA trend indicators, with bullish momentum starting to contract and top-side pressure showing a clear downward shift. The MACD has continuously reduced trading volume while approaching the zero line, with DIF and DEA converging, signaling that a top divergence pattern has spread to the medium-term trend. During the Bollinger Bands' sideways phase, the upper band resistance is at $105,200, and the lower band support is at $101,800.

The latest U.S. inflation data came in below expectations, strengthening market expectations for Federal Reserve rate cuts—a factor typically boosting risk asset performance. Additionally, the initial progress in U.S.-China trade negotiations, where both sides agreed to reduce tariffs, has improved geopolitical conditions and provided further support for Bitcoin.

you are currently struggling with losses, or are unsure which of the numerous trading strategies to follow, at this moment, you can choose to observe the operations within our channel.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.