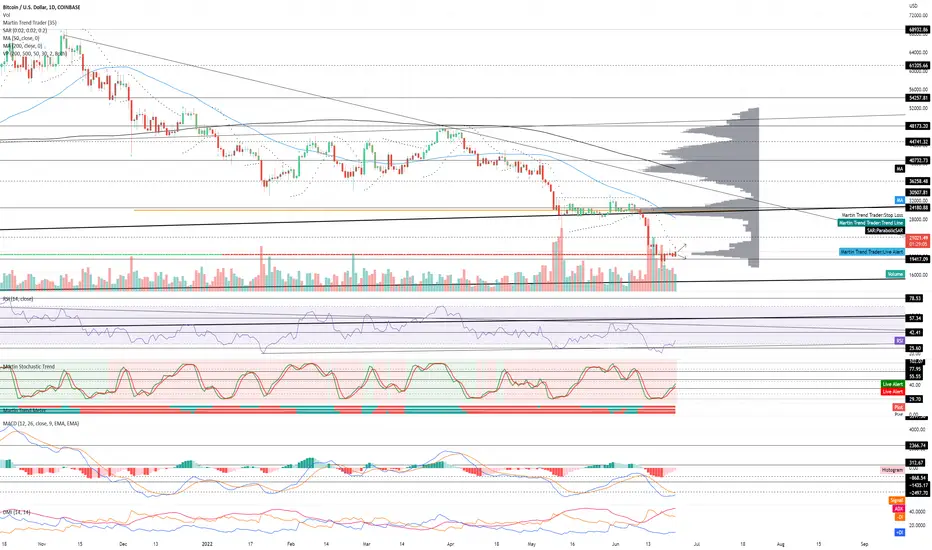

BTCUSD Daily neutral with a bullish bias. Recommended ratio: 60% BTC, 40% Cash. *Cryptos and equities are still enjoying the technical relief rally. PMI numbers came out this morning and showed a significant reduction in output largely attributed to a reduction in demand; a higher federal funds rate and quantitative tightening are two of the main reasons why and the Federal Reserve intended to bring down demand so I would say it's a good thing. The Federal Reserve also reported 2022 US bank Stress Test results today (ran a hypothetical severe recessionary scenario on 34 of the biggest banks managing over $100b in assets) and the banks passed the test meaning they had sufficient capital to endure a 'hard landing' if there is one. In the report they mentioned that they removed all but one model adjustment in this year's test because banking conditions have stabilized and macroeconomic outlook has improved. This is very arguable for several points: many European countries are currently seeing soaring inflation numbers and only just now are raising interest rates (Norway, BOE, ECB), all while there is a steepening energy and food crisis looming right over them; China is still maintaining their 'Zero Covid Policy' while becoming more aggressive in the South and East China Sea toward both Taiwan and Japan; Russia is quickly restructuring trade routes with 'friendlies' while still attacking Ukraine and further disrupting grain, fertilizer and oil supply chains causing global food shortages; and Israel is currently experiencing a political collapse. Seems like only a cynic would say that the macroeconomic outlook as improved, but here we are.* Price is currently trending up at $20.7k as it attempts to establish a local bottom at $19417 support. Volume remains moderate and has been technically shrinking for what could be ten consecutive sessions if it stays calm for a couple more hours; it also remains fairly balanced between buyers and sellers which is indicative of consolidation. Parabolic SAR flips bullish at $21820, this margin is mildly bullish at the moment. RSI is currently trending up at 33 after bouncing off of the uptrend line from 01/22/22 at 25.60 support, which implies that the uptrend is still intact in the short term; the next resistance is at 42.41. Stochastic remains bullish and is currently trending up at 44, the next resistance is at 55.55. MACD is currently trending up slightly at -2777 as it attempts to break above -2497 minor support and cross over bullish. ADX is currently trending up slightly at 45 and beginning to form a soft peak as Price pushes higher, this is neutral at the moment; if ADX can peak and start coming down as Price continues up, this would be bullish. If Price is able to breakout from this consolidation then it will likely test $24180 minor resistance. However, if Price breaks down here, it will likely retest $19417 support before potentially retesting the uptrend line from April 2017 at ~$15k for the first time since September 2020. Mental Stop Loss: (two consecutive closes below) $19417.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.