The dollar-value locked-in open futures and perpetual futures contracts for Bitcoin (

According to CoinGlass, the notional open interest, which refers to the dollar value locked in the number of open or active Bitcoin (

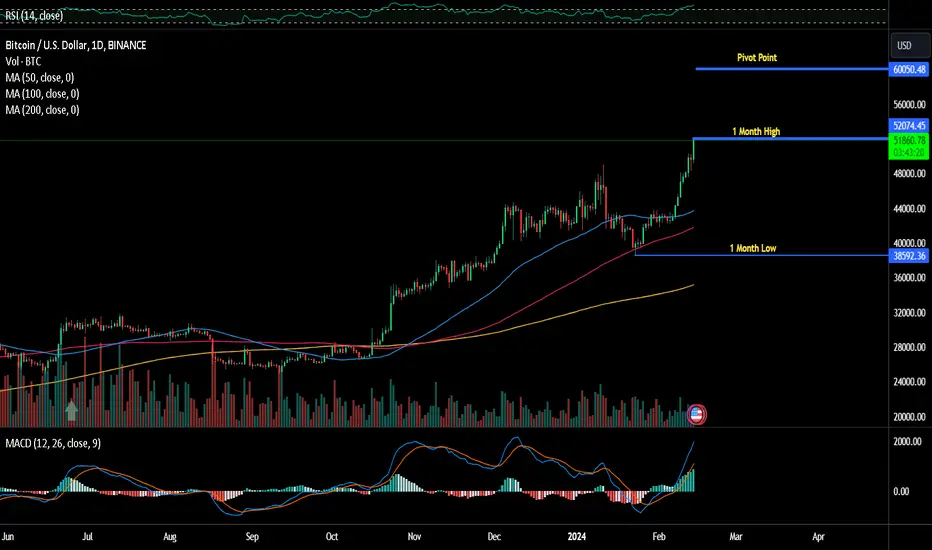

The renewed interest in leveraged products like futures, coupled with a price rise, confirms the uptrend and represents an influx of new money on the bullish side. Bitcoin (

However, leverage magnifies both profits and losses, so a notable rise in futures open interest is often seen as a warning of price volatility. The overall leverage in the market is still low, indicating a low probability of sudden long (buy positions) liquidations leading to a price crash. Liquidation refers to the forced closure of bullish long or bearish short positions by exchanges due to a margin shortage, and mass liquidations are known to inject bullish/bearish volatility into the market.

Bitcoin's (

Noelle Acheson, the author of the popular Crypto is Macro Now newsletter, confidently stated in Tuesday's edition, "The leverage build-up is still relatively low, judging by the

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.