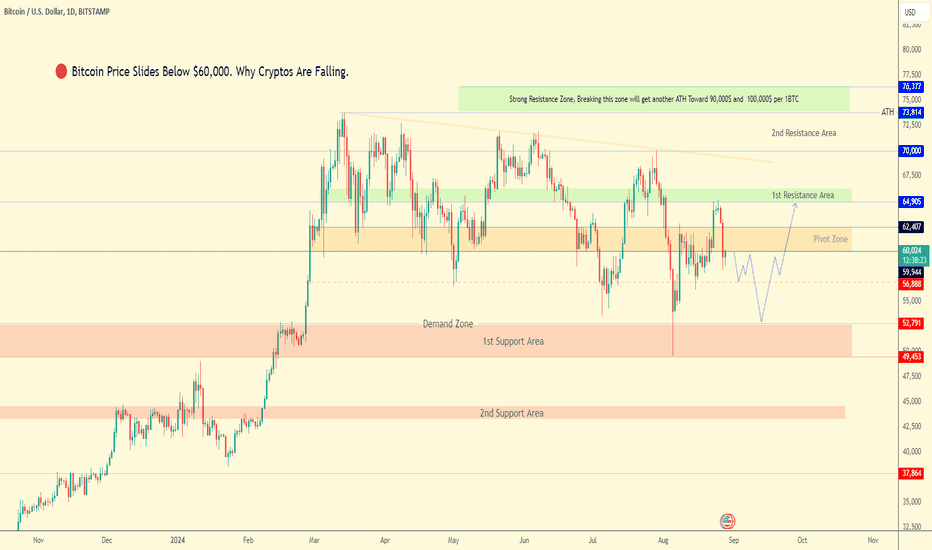

Bearish Momentum Persists as Bitcoin Stabilizes Below Pivot Line: Key Levels and Expected Range

The price has already dropped to the level we previously discussed, and the trend remains bearish. This is confirmed by the daily candle closing below the Pivot line at $56,888, signaling further movement toward the $52,790 support level.

For the trend to shift to bullish, the price would need to stabilize above the $56,890 mark, opening the potential for a move towards $59,950.

Key Levels:

Pivot Line: $56,890

Resistance Levels: $59,950, $62,410, $64,900

Support Levels: $52,800, $49,460, $44,600

Expected Range: Bitcoin is anticipated to fluctuate between $52,790 and $59,950.

previous idea :

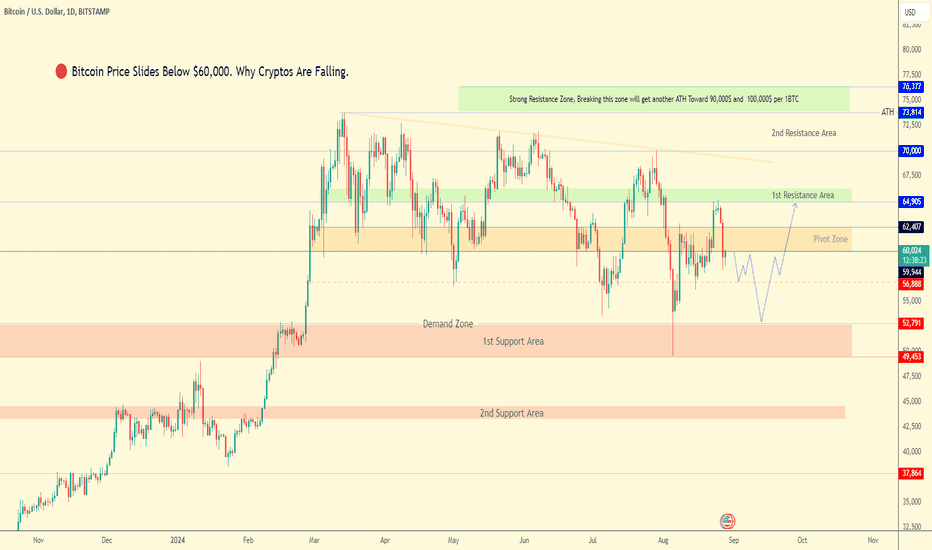

The price has already dropped to the level we previously discussed, and the trend remains bearish. This is confirmed by the daily candle closing below the Pivot line at $56,888, signaling further movement toward the $52,790 support level.

For the trend to shift to bullish, the price would need to stabilize above the $56,890 mark, opening the potential for a move towards $59,950.

Key Levels:

Pivot Line: $56,890

Resistance Levels: $59,950, $62,410, $64,900

Support Levels: $52,800, $49,460, $44,600

Expected Range: Bitcoin is anticipated to fluctuate between $52,790 and $59,950.

previous idea :

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.