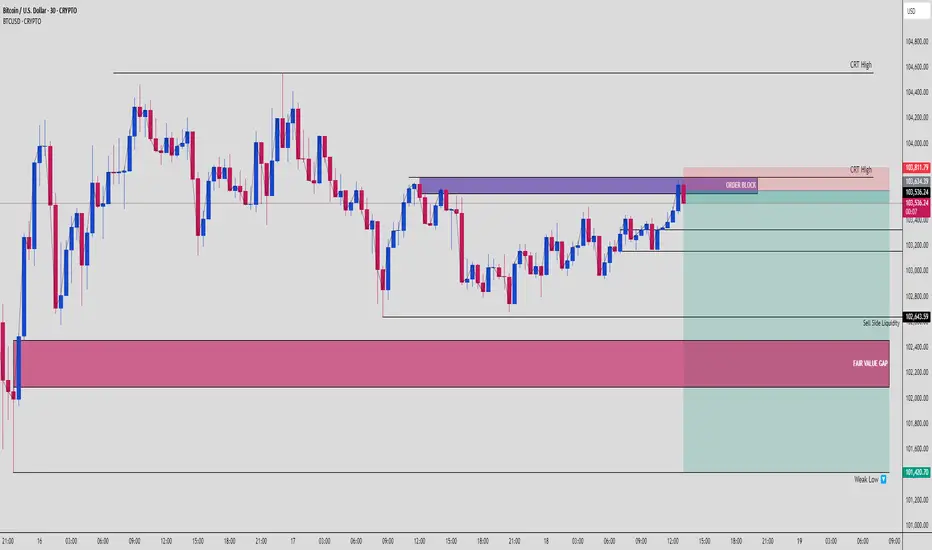

Smart Money Concept Breakdown | May 18, 2025

This BTC setup is screaming institutional manipulation — and we’re ready to ride the wave. The most recent candle shows another clean rejection from the 30M Order Block, giving high confidence in bearish continuation.

🔍 Key Breakdown:

Entry Confluence:

Bearish OB between 103,569–103,634 tapped with a perfect wick

Candle rejected CRT High (high-probability manipulation zone)

Rejection confirmed with a bearish engulfing candle structure

Target Mapping:

Sell Side Liquidity: 102,643.59

Fair Value Gap: 102,200 zone

Weak Low: 101,420.70 (likely final draw on liquidity)

RR Setup:

Entry: 103,570 zone

SL: Just above CRT High at 103,811

TP1: SSL pool

TP2: FVG

TP3: Weak Low

Risk-Reward Range: From 1:2.5 to 1:5+ 💰

🧠 Institutional Logic:

The rally into the OB was likely a buy-side liquidity grab, faking retail breakout traders before dropping. If price breaks below 102,643 with momentum, expect a sweep of the FVG and weak low.

🎯 Bonus Watch:

If price returns to the OB but fails to break CRT High again = solid re-entry confirmation 📉🧠

This BTC setup is screaming institutional manipulation — and we’re ready to ride the wave. The most recent candle shows another clean rejection from the 30M Order Block, giving high confidence in bearish continuation.

🔍 Key Breakdown:

Entry Confluence:

Bearish OB between 103,569–103,634 tapped with a perfect wick

Candle rejected CRT High (high-probability manipulation zone)

Rejection confirmed with a bearish engulfing candle structure

Target Mapping:

Sell Side Liquidity: 102,643.59

Fair Value Gap: 102,200 zone

Weak Low: 101,420.70 (likely final draw on liquidity)

RR Setup:

Entry: 103,570 zone

SL: Just above CRT High at 103,811

TP1: SSL pool

TP2: FVG

TP3: Weak Low

Risk-Reward Range: From 1:2.5 to 1:5+ 💰

🧠 Institutional Logic:

The rally into the OB was likely a buy-side liquidity grab, faking retail breakout traders before dropping. If price breaks below 102,643 with momentum, expect a sweep of the FVG and weak low.

🎯 Bonus Watch:

If price returns to the OB but fails to break CRT High again = solid re-entry confirmation 📉🧠

Trade closed: stop reached

📍 Trade Update:✅ Setup triggered cleanly but no further momentum.

✅ Price returned to entry point = Breakeven secured! 🔒

🔥 Risk-free is still a win. Next sniper entry loading...

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.