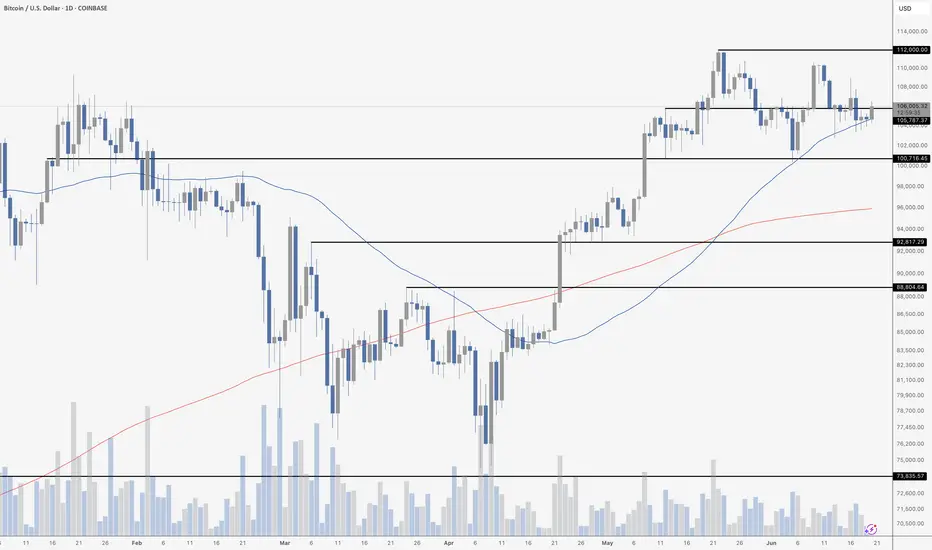

Bitcoin continues to treat the 50-day moving average like a sacred line in the sand. Once again, price dipped to test the level and found immediate support – bouncing right off the blue line with a solid daily candle and gaining over 1% in the process. That makes multiple successful defenses of the 50 MA in recent weeks – clearly, traders are watching it closely.

The key takeaway here isn’t just the bounce, but the fact that BTC remains in a tightening range between ~$112,000 resistance and ~$100,700 support. We’re seeing a clear battle between bulls and bears – with bulls still managing to defend higher lows while momentum tries to rebuild. As long as the 50 MA continues to hold, the structure remains bullish – but if it breaks, it could signal a retest of the $100K psychological level or even a deeper pullback toward the mid-$90Ks.

For now, the trend is still your friend. But keep one eye on the moving average – because the moment it fails, this range could resolve sharply. Until then, it’s a patient trader’s market.

The key takeaway here isn’t just the bounce, but the fact that BTC remains in a tightening range between ~$112,000 resistance and ~$100,700 support. We’re seeing a clear battle between bulls and bears – with bulls still managing to defend higher lows while momentum tries to rebuild. As long as the 50 MA continues to hold, the structure remains bullish – but if it breaks, it could signal a retest of the $100K psychological level or even a deeper pullback toward the mid-$90Ks.

For now, the trend is still your friend. But keep one eye on the moving average – because the moment it fails, this range could resolve sharply. Until then, it’s a patient trader’s market.

scott.melker@texaswestcapital.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

scott.melker@texaswestcapital.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.