Momentum indicators such as RSI and MACD likely show bearish divergence or downward momentum, supporting the short thesis.

The recommended stop-loss for this setup is at 119,000, which is just above recent resistance and protects against false breakouts.

This SL level offers a good risk-reward ratio, with approximately 2:1 or better depending on entry precision.

If price fails to reclaim 119,000 or form higher highs, the bearish momentum is expected to persist.

Price rejection candles or bearish engulfing patterns near 117,500 further validate short entries.

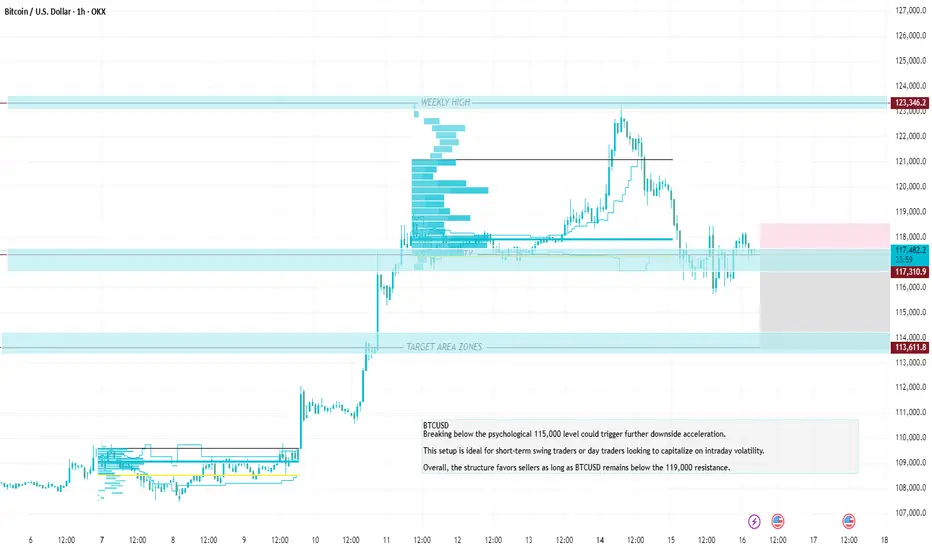

Breaking below the psychological 115,000 level could trigger further downside acceleration.

This setup is ideal for short-term swing traders or day traders looking to capitalize on intraday volatility.

Overall, the structure favors sellers as long as BTCUSD remains below the 119,000 resistance.

The recommended stop-loss for this setup is at 119,000, which is just above recent resistance and protects against false breakouts.

This SL level offers a good risk-reward ratio, with approximately 2:1 or better depending on entry precision.

If price fails to reclaim 119,000 or form higher highs, the bearish momentum is expected to persist.

Price rejection candles or bearish engulfing patterns near 117,500 further validate short entries.

Breaking below the psychological 115,000 level could trigger further downside acceleration.

This setup is ideal for short-term swing traders or day traders looking to capitalize on intraday volatility.

Overall, the structure favors sellers as long as BTCUSD remains below the 119,000 resistance.

✅FREE FREE FREE XAUUSD/BTCUSD SIGNALS ALWAYS FREEEEE

t.me/TESLA_FOREX_TRADING

✅JOIN MY TELEGRAM FAST:❤️

☑️ JOIN NOW t.me/TESLA_FOREX_TRADING

✅BEST BROKER LINK: (EXNESS)

one.exnesstrack.net/a/zzz57mij30

t.me/TESLA_FOREX_TRADING

✅JOIN MY TELEGRAM FAST:❤️

☑️ JOIN NOW t.me/TESLA_FOREX_TRADING

✅BEST BROKER LINK: (EXNESS)

one.exnesstrack.net/a/zzz57mij30

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅FREE FREE FREE XAUUSD/BTCUSD SIGNALS ALWAYS FREEEEE

t.me/TESLA_FOREX_TRADING

✅JOIN MY TELEGRAM FAST:❤️

☑️ JOIN NOW t.me/TESLA_FOREX_TRADING

✅BEST BROKER LINK: (EXNESS)

one.exnesstrack.net/a/zzz57mij30

t.me/TESLA_FOREX_TRADING

✅JOIN MY TELEGRAM FAST:❤️

☑️ JOIN NOW t.me/TESLA_FOREX_TRADING

✅BEST BROKER LINK: (EXNESS)

one.exnesstrack.net/a/zzz57mij30

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.