Powered by Advanced Time-Price Analysis | Dr.Gemy | Digital Gann Strategy

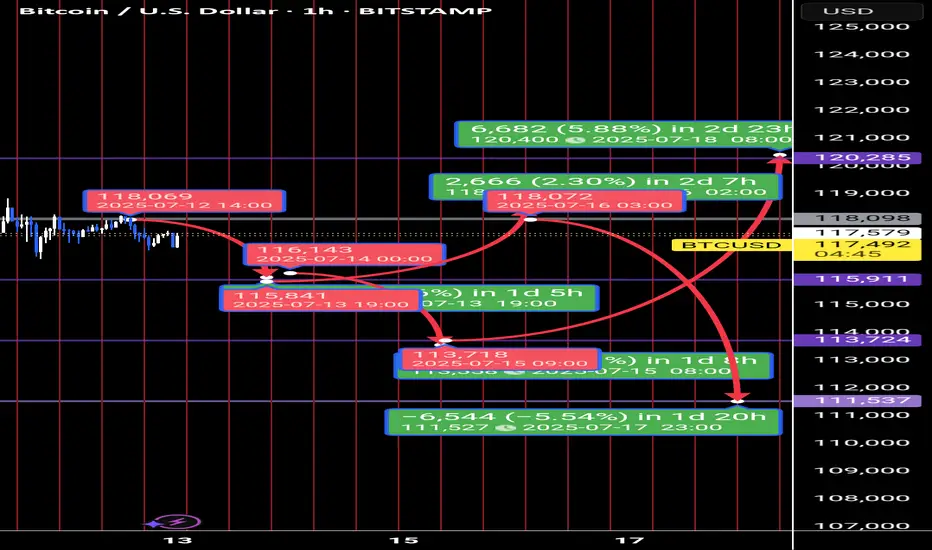

Using Time Cycles, IPDA logic, and Digital Gann structure, the upcoming week for Bitcoin is setting up for a high-probability liquidity event, especially with high-impact macro data scheduled.

📍In the next 18 hours, we expect a short-term correction toward the 115,911 USD zone.

---

⏰ CPI (Tuesday) & PPI (Wednesday) = catalysts for smart money traps.

I expect a textbook liquidity hunt around the inflation data window.

Time is more important than price.

🔮 Two Critical Scenarios Unfolding:

✅ Scenario 1 – CPI Trap Setup (Tuesday News Play)

🕒 If BTC continues correcting into Tuesday (July 15), targeting 113,724 USD, this will align perfectly with the release of U.S. CPI (Inflation) data at 3:30 PM GMT+3.

📈 A fake bullish breakout above 118,098 USD could follow, luring retail traders with an inflation-driven spike, only to be reversed sharply to collect liquidity around 111,537 USD.

🧠 CPI y/y forecast is 2.6% vs 2.4% prior – higher inflation could spark temporary bullish reaction, but the underlying setup suggests it's a trap.

---

🎭 Scenario 2 – Smart Money Pump and Dump

📈 BTC might front-run expectations with an early week rally to retest 118,098 USD, only to reverse midweek (around Wednesday's PPI release) as the market reacts to deeper macro data and shifting dollar strength.

💣 Downside continuation could sweep below 113,724 USD, ultimately reaching the key demand base at 111,537 USD, which marks the beginning of the last major impulsive move.

---

🧠 Strategic Concepts Used:

Time Fractals (9H Cycle Lines)

Gann Reversal Timing & Breaker Blocks (H4)

Smart Money Traps around News

IPDA Voids & Liquidity Pools

CPI/PPI/Macro Liquidity Zones

#CryptoForecast #BTCUSD #CPIWeek #GannTiming #SmartMoney #LiquiditySweep #IPDA #ForexStyleCrypto #DigitalGann #DrGemy

Using Time Cycles, IPDA logic, and Digital Gann structure, the upcoming week for Bitcoin is setting up for a high-probability liquidity event, especially with high-impact macro data scheduled.

📍In the next 18 hours, we expect a short-term correction toward the 115,911 USD zone.

---

⏰ CPI (Tuesday) & PPI (Wednesday) = catalysts for smart money traps.

I expect a textbook liquidity hunt around the inflation data window.

Time is more important than price.

🔮 Two Critical Scenarios Unfolding:

✅ Scenario 1 – CPI Trap Setup (Tuesday News Play)

🕒 If BTC continues correcting into Tuesday (July 15), targeting 113,724 USD, this will align perfectly with the release of U.S. CPI (Inflation) data at 3:30 PM GMT+3.

📈 A fake bullish breakout above 118,098 USD could follow, luring retail traders with an inflation-driven spike, only to be reversed sharply to collect liquidity around 111,537 USD.

🧠 CPI y/y forecast is 2.6% vs 2.4% prior – higher inflation could spark temporary bullish reaction, but the underlying setup suggests it's a trap.

---

🎭 Scenario 2 – Smart Money Pump and Dump

📈 BTC might front-run expectations with an early week rally to retest 118,098 USD, only to reverse midweek (around Wednesday's PPI release) as the market reacts to deeper macro data and shifting dollar strength.

💣 Downside continuation could sweep below 113,724 USD, ultimately reaching the key demand base at 111,537 USD, which marks the beginning of the last major impulsive move.

---

🧠 Strategic Concepts Used:

Time Fractals (9H Cycle Lines)

Gann Reversal Timing & Breaker Blocks (H4)

Smart Money Traps around News

IPDA Voids & Liquidity Pools

CPI/PPI/Macro Liquidity Zones

#CryptoForecast #BTCUSD #CPIWeek #GannTiming #SmartMoney #LiquiditySweep #IPDA #ForexStyleCrypto #DigitalGann #DrGemy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.