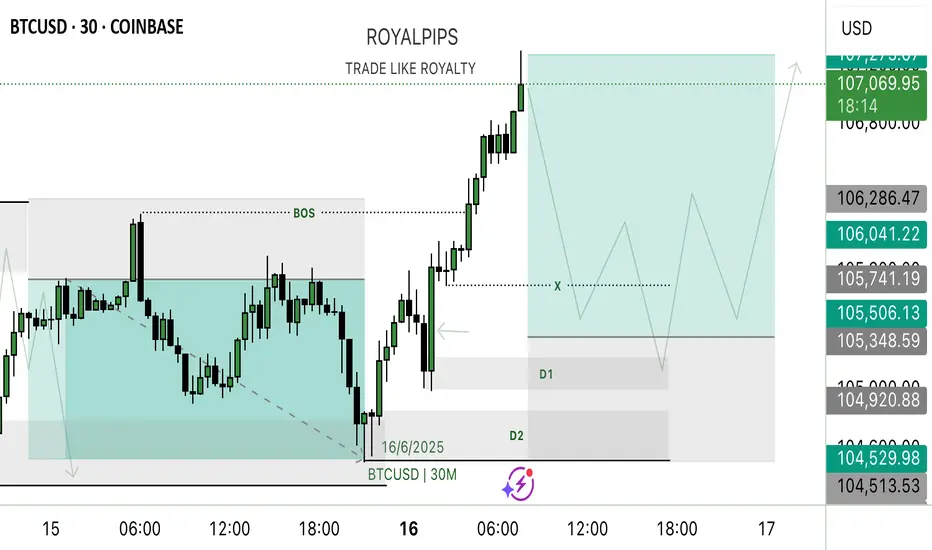

BTC has recently broken its last lower timeframe High, shifting market structure and indicating Buyers are currently in control.

This break opened up a clear Demand Zone below, a small base or last bearish candle before the rise, which is a key area where unfulfilled buy orders may be resting.

Price is likely to retrace back into this Demand Zone to fill those orders. Once it reaches this area, we expect buying pressure to resume and push price upward, honoring the imbalance left by the rise.

Entry:

I’m looking to buy from this Demand Zone on a pullback, adding to go long when price enters this area.

This lets me enter at a discount price while trading in direction of the newly established upward momentum.

Target:

The first Target Profit (TP) is set at the next supply Zone above, where selling pressure might emerge.

Stop Loss:

To control risk, the Stop Loss (SL) is placed just below the demand Zone.

If price drops below this area, it would invalidate the demand’s ability to hold, signaling a potential reversal.

✅ Summary:

• Market has shifted to bullish after breaking last high.

• Demand Zone below is a key area to watch for buying opportunities.

• Buy upon retracement into Demand, with Stop Loss below and Target at supply above.

This break opened up a clear Demand Zone below, a small base or last bearish candle before the rise, which is a key area where unfulfilled buy orders may be resting.

Price is likely to retrace back into this Demand Zone to fill those orders. Once it reaches this area, we expect buying pressure to resume and push price upward, honoring the imbalance left by the rise.

Entry:

I’m looking to buy from this Demand Zone on a pullback, adding to go long when price enters this area.

This lets me enter at a discount price while trading in direction of the newly established upward momentum.

Target:

The first Target Profit (TP) is set at the next supply Zone above, where selling pressure might emerge.

Stop Loss:

To control risk, the Stop Loss (SL) is placed just below the demand Zone.

If price drops below this area, it would invalidate the demand’s ability to hold, signaling a potential reversal.

✅ Summary:

• Market has shifted to bullish after breaking last high.

• Demand Zone below is a key area to watch for buying opportunities.

• Buy upon retracement into Demand, with Stop Loss below and Target at supply above.

Trade active

Trade is currently active Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.