If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

Bitcoin Breaks to All-Time Highs — What’s Next for Price Structure?

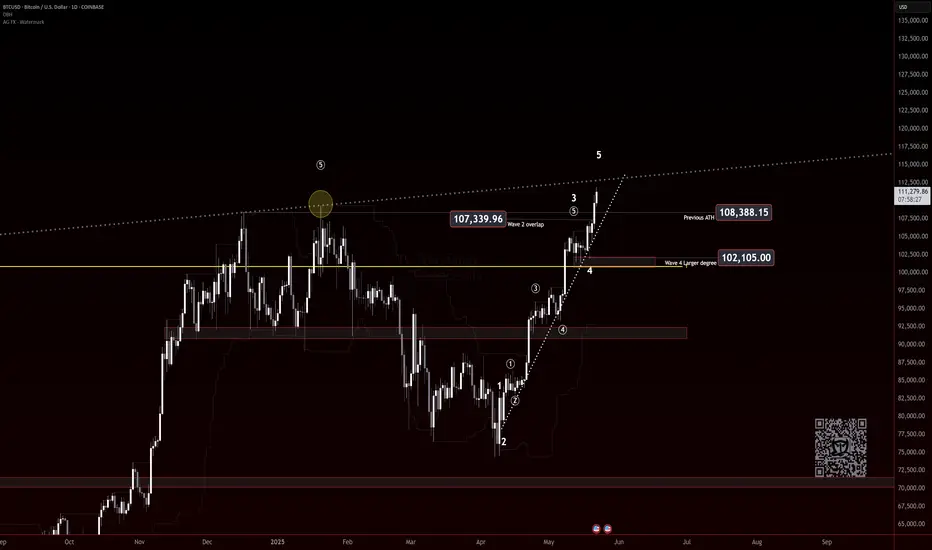

Bitcoin has officially pushed into new all-time highs, and while the move wasn’t entirely unexpected, it still packs a punch. We discussed this possibility in recent videos, though I wasn’t fully convinced at the time. That’s the nature of trading—uncertainty is the cost of admission, and conviction builds as structure confirms.

As always, I was watching the price action closely. BTC started providing the clues needed to lean into the more bullish interpretation. The levels held. The flips were clean. Momentum lined up.

That said, I did take some speculative shorts at lower degrees—not to fight the trend, but to respect possible overextensions within the count. For those following the Elliott Wave roadmap, these intraday reactions were worth probing, but nothing confirmed a larger reversal yet.

The key now is structure.

We’re currently navigating uncharted territory, and in these zones, understanding wave context and market behavior around prior resistance becomes even more critical. There’s no overhead supply—only psychology, fib projections and profit-taking to watch for.

Here’s what I’m focused on:

Clear labeling of the motive sequence—is this the end of a Wave 3 or just a smaller subdivision?

Volume behavior and momentum divergence—looking for any signals that we’re near exhaustion.

Pullback zones—marking areas where Wave 4 or consolidation might emerge, if it’s due.

This is a time to stay sharp, not euphoric.

Trade safe, trade smart, trade clarity.

Bitcoin Breaks to All-Time Highs — What’s Next for Price Structure?

Bitcoin has officially pushed into new all-time highs, and while the move wasn’t entirely unexpected, it still packs a punch. We discussed this possibility in recent videos, though I wasn’t fully convinced at the time. That’s the nature of trading—uncertainty is the cost of admission, and conviction builds as structure confirms.

As always, I was watching the price action closely. BTC started providing the clues needed to lean into the more bullish interpretation. The levels held. The flips were clean. Momentum lined up.

That said, I did take some speculative shorts at lower degrees—not to fight the trend, but to respect possible overextensions within the count. For those following the Elliott Wave roadmap, these intraday reactions were worth probing, but nothing confirmed a larger reversal yet.

The key now is structure.

We’re currently navigating uncharted territory, and in these zones, understanding wave context and market behavior around prior resistance becomes even more critical. There’s no overhead supply—only psychology, fib projections and profit-taking to watch for.

Here’s what I’m focused on:

Clear labeling of the motive sequence—is this the end of a Wave 3 or just a smaller subdivision?

Volume behavior and momentum divergence—looking for any signals that we’re near exhaustion.

Pullback zones—marking areas where Wave 4 or consolidation might emerge, if it’s due.

This is a time to stay sharp, not euphoric.

Trade safe, trade smart, trade clarity.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.