BTC/USD – Bearish Pullback to $110,000 Incoming?

Technical Overview:

Bitcoin is currently showing signs of exhaustion after reaching the $125K–$130K resistance zone, which aligns with the upper boundary of the long-term ascending channel formed since the $20K breakout. RSI is flashing strong bearish divergence on the daily and weekly timeframes, suggesting the bulls are losing momentum.

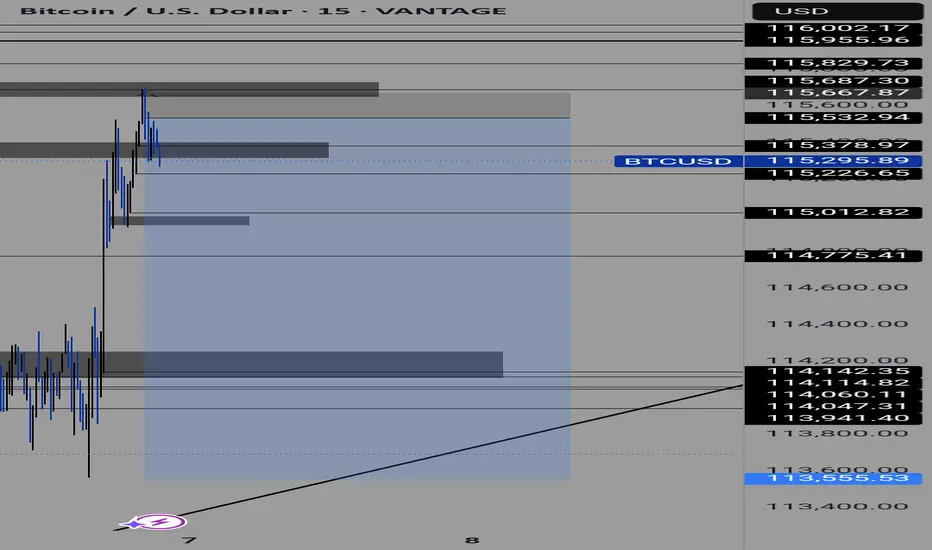

The price also failed to hold above the key psychological level at $120K, now acting as strong resistance. A decisive break below the $115K support zone could trigger a broader correction down toward $110,000, which marks the following confluences:

0.382 Fibonacci retracement of the last impulse from $95K to $130K

High-volume node on the VPVR (Volume Profile Visible Range)

Retest of the previous macro breakout level (former resistance now potential support)

Macro Factors:

Growing speculation of delayed rate cuts from the Fed is putting pressure on risk-on assets, including crypto

Whales and institutional players have been seen rotating out of BTC into altcoins and cash in recent on-chain data

ETF inflows have slowed dramatically compared to earlier in the cycle

Conclusion:

Unless BTC can reclaim $120K with strong volume, the path of least resistance looks like a healthy correction toward $110,000, where stronger demand may kick in. This could provide a better risk-reward entry for long-term bulls.

🚨 Watch for a daily close below $115K to confirm bearish!

Technical Overview:

Bitcoin is currently showing signs of exhaustion after reaching the $125K–$130K resistance zone, which aligns with the upper boundary of the long-term ascending channel formed since the $20K breakout. RSI is flashing strong bearish divergence on the daily and weekly timeframes, suggesting the bulls are losing momentum.

The price also failed to hold above the key psychological level at $120K, now acting as strong resistance. A decisive break below the $115K support zone could trigger a broader correction down toward $110,000, which marks the following confluences:

0.382 Fibonacci retracement of the last impulse from $95K to $130K

High-volume node on the VPVR (Volume Profile Visible Range)

Retest of the previous macro breakout level (former resistance now potential support)

Macro Factors:

Growing speculation of delayed rate cuts from the Fed is putting pressure on risk-on assets, including crypto

Whales and institutional players have been seen rotating out of BTC into altcoins and cash in recent on-chain data

ETF inflows have slowed dramatically compared to earlier in the cycle

Conclusion:

Unless BTC can reclaim $120K with strong volume, the path of least resistance looks like a healthy correction toward $110,000, where stronger demand may kick in. This could provide a better risk-reward entry for long-term bulls.

🚨 Watch for a daily close below $115K to confirm bearish!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.