Congressional Crypto Week: Bitcoin Hits All-Time Highs in a Decisive Week for the U.S.

Ion Jauregui – Analyst at ActivTrades

Bitcoin (BTCUSD) is back in global headlines after breaking above $123,203 this Tuesday, setting a new all-time high in the same week. So far in July, the leading cryptocurrency has surged 17%, fueled by a combination of institutional inflows, political momentum, and evolving regulation. This week, Washington is hosting “Crypto Week,” a key event that may define the legal and financial future of digital assets in the United States. At the same time, institutional backing shows no signs of slowing down—Bitcoin ETFs continue to set records for net inflows, particularly BlackRock’s IBIT, now managing over $85 billion in assets.

ETFs, Trump, and Regulation: All Roads Lead to Crypto

BlackRock’s spot Bitcoin ETF, IBIT, attracted $729 million in net inflows last week alone, setting a historic milestone by becoming the fastest ETF ever to reach $80 billion in assets under management—just 374 days, compared to over 1,800 days for the previous record held by the Vanguard S&P 500 ETF. The growing institutional interest—with over 265 funds and entities now actively investing in BTC—not only validates the asset class but also tightens supply: BlackRock reportedly acquired an average of more than 860 bitcoins per day last week. This persistent demand is directly contributing to the price momentum.

A Legal Framework in Progress

Three major bills are on the Congressional agenda this week:

This regulatory push is seen by the market as a sign of institutional consolidation in the crypto space, paralleling the already advanced European MiCA framework.

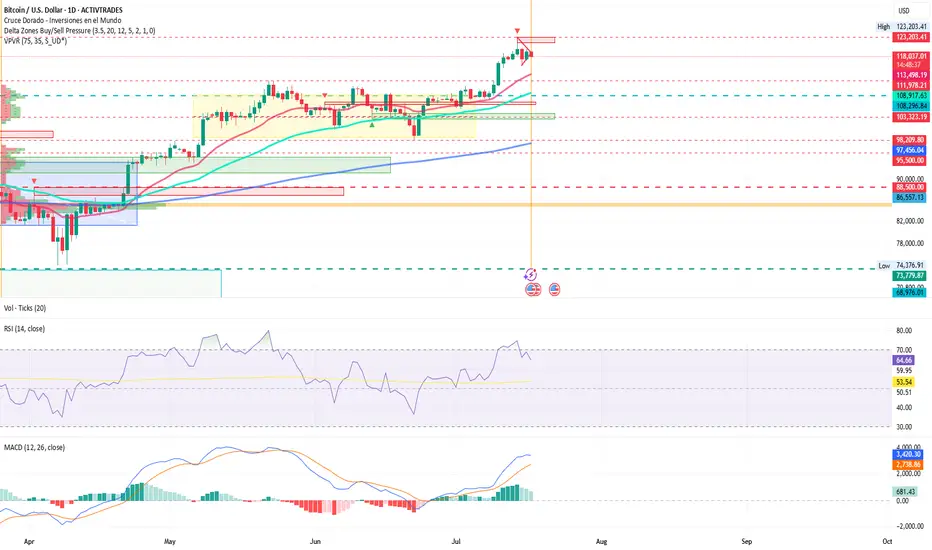

Technical Analysis of BTCUSD

On the daily chart, Bitcoin broke decisively above the previous ceiling at $112,000 on July 12 and has since been validating a consolidation pattern near the $120,000 level—forming a bullish pennant on the 1-hour chart. The RSI remains overbought at 64.92%, but with no current signs of bearish divergence. The next technical target lies in the $130,000–$135,000 zone, while the nearest support is found at $118,000. A daily close below that level could trigger a technical correction toward $108,000–$109,000, marking the base of the current impulse. The point of control sits far lower at $85,195, although the current move appears to be unfolding within the third of three key volume profile levels. The MACD continues to support price expansion, though trading volume appears to be declining. Delta level indicators suggest strong resistance near current price highs, meaning another push may be needed—possibly triggered by continued regulatory momentum.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Ion Jauregui – Analyst at ActivTrades

Bitcoin (BTCUSD) is back in global headlines after breaking above $123,203 this Tuesday, setting a new all-time high in the same week. So far in July, the leading cryptocurrency has surged 17%, fueled by a combination of institutional inflows, political momentum, and evolving regulation. This week, Washington is hosting “Crypto Week,” a key event that may define the legal and financial future of digital assets in the United States. At the same time, institutional backing shows no signs of slowing down—Bitcoin ETFs continue to set records for net inflows, particularly BlackRock’s IBIT, now managing over $85 billion in assets.

ETFs, Trump, and Regulation: All Roads Lead to Crypto

BlackRock’s spot Bitcoin ETF, IBIT, attracted $729 million in net inflows last week alone, setting a historic milestone by becoming the fastest ETF ever to reach $80 billion in assets under management—just 374 days, compared to over 1,800 days for the previous record held by the Vanguard S&P 500 ETF. The growing institutional interest—with over 265 funds and entities now actively investing in BTC—not only validates the asset class but also tightens supply: BlackRock reportedly acquired an average of more than 860 bitcoins per day last week. This persistent demand is directly contributing to the price momentum.

A Legal Framework in Progress

Three major bills are on the Congressional agenda this week:

- The Genius Act: Aims to regulate stablecoins and has already passed the Senate with bipartisan support.

- The Clarity Act: Seeks to define which cryptocurrencies qualify as securities or commodities, clarifying regulatory oversight.

- The Anti-CBDC Act: Proposes restricting the government’s ability to issue an official digital currency, favoring decentralized ecosystems.

This regulatory push is seen by the market as a sign of institutional consolidation in the crypto space, paralleling the already advanced European MiCA framework.

Technical Analysis of BTCUSD

On the daily chart, Bitcoin broke decisively above the previous ceiling at $112,000 on July 12 and has since been validating a consolidation pattern near the $120,000 level—forming a bullish pennant on the 1-hour chart. The RSI remains overbought at 64.92%, but with no current signs of bearish divergence. The next technical target lies in the $130,000–$135,000 zone, while the nearest support is found at $118,000. A daily close below that level could trigger a technical correction toward $108,000–$109,000, marking the base of the current impulse. The point of control sits far lower at $85,195, although the current move appears to be unfolding within the third of three key volume profile levels. The MACD continues to support price expansion, though trading volume appears to be declining. Delta level indicators suggest strong resistance near current price highs, meaning another push may be needed—possibly triggered by continued regulatory momentum.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.