Rejection Blocks (ICT Concept) – Complete Guide

1. What is a Rejection Block?

A rejection block is a special type of price level that forms when the market attempts to push through but gets denied and reverses. Unlike a traditional order block, which represents accumulation or distribution by institutions, a rejection block shows a failed attempt to continue in one direction. It is a footprint of rejection and often becomes a strong reaction zone in the future.

There are two types:

Bullish Rejection Block:

Forms from a bearish candle whose low is taken out, but price fails to continue lower and closes back above. The low of that candle becomes the key level.

Bearish Rejection Block:

Forms from a bullish candle whose high is breached, but price fails to continue higher and closes back inside. The high of that candle becomes the key level.

These levels can act as hidden support or resistance and often serve as high-probability entry points when combined with market structure.

2. How to Spot a Valid Rejection Block

To correctly identify rejection blocks, you need to look for:

1. Clear Attempt Beyond a Candle

Price must trade beyond the high or low of a prior candle, suggesting continuation.

2. Failure and Return

After breaching the level, price fails and closes back inside the candle’s body.

3. Liquidity Context

A rejection block is more powerful if the wick that caused it swept liquidity (equal highs/lows or a previous key level).

4. Higher Timeframe Confluence

The best rejection blocks line up with higher timeframe bias (for example, spotting a bearish rejection block inside a 4H premium zone during a downtrend).

3. How to Trade Rejection Blocks

Trading them involves waiting for price to come back to the rejection block level and using it as an entry or reaction zone.

Bullish Setup:

When price trades below a bearish candle, fails, and closes higher, mark the low of that candle. On a retracement, price often retests that level as support.

Bearish Setup:

When price trades above a bullish candle, fails, and closes lower, mark the high of that candle. On a retracement, price often retests that level as resistance.

Entry Technique:

You can enter "blindly" when you're understanding the confluences. But to begin with do this Instead, when price returns to the rejection block, drop to a lower timeframe and look for confirmation such as:

* Fair Value Gap (FVG) entries.

* Market Structure Shift (MSS).

* Liquidity sweeps into the level.

Stop Loss Placement:

Always place stops beyond the rejection candle itself (above the high for bearish RB, below the low for bullish RB).

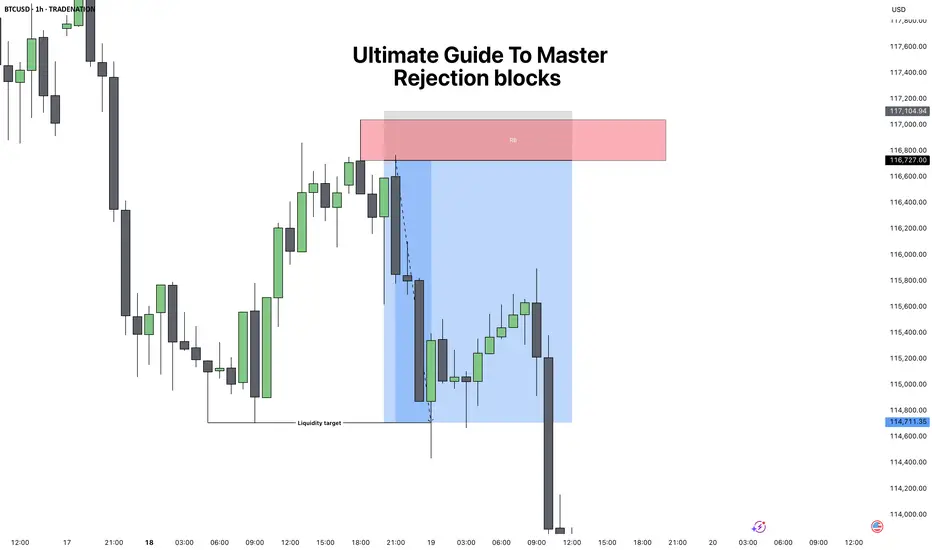

4. Practical Examples and Market Context

Rejection blocks work best when they appear in the following situations:

Liquidity Sweeps:

After equal highs or equal lows are taken out, a rejection block often marks the failure point.

Inside Premium/Discount Zones:

In a bearish bias, look for bearish RBs in premium pricing. In a bullish bias, look for bullish RBs in discount pricing.

During Consolidation Breakouts:

If the market fakes a breakout and closes back inside, the rejection block often becomes the level to fade the fake move.

For example, if BTC takes out a prior daily high, prints a rejection block, and then closes back inside, the odds of reversal are high, especially if price was already in premium territory.

5. Combining Rejection Blocks with ICT Concepts

To increase accuracy, always combine RBs with ICT’s other tools:

Fair Value Gaps:

If a rejection block aligns with an FVG, it adds strength to the level.

Market Structure Shifts:

A rejection block is more powerful if followed by displacement and an MSS.

CISD Pattern:

A rejection block often forms right after the “Stop Hunt” part of the CISD sequence, serving as a clean entry.

Liquidity Pools:

Look for RBs near equal highs/lows, old highs/lows, or session liquidity (London/New York).

Conclusion

Rejection blocks are subtle but highly effective levels that show where the market tried to extend but failed, leaving behind a hidden form of support or resistance. By themselves they are useful, but when combined with ICT concepts like liquidity sweeps, MSS, and FVGs, they become powerful entry tools. The key is to always wait for price to return and confirm the level before entering, and to only trade them in alignment with higher timeframe bias.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support! If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

1. What is a Rejection Block?

A rejection block is a special type of price level that forms when the market attempts to push through but gets denied and reverses. Unlike a traditional order block, which represents accumulation or distribution by institutions, a rejection block shows a failed attempt to continue in one direction. It is a footprint of rejection and often becomes a strong reaction zone in the future.

There are two types:

Bullish Rejection Block:

Forms from a bearish candle whose low is taken out, but price fails to continue lower and closes back above. The low of that candle becomes the key level.

Bearish Rejection Block:

Forms from a bullish candle whose high is breached, but price fails to continue higher and closes back inside. The high of that candle becomes the key level.

These levels can act as hidden support or resistance and often serve as high-probability entry points when combined with market structure.

2. How to Spot a Valid Rejection Block

To correctly identify rejection blocks, you need to look for:

1. Clear Attempt Beyond a Candle

Price must trade beyond the high or low of a prior candle, suggesting continuation.

2. Failure and Return

After breaching the level, price fails and closes back inside the candle’s body.

3. Liquidity Context

A rejection block is more powerful if the wick that caused it swept liquidity (equal highs/lows or a previous key level).

4. Higher Timeframe Confluence

The best rejection blocks line up with higher timeframe bias (for example, spotting a bearish rejection block inside a 4H premium zone during a downtrend).

3. How to Trade Rejection Blocks

Trading them involves waiting for price to come back to the rejection block level and using it as an entry or reaction zone.

Bullish Setup:

When price trades below a bearish candle, fails, and closes higher, mark the low of that candle. On a retracement, price often retests that level as support.

Bearish Setup:

When price trades above a bullish candle, fails, and closes lower, mark the high of that candle. On a retracement, price often retests that level as resistance.

Entry Technique:

You can enter "blindly" when you're understanding the confluences. But to begin with do this Instead, when price returns to the rejection block, drop to a lower timeframe and look for confirmation such as:

* Fair Value Gap (FVG) entries.

* Market Structure Shift (MSS).

* Liquidity sweeps into the level.

Stop Loss Placement:

Always place stops beyond the rejection candle itself (above the high for bearish RB, below the low for bullish RB).

4. Practical Examples and Market Context

Rejection blocks work best when they appear in the following situations:

Liquidity Sweeps:

After equal highs or equal lows are taken out, a rejection block often marks the failure point.

Inside Premium/Discount Zones:

In a bearish bias, look for bearish RBs in premium pricing. In a bullish bias, look for bullish RBs in discount pricing.

During Consolidation Breakouts:

If the market fakes a breakout and closes back inside, the rejection block often becomes the level to fade the fake move.

For example, if BTC takes out a prior daily high, prints a rejection block, and then closes back inside, the odds of reversal are high, especially if price was already in premium territory.

5. Combining Rejection Blocks with ICT Concepts

To increase accuracy, always combine RBs with ICT’s other tools:

Fair Value Gaps:

If a rejection block aligns with an FVG, it adds strength to the level.

Market Structure Shifts:

A rejection block is more powerful if followed by displacement and an MSS.

CISD Pattern:

A rejection block often forms right after the “Stop Hunt” part of the CISD sequence, serving as a clean entry.

Liquidity Pools:

Look for RBs near equal highs/lows, old highs/lows, or session liquidity (London/New York).

Conclusion

Rejection blocks are subtle but highly effective levels that show where the market tried to extend but failed, leaving behind a hidden form of support or resistance. By themselves they are useful, but when combined with ICT concepts like liquidity sweeps, MSS, and FVGs, they become powerful entry tools. The key is to always wait for price to return and confirm the level before entering, and to only trade them in alignment with higher timeframe bias.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support! If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

𝟔 𝐘𝐄𝐀𝐑𝐒 𝐄𝐗𝐏𝐄𝐑𝐈𝐄𝐍𝐂𝐄𝐃 𝐓𝐑𝐀𝐃𝐄𝐑

💎 Free Signals

t.me/codeandcandle

🎁 Free trading Discord community

bit.ly/TehThomas

🥇 My Preferred Exchange - 20% cashback

bit.ly/BloFin20

💎 Free Signals

t.me/codeandcandle

🎁 Free trading Discord community

bit.ly/TehThomas

🥇 My Preferred Exchange - 20% cashback

bit.ly/BloFin20

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

𝟔 𝐘𝐄𝐀𝐑𝐒 𝐄𝐗𝐏𝐄𝐑𝐈𝐄𝐍𝐂𝐄𝐃 𝐓𝐑𝐀𝐃𝐄𝐑

💎 Free Signals

t.me/codeandcandle

🎁 Free trading Discord community

bit.ly/TehThomas

🥇 My Preferred Exchange - 20% cashback

bit.ly/BloFin20

💎 Free Signals

t.me/codeandcandle

🎁 Free trading Discord community

bit.ly/TehThomas

🥇 My Preferred Exchange - 20% cashback

bit.ly/BloFin20

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.