⊢

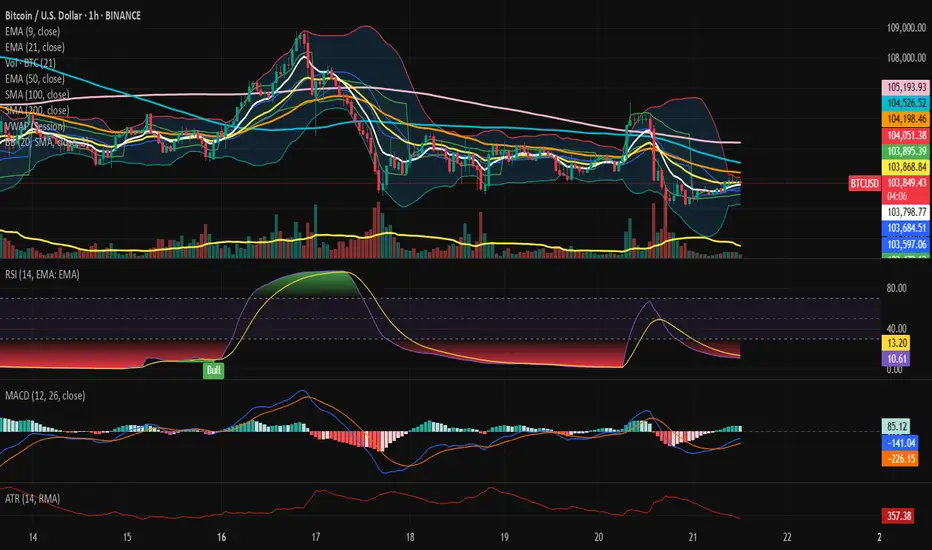

⟁ BTC/USD – Binance – (CHART: 1H) – (June 21, 2025).

⟐ Analysis Price: $103,909.52.

⊢

⨀ I. Temporal Axis – Strategic Interval – (H1):

▦ EMA9 – ($103,783.82):

∴ The price oscillates around EMA9 with marginal bullish slope;

∴ Two candle rejections confirmed the EMA9 as a reactive short-term axis;

∴ Current close is above, but lacking directional follow-through.

✴️ Conclusion: Momentum attempt, yet unsupported – fragility persists.

⊢

▦ EMA21 – ($103,869.74):

∴ Flattened trajectory overlapping EMA9;

∴ Indicates tactical compression – a latency band rather than trendline;

∴ No breakout confirmation.

✴️ Conclusion: Equilibrium zone – direction undecided.

⊢

▦ EMA50 – ($104,212.18):

∴ Serves as immediate dynamic resistance;

∴ Price has not closed above since June 20, 13:00 UTC;

∴ Requires sustained move to invalidate micro-downtrend.

✴️ Conclusion: Key reversal barrier – price remains below structural trigger.

⊢

▦ SMA100 – ($104,552.65):

∴ Downsloping, acting as mid-term ceiling;

∴ No candle engagement in recent sessions;

∴ Confluence zone with EMA50 adds density.

✴️ Conclusion: Inertial resistance zone – trend continuity until breach.

⊢

▦ SMA200 – ($105,197.18):

∴ Highest structural ceiling on H1;

∴ Remains untouched, reinforcing broader tactical bearish bias.

✴️ Conclusion: SMA200 maintains bearish structure – trend remains capped.

⊢

▦ Bollinger Bands - (20,2):

∴ Bands tightened – low volatility configuration;

∴ Upper band slightly expands – minor opening signal;

∴ Price contacts upper range without strength.

✴️ Conclusion: Potential breakout pattern – requires volume ignition.

⊢

▦ RSI (14, smoothed by EMA9) – (11.00 | Avg: 13.85):

∴ RSI at historical low – indicative of exhaustion rather than momentum;

∴ EMA of RSI confirms suppressed structure;

∴ Hidden divergence plausible but not confirmed.

✴️ Conclusion: Latent reversal conditions – needs confirmation from RSI reclaim.

⊢

▦ MACD (12,26,9) – (MACD: 88.35 | Signal: -159.25 | Histogram: -247.60):

∴ Histogram remains negative but is narrowing;

∴ MACD line curling upward, approaching signal;

∴ No crossover yet – early recovery signal under surveillance.

✴️ Conclusion: Bullish divergence forming – reversal not validated.

⊢

▦ ATR (14, RMA) – (372.44):

∴ Volatility decreasing after a local spike;

∴ Range-bound structure indicates compression, not impulse.

✴️ Conclusion: Tactical latency – volatility may reawaken post-volume.

⊢

▦ Volume (21):

∴ Faint increase in last bullish candle – still below strategic threshold;

∴ Lacks institutional confirmation.

✴️ Conclusion: Spot activity insufficient – neutral, vulnerable structure.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ H1 presents structural compression between EMA9/21/50, confirming tactical latency;

∴ RSI at deep oversold – signal of exhaustion, not yet momentum;

∴ Bollinger and MACD show early signs of kinetic preparation;

∴ The market is postured, not reactive – awaiting a directional event.

✴️ Tactical View: Structurally Neutral – Momentum Suspended, entry only upon RSI/Volume confirmation and MACD validation.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

∴ Update as of June 21, 2025 – Synchronized to H1 Structural Reading.

▦ Exchange Netflow Total – (All Exchanges) – (+692 BTC):

∴ Positive net inflow detected over 24h;

∴ Suggests moderate sell-side liquidity entering exchanges;

∴ Reflects defensive posturing, not panic-driven behavior.

✴️ Conclusion: Mild bearish pressure – not sufficient to invalidate structural base.

⊢

▦ Spot Taker CVD - (Cumulative Volume Delta, 90-day):

∴ Dominance of Taker Sell Volume confirmed – aggressive sellers remain in control;

∴ Pattern consistent over the last 6 sessions;

∴ No divergence between volume behavior and price structure.

✴️ Conclusion: Market remains tactically sell-biased – momentum driven by taker aggression.

⊢

▦ Spent Output Profit Ratio (SOPR) – (1.009):

∴ Marginally above 1.00 – coins being spent in mild profit;

∴ Absence of capitulation, but also no sign of deep conviction among holders;

∴ Stable rotation, not breakout-driven.

✴️ Conclusion: Structural neutrality – market is churning without direction.

⊢

▦ Adjusted SOPR (aSOPR) – (≈1.00):

∴ Flat – confirms lack of distribution or panic;

∴ Historically aligns with consolidation regimes.

✴️ Conclusion: Supply behavior is balanced – trend-neutral reading.

⊢

▦ Open Interest – All Exchanges – ($34.01B):

∴ Remains elevated – indicative of speculative leverage;

∴ Elevated risk of liquidation cascade on directional volatility;

∴ OI rising faster than spot volume = synthetic exposure dominating.

✴️ Conclusion: Market structurally exposed – fragile to external triggers.

⊢

▦ Funding Rate – All Exchanges – (-0.003):

∴ Slightly negative – shorts funding longs;

∴ Suggests bearish bias among leveraged participants;

∴ Conditions ripe for short squeeze if spot demand increases.

✴️ Conclusion: Contrarian setup building – tactical upside risk exists.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ Metrics reflect a market under cautious speculative tension;

∴ No broad liquidation, no long-term holder exit – base intact;

∴ Taker dominance and leverage build-up suggest reactive positioning;

∴ System is neutral-leaning fragile – vulnerable to both triggers and traps.

✴️ Tactical Note: "Structurally Stable – Tactically Unsettled"

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

∴ Macro Landscape Reference – June 21, 2025.

▦ United States – Federal Policy & Risk Layer:

∴ Treasury Yield Curve remains slightly positive (+0.44%), removing short-term recession signal;

∴ 10Y yield elevated at 4.42% – reflects sustained inflation resistance and risk demand;

∴ Fed maintains QT stance – no rate cuts expected before September;

∴ Tension with Iran intensifying – military rhetoric entering fiscal discourse.

✴️ Conclusion: U.S. macro acts as compression catalyst – neutral on surface, volatile underneath.

⊢

▦ Strategic Bitcoin Reserve – (Executive Order – Trump):

∴ Recent Executive Order establishes BTC as sovereign asset class;

∴ Adds policy-level legitimacy to institutional accumulation;

∴ Reflects shift from “hedge” to “strategic reserve logic”.

✴️ Conclusion: Structural bull signal – narrative transition confirmed.

⊢

▦ China – Internal Stimulus & Soft Deflation:

∴ PPI negative at -3.3%, Retail Sales up 6.4% – stimulus-driven divergence;

∴ Fiscal revenue declining YTD – systemic drag despite easing;

∴ Not a current volatility driver.

✴️ Conclusion: China is neutral to crypto – reactive, not directive.

⊢

▦ European Union – Disinflation & Monetary Drift:

∴ HICP falls to 1.9%, ECB cuts deposit rate to 2.00%;

∴ PMI Composite < 50 – economic contraction quietly progressing;

∴ Forward guidance hesitant.

✴️ Conclusion: EU remains marginal – supportive for risk, but not catalytic.

⊢

▦ Global Fragmentation & SWIFT Erosion:

∴ Geopolitical blocs continue diverging – dollar-reliant systems weakening;

∴ Bitcoin seen increasingly as transactional hedge in sanctioned environments;

∴ De-dollarization dynamic accelerating.

✴️ Conclusion: Bitcoin positioned as neutral monetary rail – volatility shield and escape valve.

⊢

🜎 Strategic Insight – Interflux Macro Oracle:

∴ U.S. remains the dominant macro variable – its monetary and geopolitical stance defines volatility posture;

∴ Bitcoin structurally benefits from institutional legitimacy, but tactically suspended by risk-off layers;

∴ The system is internally calm, externally tense – volatility is downstream of Powell and geopolitical shock.

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ Temporal structure remains compressed, yet technically reactive;

∴ On-chain behavior supports latent structural integrity, but reveals synthetic tension;

∴ Macro axis introduces dual asymmetry – stability in policy, instability in conflict;

∴ The system is in latency – not due to certainty, but due to mutual hesitation.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish.

∴ The underlying structure - long-term moving averages, exchange reserves, macro narrative, and holder behavior - remains intact and upward-biased;

∴ There is no technical breakdown or structural disassembly;

∴ It is the silent foundation - the “floor” of the chart remains elevated.

⊢

▦ Tactically Suspended.

∴ Although the structure points to strength, the present moment neither demands nor validates action;

∴ There is no volume, no ignition signal, no confirmation flow;

∴ Thus, the tactic is suspended - the trader (or observer) is in a disciplined state of observation, not execution.

⊢

⧉

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

𓂀 Wisdom begins in silence. Precision unfolds in strategy.

⧉

⊢

⟁ BTC/USD – Binance – (CHART: 1H) – (June 21, 2025).

⟐ Analysis Price: $103,909.52.

⊢

⨀ I. Temporal Axis – Strategic Interval – (H1):

▦ EMA9 – ($103,783.82):

∴ The price oscillates around EMA9 with marginal bullish slope;

∴ Two candle rejections confirmed the EMA9 as a reactive short-term axis;

∴ Current close is above, but lacking directional follow-through.

✴️ Conclusion: Momentum attempt, yet unsupported – fragility persists.

⊢

▦ EMA21 – ($103,869.74):

∴ Flattened trajectory overlapping EMA9;

∴ Indicates tactical compression – a latency band rather than trendline;

∴ No breakout confirmation.

✴️ Conclusion: Equilibrium zone – direction undecided.

⊢

▦ EMA50 – ($104,212.18):

∴ Serves as immediate dynamic resistance;

∴ Price has not closed above since June 20, 13:00 UTC;

∴ Requires sustained move to invalidate micro-downtrend.

✴️ Conclusion: Key reversal barrier – price remains below structural trigger.

⊢

▦ SMA100 – ($104,552.65):

∴ Downsloping, acting as mid-term ceiling;

∴ No candle engagement in recent sessions;

∴ Confluence zone with EMA50 adds density.

✴️ Conclusion: Inertial resistance zone – trend continuity until breach.

⊢

▦ SMA200 – ($105,197.18):

∴ Highest structural ceiling on H1;

∴ Remains untouched, reinforcing broader tactical bearish bias.

✴️ Conclusion: SMA200 maintains bearish structure – trend remains capped.

⊢

▦ Bollinger Bands - (20,2):

∴ Bands tightened – low volatility configuration;

∴ Upper band slightly expands – minor opening signal;

∴ Price contacts upper range without strength.

✴️ Conclusion: Potential breakout pattern – requires volume ignition.

⊢

▦ RSI (14, smoothed by EMA9) – (11.00 | Avg: 13.85):

∴ RSI at historical low – indicative of exhaustion rather than momentum;

∴ EMA of RSI confirms suppressed structure;

∴ Hidden divergence plausible but not confirmed.

✴️ Conclusion: Latent reversal conditions – needs confirmation from RSI reclaim.

⊢

▦ MACD (12,26,9) – (MACD: 88.35 | Signal: -159.25 | Histogram: -247.60):

∴ Histogram remains negative but is narrowing;

∴ MACD line curling upward, approaching signal;

∴ No crossover yet – early recovery signal under surveillance.

✴️ Conclusion: Bullish divergence forming – reversal not validated.

⊢

▦ ATR (14, RMA) – (372.44):

∴ Volatility decreasing after a local spike;

∴ Range-bound structure indicates compression, not impulse.

✴️ Conclusion: Tactical latency – volatility may reawaken post-volume.

⊢

▦ Volume (21):

∴ Faint increase in last bullish candle – still below strategic threshold;

∴ Lacks institutional confirmation.

✴️ Conclusion: Spot activity insufficient – neutral, vulnerable structure.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ H1 presents structural compression between EMA9/21/50, confirming tactical latency;

∴ RSI at deep oversold – signal of exhaustion, not yet momentum;

∴ Bollinger and MACD show early signs of kinetic preparation;

∴ The market is postured, not reactive – awaiting a directional event.

✴️ Tactical View: Structurally Neutral – Momentum Suspended, entry only upon RSI/Volume confirmation and MACD validation.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

∴ Update as of June 21, 2025 – Synchronized to H1 Structural Reading.

▦ Exchange Netflow Total – (All Exchanges) – (+692 BTC):

∴ Positive net inflow detected over 24h;

∴ Suggests moderate sell-side liquidity entering exchanges;

∴ Reflects defensive posturing, not panic-driven behavior.

✴️ Conclusion: Mild bearish pressure – not sufficient to invalidate structural base.

⊢

▦ Spot Taker CVD - (Cumulative Volume Delta, 90-day):

∴ Dominance of Taker Sell Volume confirmed – aggressive sellers remain in control;

∴ Pattern consistent over the last 6 sessions;

∴ No divergence between volume behavior and price structure.

✴️ Conclusion: Market remains tactically sell-biased – momentum driven by taker aggression.

⊢

▦ Spent Output Profit Ratio (SOPR) – (1.009):

∴ Marginally above 1.00 – coins being spent in mild profit;

∴ Absence of capitulation, but also no sign of deep conviction among holders;

∴ Stable rotation, not breakout-driven.

✴️ Conclusion: Structural neutrality – market is churning without direction.

⊢

▦ Adjusted SOPR (aSOPR) – (≈1.00):

∴ Flat – confirms lack of distribution or panic;

∴ Historically aligns with consolidation regimes.

✴️ Conclusion: Supply behavior is balanced – trend-neutral reading.

⊢

▦ Open Interest – All Exchanges – ($34.01B):

∴ Remains elevated – indicative of speculative leverage;

∴ Elevated risk of liquidation cascade on directional volatility;

∴ OI rising faster than spot volume = synthetic exposure dominating.

✴️ Conclusion: Market structurally exposed – fragile to external triggers.

⊢

▦ Funding Rate – All Exchanges – (-0.003):

∴ Slightly negative – shorts funding longs;

∴ Suggests bearish bias among leveraged participants;

∴ Conditions ripe for short squeeze if spot demand increases.

✴️ Conclusion: Contrarian setup building – tactical upside risk exists.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ Metrics reflect a market under cautious speculative tension;

∴ No broad liquidation, no long-term holder exit – base intact;

∴ Taker dominance and leverage build-up suggest reactive positioning;

∴ System is neutral-leaning fragile – vulnerable to both triggers and traps.

✴️ Tactical Note: "Structurally Stable – Tactically Unsettled"

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

∴ Macro Landscape Reference – June 21, 2025.

▦ United States – Federal Policy & Risk Layer:

∴ Treasury Yield Curve remains slightly positive (+0.44%), removing short-term recession signal;

∴ 10Y yield elevated at 4.42% – reflects sustained inflation resistance and risk demand;

∴ Fed maintains QT stance – no rate cuts expected before September;

∴ Tension with Iran intensifying – military rhetoric entering fiscal discourse.

✴️ Conclusion: U.S. macro acts as compression catalyst – neutral on surface, volatile underneath.

⊢

▦ Strategic Bitcoin Reserve – (Executive Order – Trump):

∴ Recent Executive Order establishes BTC as sovereign asset class;

∴ Adds policy-level legitimacy to institutional accumulation;

∴ Reflects shift from “hedge” to “strategic reserve logic”.

✴️ Conclusion: Structural bull signal – narrative transition confirmed.

⊢

▦ China – Internal Stimulus & Soft Deflation:

∴ PPI negative at -3.3%, Retail Sales up 6.4% – stimulus-driven divergence;

∴ Fiscal revenue declining YTD – systemic drag despite easing;

∴ Not a current volatility driver.

✴️ Conclusion: China is neutral to crypto – reactive, not directive.

⊢

▦ European Union – Disinflation & Monetary Drift:

∴ HICP falls to 1.9%, ECB cuts deposit rate to 2.00%;

∴ PMI Composite < 50 – economic contraction quietly progressing;

∴ Forward guidance hesitant.

✴️ Conclusion: EU remains marginal – supportive for risk, but not catalytic.

⊢

▦ Global Fragmentation & SWIFT Erosion:

∴ Geopolitical blocs continue diverging – dollar-reliant systems weakening;

∴ Bitcoin seen increasingly as transactional hedge in sanctioned environments;

∴ De-dollarization dynamic accelerating.

✴️ Conclusion: Bitcoin positioned as neutral monetary rail – volatility shield and escape valve.

⊢

🜎 Strategic Insight – Interflux Macro Oracle:

∴ U.S. remains the dominant macro variable – its monetary and geopolitical stance defines volatility posture;

∴ Bitcoin structurally benefits from institutional legitimacy, but tactically suspended by risk-off layers;

∴ The system is internally calm, externally tense – volatility is downstream of Powell and geopolitical shock.

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ Temporal structure remains compressed, yet technically reactive;

∴ On-chain behavior supports latent structural integrity, but reveals synthetic tension;

∴ Macro axis introduces dual asymmetry – stability in policy, instability in conflict;

∴ The system is in latency – not due to certainty, but due to mutual hesitation.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish.

∴ The underlying structure - long-term moving averages, exchange reserves, macro narrative, and holder behavior - remains intact and upward-biased;

∴ There is no technical breakdown or structural disassembly;

∴ It is the silent foundation - the “floor” of the chart remains elevated.

⊢

▦ Tactically Suspended.

∴ Although the structure points to strength, the present moment neither demands nor validates action;

∴ There is no volume, no ignition signal, no confirmation flow;

∴ Thus, the tactic is suspended - the trader (or observer) is in a disciplined state of observation, not execution.

⊢

⧉

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

𓂀 Wisdom begins in silence. Precision unfolds in strategy.

⧉

⊢

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.