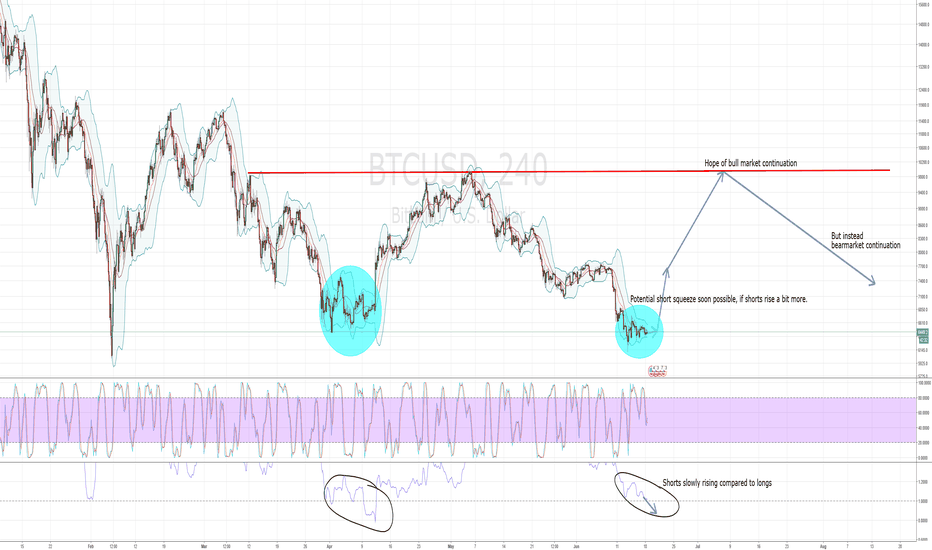

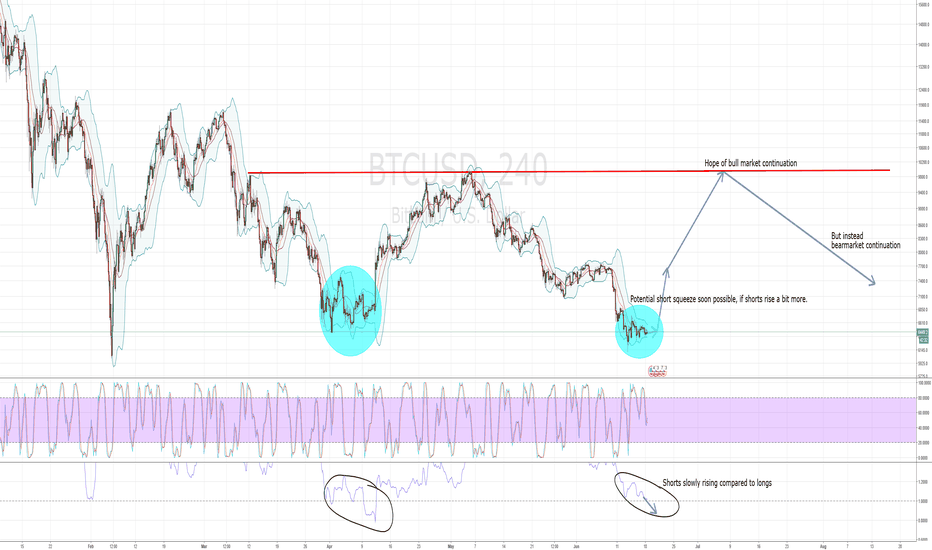

So, as I posted in my last update two updates to my previous idea, a further dump was more likely as compared to a short squeeze:

The reason is that too many people are still long, the sentiment is still too bullish, and whales will brutally exploit that with a long squeeze, leading to dumps.

But where are we now in the grand mega cycle?

Well, the bearmarket is pretty cemented as of now. Comparing with the 2014 fractal, I see a strong similarity of the situation now with the weekly candle of 7th of April 2014. The dump went below the weekly bollinger band, with

a strong subsequent rebound.

I think the same will happen now. I numbered the dumps and rallies all down to the lowest low, which we'll probably see in early to mid 2019 (at 2-3k, minimum of 2k).

So this dump will probably take us down to 5000-5400 area. I don't think it will hit the 78% fibo support level at 4300, this is too far from the lower weekly bollinger band.

I think we'll see a strong rebound after the low at 5000-5400, up to around 8k. This is a nice chance for some good profit.

The reason is that too many people are still long, the sentiment is still too bullish, and whales will brutally exploit that with a long squeeze, leading to dumps.

But where are we now in the grand mega cycle?

Well, the bearmarket is pretty cemented as of now. Comparing with the 2014 fractal, I see a strong similarity of the situation now with the weekly candle of 7th of April 2014. The dump went below the weekly bollinger band, with

a strong subsequent rebound.

I think the same will happen now. I numbered the dumps and rallies all down to the lowest low, which we'll probably see in early to mid 2019 (at 2-3k, minimum of 2k).

So this dump will probably take us down to 5000-5400 area. I don't think it will hit the 78% fibo support level at 4300, this is too far from the lower weekly bollinger band.

I think we'll see a strong rebound after the low at 5000-5400, up to around 8k. This is a nice chance for some good profit.

Note

I am currently closely watching the shorts on Bitfinex, and they are rising fast. If we don't continue to dump within the next 8-12 hours, I will close my shorts, because a short squeeze will get more likely.Note

Yep, shorts were too high, and now they get squeezed. I am exiting my short position and will see what happens next. I am still mid-term bearish though overall, however, this bounce could go up a few hundred usd.Note

Ok, this bounce was not as hard as I expected. We continue down to the target area of 5200 plusminus.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.