Hello friends,

Today, BTCUSD is showing a slight bearish bias, currently hovering around $115,000.

On the macro front, global financial markets are still digesting expectations that the Fed could cut interest rates in September, with current odds close to 90%, according to the CME FedWatch Tool. The main driver? Last week’s disappointing Non-Farm Payroll (NFP) report, which slightly weakened the US dollar and gave Bitcoin some short-term relief.

However, BTC is still not out of the woods. Institutional investors remain cautious, awaiting clearer signals from the Fed. If the US stock market pulls back, Bitcoin could follow suit as part of a short-term profit-taking wave.

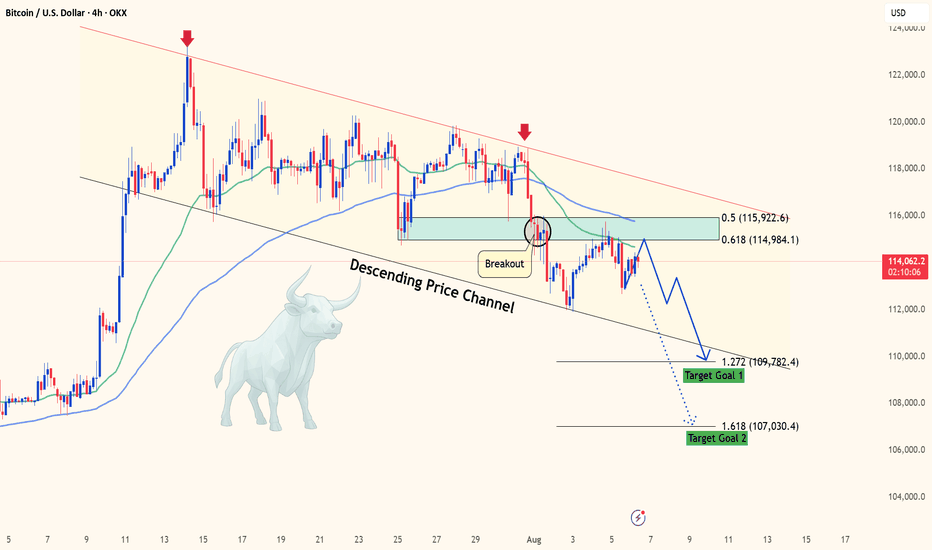

From a technical point of view, BTCUSD is still respecting a well-defined descending channel on the H4 timeframe. Price is approaching a strong confluence resistance zone around $115,800 (Entry Sell 1), aligned with both EMA and trendline. The next key level to watch is $118,000 (Entry Sell 2) – a zone that may trigger a false breakout before sellers step back in.

Looking ahead, the plan is to sell if the price shows rejection signs near 115,800 or 118,000. Place your SL just above resistance, and TP targets at 112,000, with an extended target near the $110,000 channel bottom.

So, what’s your take – will BTC break the downtrend channel or drop further?

Drop your thoughts in the comments below!

Today, BTCUSD is showing a slight bearish bias, currently hovering around $115,000.

On the macro front, global financial markets are still digesting expectations that the Fed could cut interest rates in September, with current odds close to 90%, according to the CME FedWatch Tool. The main driver? Last week’s disappointing Non-Farm Payroll (NFP) report, which slightly weakened the US dollar and gave Bitcoin some short-term relief.

However, BTC is still not out of the woods. Institutional investors remain cautious, awaiting clearer signals from the Fed. If the US stock market pulls back, Bitcoin could follow suit as part of a short-term profit-taking wave.

From a technical point of view, BTCUSD is still respecting a well-defined descending channel on the H4 timeframe. Price is approaching a strong confluence resistance zone around $115,800 (Entry Sell 1), aligned with both EMA and trendline. The next key level to watch is $118,000 (Entry Sell 2) – a zone that may trigger a false breakout before sellers step back in.

Looking ahead, the plan is to sell if the price shows rejection signs near 115,800 or 118,000. Place your SL just above resistance, and TP targets at 112,000, with an extended target near the $110,000 channel bottom.

So, what’s your take – will BTC break the downtrend channel or drop further?

Drop your thoughts in the comments below!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.