Bitcoin ‘GOLD 2.0’ Overview

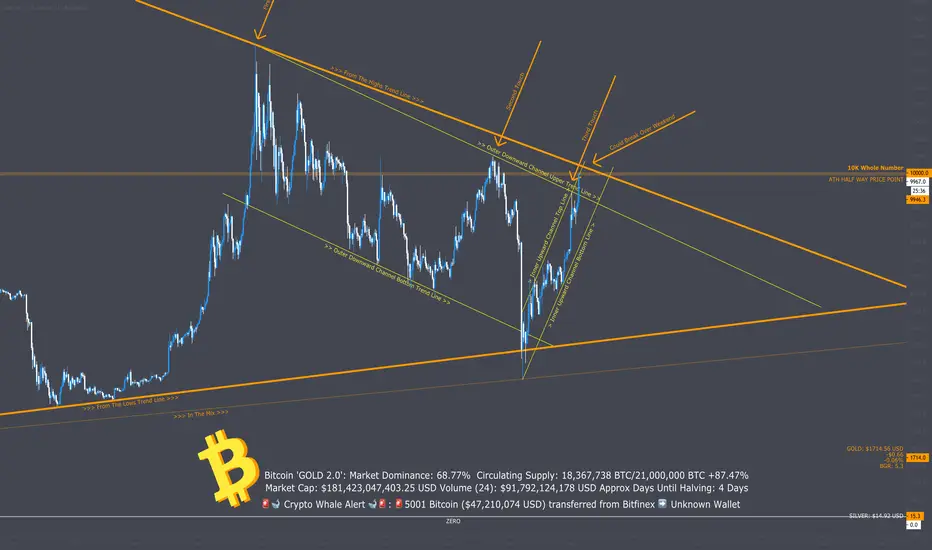

Price action has seen Bitcoin push with vigour through the inner upward channel and outer upper trend line after 4 tests within the triangle which has been absolutely broken. This push blasting through the double top, remember all of these now become support zones. Currently Bitcoin is breathing some more fresh air however for cleaner air needs to push above the ‘Area of Interest’ (See below) and battle the outer double top at 10500 resistance. Beware that the Trend line from the ATH/highs in the market is now in sight and a break of this will confirm positive momentum. We are testing the ATH half way price point also - This will get traders antsy from this positive price movement.

Outer Perspective

Since the 16 June 2019 price has bounced around to form this large downward channel, now we see its broken the 100% range. Other traders may have something similar marked on their charts or a trend line of the upper this will mark for them that bitcoin has stretch from their perspectives. We’ll see some FOMO news articles come out considering we are currently 4-5 days away from halving. So be aware of market sentiment when most are fearful of the current covid economic affects. Price could come to test the upper tiers spoken about above, remember this for future reference.

Inner Perspective

A quick one here as price is pretty self serving of its move within this upward channel. Thus I’d like to point out the test of the upper trend line currently respecting this into todays daily open. As stated previously above this coincides with the ATH half way price point which is a major psychological zone which won’t actually be noted by many however perceive it. You’ll see the ‘Potential 3rd Double Top Point’ (alas to say where price will retest the previous double top points formed) and consider this a target point for potential price action. (See Area Of Interest fro more clarification)

Area of Interest

This section is taking out of account the bitcoin halving and consider it as simply taking a snap shot of the market right now. Support and resistance zones to be respected here also. As a break of the outer downward channels’s upper trend line i’e depicted a subtle Trend line (what other traders and computer algorithms will place) this coupled with the inner upward channel now paints a zone or area of interest. This is to be considered a potential price range if the channel holds true.

Support & Resistance

Support Levels

1st Support Zone: 9530

2nd Support Zone: 9000

3rd Support Zone: 8700

Resistance Levels:

1st Resistance Zone: 10100

2nd Resistance Zone: 10500

3rd Resistance Zone: 11500

Price Level Consideration

Approximate Days Until Halving: 5 Days* Pending Timezone

All Time High Half Way Point: 9942.5

Prominent High: 13767.4

Prominent Low: 3994.1

🐃 Bulls Verse Bears 🐻

🐃 Bullish above 10485.8

🐻 Bearish below 6474.1

Monthly & Weekly Opens

Monthly Open: 8629.2

Weekly Open: 8900.0

Current Price Zone: ACCUMULATION ZONE

Bitcoin to Date

Daily

Current Price: $9870.8 USD

Daily Change %: +7.85%

Market Cap: $181,423,047,403.25 USD

24 Hour Volume: $91,792,124,178 USD

Population of the World: ~7,782,930,000+ humans

Today’s Bitcoin Total / World Population: ~ 0.002360002980883 Satoshi’s / $23.29 USD per person

Overall

Approximate Bitcoin in Circulation: 18,367,738 BTC

Approximate Bitcoin Mined Last 24hr: 1,800 BTC

Approximate Bitcoin Left to Mine: 2,632,263 BTC

Road to 21,000,000 Bitcoin Mined: 87.47%

Current Bitcoin Dominance: 68.77%

Biggest Bitcoin Transaction of the Day

1.🚨5001 Bitcoin ($47,210,074 USD) transferred from Bitfinex ➡️ Unknown Wallet

2.🚨2900 Bitcoin ($28,560,854 USD) transferred from Binance ➡️ Unknown Wallet

3. 🚨2001 Bitcoin ($18,493,639 USD) transferred from OKEx ➡️ Unknown Wallet

Largest Cryptocurrency Transaction known Today:

🚨🚨5001 Bitcoin ($47,210,074 USD) transferred from Bitfinex ➡️ Unknown Wallet🚨🚨

GOLD:

Current Price: $1714.06 USD

Dollar Change: -$1.31 USD

Percentage Change -0.08%

Bitcoin to Gold Ratio: 5.3

Price action has seen Bitcoin push with vigour through the inner upward channel and outer upper trend line after 4 tests within the triangle which has been absolutely broken. This push blasting through the double top, remember all of these now become support zones. Currently Bitcoin is breathing some more fresh air however for cleaner air needs to push above the ‘Area of Interest’ (See below) and battle the outer double top at 10500 resistance. Beware that the Trend line from the ATH/highs in the market is now in sight and a break of this will confirm positive momentum. We are testing the ATH half way price point also - This will get traders antsy from this positive price movement.

Outer Perspective

Since the 16 June 2019 price has bounced around to form this large downward channel, now we see its broken the 100% range. Other traders may have something similar marked on their charts or a trend line of the upper this will mark for them that bitcoin has stretch from their perspectives. We’ll see some FOMO news articles come out considering we are currently 4-5 days away from halving. So be aware of market sentiment when most are fearful of the current covid economic affects. Price could come to test the upper tiers spoken about above, remember this for future reference.

Inner Perspective

A quick one here as price is pretty self serving of its move within this upward channel. Thus I’d like to point out the test of the upper trend line currently respecting this into todays daily open. As stated previously above this coincides with the ATH half way price point which is a major psychological zone which won’t actually be noted by many however perceive it. You’ll see the ‘Potential 3rd Double Top Point’ (alas to say where price will retest the previous double top points formed) and consider this a target point for potential price action. (See Area Of Interest fro more clarification)

Area of Interest

This section is taking out of account the bitcoin halving and consider it as simply taking a snap shot of the market right now. Support and resistance zones to be respected here also. As a break of the outer downward channels’s upper trend line i’e depicted a subtle Trend line (what other traders and computer algorithms will place) this coupled with the inner upward channel now paints a zone or area of interest. This is to be considered a potential price range if the channel holds true.

Support & Resistance

Support Levels

1st Support Zone: 9530

2nd Support Zone: 9000

3rd Support Zone: 8700

Resistance Levels:

1st Resistance Zone: 10100

2nd Resistance Zone: 10500

3rd Resistance Zone: 11500

Price Level Consideration

Approximate Days Until Halving: 5 Days* Pending Timezone

All Time High Half Way Point: 9942.5

Prominent High: 13767.4

Prominent Low: 3994.1

🐃 Bulls Verse Bears 🐻

🐃 Bullish above 10485.8

🐻 Bearish below 6474.1

Monthly & Weekly Opens

Monthly Open: 8629.2

Weekly Open: 8900.0

Current Price Zone: ACCUMULATION ZONE

Bitcoin to Date

Daily

Current Price: $9870.8 USD

Daily Change %: +7.85%

Market Cap: $181,423,047,403.25 USD

24 Hour Volume: $91,792,124,178 USD

Population of the World: ~7,782,930,000+ humans

Today’s Bitcoin Total / World Population: ~ 0.002360002980883 Satoshi’s / $23.29 USD per person

Overall

Approximate Bitcoin in Circulation: 18,367,738 BTC

Approximate Bitcoin Mined Last 24hr: 1,800 BTC

Approximate Bitcoin Left to Mine: 2,632,263 BTC

Road to 21,000,000 Bitcoin Mined: 87.47%

Current Bitcoin Dominance: 68.77%

Biggest Bitcoin Transaction of the Day

1.🚨5001 Bitcoin ($47,210,074 USD) transferred from Bitfinex ➡️ Unknown Wallet

2.🚨2900 Bitcoin ($28,560,854 USD) transferred from Binance ➡️ Unknown Wallet

3. 🚨2001 Bitcoin ($18,493,639 USD) transferred from OKEx ➡️ Unknown Wallet

Largest Cryptocurrency Transaction known Today:

🚨🚨5001 Bitcoin ($47,210,074 USD) transferred from Bitfinex ➡️ Unknown Wallet🚨🚨

GOLD:

Current Price: $1714.06 USD

Dollar Change: -$1.31 USD

Percentage Change -0.08%

Bitcoin to Gold Ratio: 5.3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.