Bitcoin is heading into September after recently printing a new ATH,

historically September is a red month, so expecting further mild losses

heading into September and limited upside, however, once the pattern

and correction is complete, we should see another bull run and mark up.

📊 Bitcoin September Seasonality (Last 10 Years: 2015–2024)

Yearly September Returns

Year 📈 Return

2024 🟢 +7.39%

2023 🟢 +3.99%

2022 🔴 −3.09%

2021 🔴 −7.03%

2020 🔴 −7.66%

2019 🔴 −13.88%

2018 🔴 −5.95%

2017 🔴 −7.72%

2016 🟢 +5.94%

2015 🟢 +2.52%

📌 At-a-glance stats (2015–2024)

📉 Mean (10-yr): −2.55%

⚖️ Median: −4.52%

🔴 Red months: 6 out of 10

❌ Worst September: 2019 (−13.88%)

✅ Best September: 2024 (+7.39%)

📅 Recent Performance (last 3 years)

2024: 🟢 +7.39% → Strongest September in a decade

2023: 🟢 +3.99% → Rare green month, breaking the red-seasonality myth

2022: 🔴 −3.09% → Modest dip during a bearish macro cycle

➡️ Average of last 3 years: 🟢 +2.8%

➡️ Average of last 5 years (2020–2024): 🔴 −1.3%

🔎 Key Insights

September Slump : Historically, September is known as a "red month" for Bitcoin, often averaging −4% to −6% declines. Over the last decade, the median return (−4.5%) aligns with this bearish narrative.

Volatility Factor: The spread between best (+7.39% in 2024) and worst (−13.88% in 2019) September is 21 percentage points, underlining Bitcoin’s volatility even within seasonal patterns.

Changing Trend? The last two years (2023 & 2024) both closed green — suggesting the September slump might be losing strength in the current cycle.

🚀 Macro & Market Context

2019–2020: Heavy red Septembers coincided with global macro uncertainty (trade wars, COVID jitters).

2021: Correction phase post-$64k BTC ATH saw September hit −7%.

2022: Ongoing bear market after Terra/LUNA & 3AC collapses kept September negative.

2023–2024: Renewed momentum, institutional inflows, and ETF speculation helped reverse September’s red streak.

🧭 Takeaway

While September has historically been Bitcoin’s weakest month, the last two years show signs of reversal. The broader trend reminds us that seasonality is a tendency, not a guarantee — macro cycles and catalysts often override calendar effects.

historically September is a red month, so expecting further mild losses

heading into September and limited upside, however, once the pattern

and correction is complete, we should see another bull run and mark up.

📊 Bitcoin September Seasonality (Last 10 Years: 2015–2024)

Yearly September Returns

Year 📈 Return

2024 🟢 +7.39%

2023 🟢 +3.99%

2022 🔴 −3.09%

2021 🔴 −7.03%

2020 🔴 −7.66%

2019 🔴 −13.88%

2018 🔴 −5.95%

2017 🔴 −7.72%

2016 🟢 +5.94%

2015 🟢 +2.52%

📌 At-a-glance stats (2015–2024)

📉 Mean (10-yr): −2.55%

⚖️ Median: −4.52%

🔴 Red months: 6 out of 10

❌ Worst September: 2019 (−13.88%)

✅ Best September: 2024 (+7.39%)

📅 Recent Performance (last 3 years)

2024: 🟢 +7.39% → Strongest September in a decade

2023: 🟢 +3.99% → Rare green month, breaking the red-seasonality myth

2022: 🔴 −3.09% → Modest dip during a bearish macro cycle

➡️ Average of last 3 years: 🟢 +2.8%

➡️ Average of last 5 years (2020–2024): 🔴 −1.3%

🔎 Key Insights

September Slump : Historically, September is known as a "red month" for Bitcoin, often averaging −4% to −6% declines. Over the last decade, the median return (−4.5%) aligns with this bearish narrative.

Volatility Factor: The spread between best (+7.39% in 2024) and worst (−13.88% in 2019) September is 21 percentage points, underlining Bitcoin’s volatility even within seasonal patterns.

Changing Trend? The last two years (2023 & 2024) both closed green — suggesting the September slump might be losing strength in the current cycle.

🚀 Macro & Market Context

2019–2020: Heavy red Septembers coincided with global macro uncertainty (trade wars, COVID jitters).

2021: Correction phase post-$64k BTC ATH saw September hit −7%.

2022: Ongoing bear market after Terra/LUNA & 3AC collapses kept September negative.

2023–2024: Renewed momentum, institutional inflows, and ETF speculation helped reverse September’s red streak.

🧭 Takeaway

While September has historically been Bitcoin’s weakest month, the last two years show signs of reversal. The broader trend reminds us that seasonality is a tendency, not a guarantee — macro cycles and catalysts often override calendar effects.

taplink.cc/black001

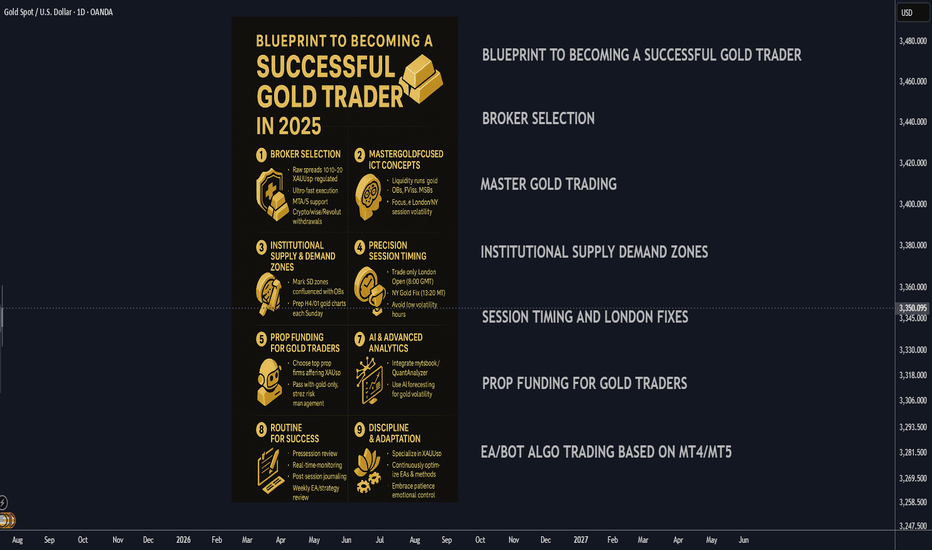

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.