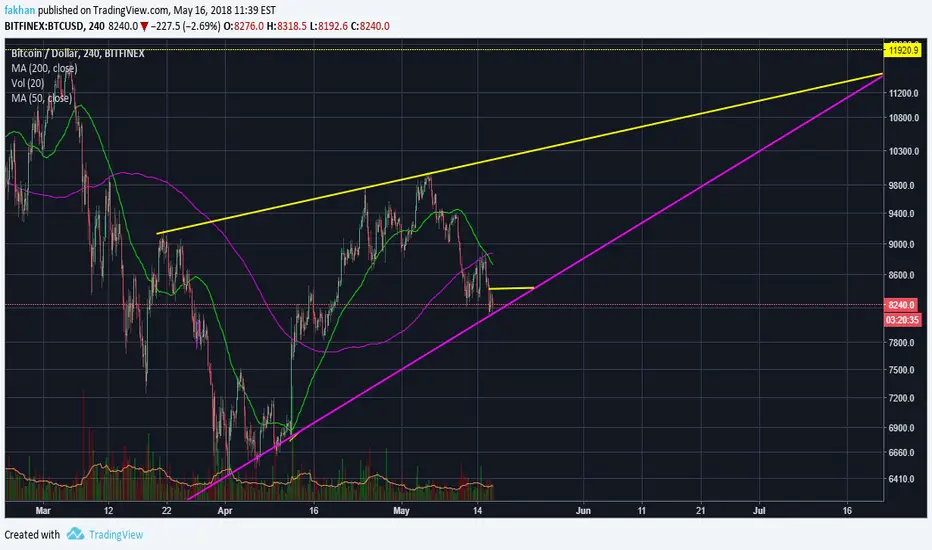

Bitcoin (BTC) currently trades at $8,357 after falling to $8,100 levels which held firmly. The price is now looking bullish short term and might continue trading in the rising wedge for the next few weeks. It is possible that the price falls below the wedge close to $11,000 levels validating the stance of most analysts. While Consensus this year was attended by over 8000 members and Lamborghinis were spotted in the vicinity of the conference, it does not mean that everyone will just up and buy on one particular day to drive the price up to new highs. It is usual for mainstream investors to expect that but there are new players in the game who do not play by the same rules.

Besides, the market cap of Bitcoin (BTC) has grown substantially big to be dominated by a few billionaires or a group of eager millionaires. Having said that, the interest of big players in Bitcoin (BTC) has also been on the rise. Those big players are institutional investors with billions of dollars at their disposal to invest in Bitcoin (BTC) or other cryptocurrencies. The difference is that they are not going to change their rules for Bitcoin (BTC). They are going to use the same tactics of manipulating the price so they can put in their iceberg orders in order to avoid spiking the price up in one go which will result in mass profit taking and the ‘clever’ institutional investors would be left holding the bags.

Read Further: cryptodaily.co.uk/2018/05/bitcoin-btc-falling-despite-consensus-excitement/

Besides, the market cap of Bitcoin (BTC) has grown substantially big to be dominated by a few billionaires or a group of eager millionaires. Having said that, the interest of big players in Bitcoin (BTC) has also been on the rise. Those big players are institutional investors with billions of dollars at their disposal to invest in Bitcoin (BTC) or other cryptocurrencies. The difference is that they are not going to change their rules for Bitcoin (BTC). They are going to use the same tactics of manipulating the price so they can put in their iceberg orders in order to avoid spiking the price up in one go which will result in mass profit taking and the ‘clever’ institutional investors would be left holding the bags.

Read Further: cryptodaily.co.uk/2018/05/bitcoin-btc-falling-despite-consensus-excitement/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.