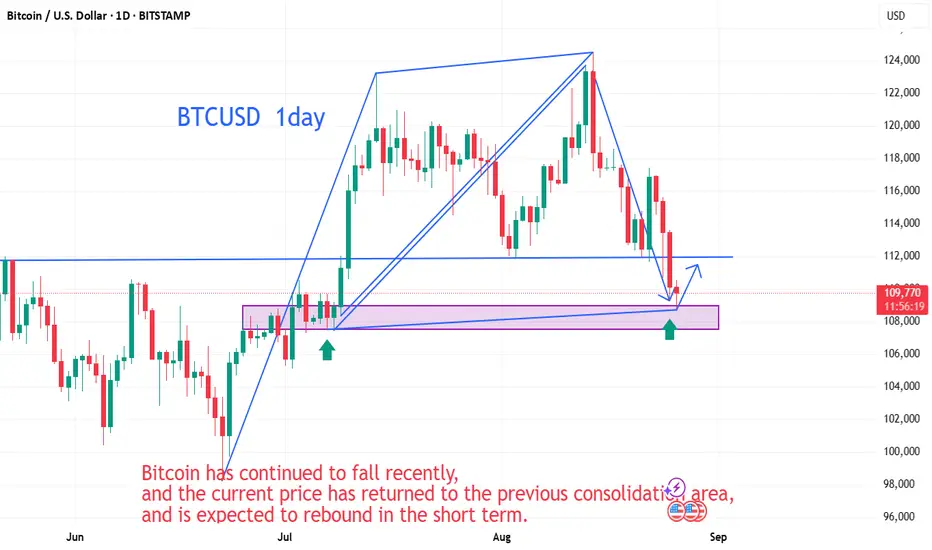

Bitcoin has been weakening recently, and the strategy of continuously opening short positions has been adopted. The price has now fallen below the 110,000 mark, which is consistent with the recent downward trend.

From the perspective of technical indicators

The daily chart shows a bearish resonance pattern. While the KDJ and MACD are currently in bullish territory, momentum has significantly weakened, forming a shrinking-volume top divergence. The moving averages are aligned in a bearish pattern, forming a strong resistance layer. While multiple indicators are simultaneously signaling bearishness, the MACD is oversold, indicating the need for a rebound. It is recommended to open long positions below 110,000 to capitalize on any corrective rebound after an oversold period.

If the Bitcoin price pulls back to around 109,500, a long position can be opened. The rebound target is above 110,000. Wait until the rebound falters before considering opening a short position. Take advantage of the oversold rebound opportunity now.

From the perspective of technical indicators

The daily chart shows a bearish resonance pattern. While the KDJ and MACD are currently in bullish territory, momentum has significantly weakened, forming a shrinking-volume top divergence. The moving averages are aligned in a bearish pattern, forming a strong resistance layer. While multiple indicators are simultaneously signaling bearishness, the MACD is oversold, indicating the need for a rebound. It is recommended to open long positions below 110,000 to capitalize on any corrective rebound after an oversold period.

If the Bitcoin price pulls back to around 109,500, a long position can be opened. The rebound target is above 110,000. Wait until the rebound falters before considering opening a short position. Take advantage of the oversold rebound opportunity now.

If you have questions about the direction of gold, crude oil, Bitcoin, and Ethereum, you can follow me.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you have questions about the direction of gold, crude oil, Bitcoin, and Ethereum, you can follow me.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.