Morning everybody,

It is difficult to express in one post the whole picture that we see. It would be better if you watch the video, where we cover all time frames...

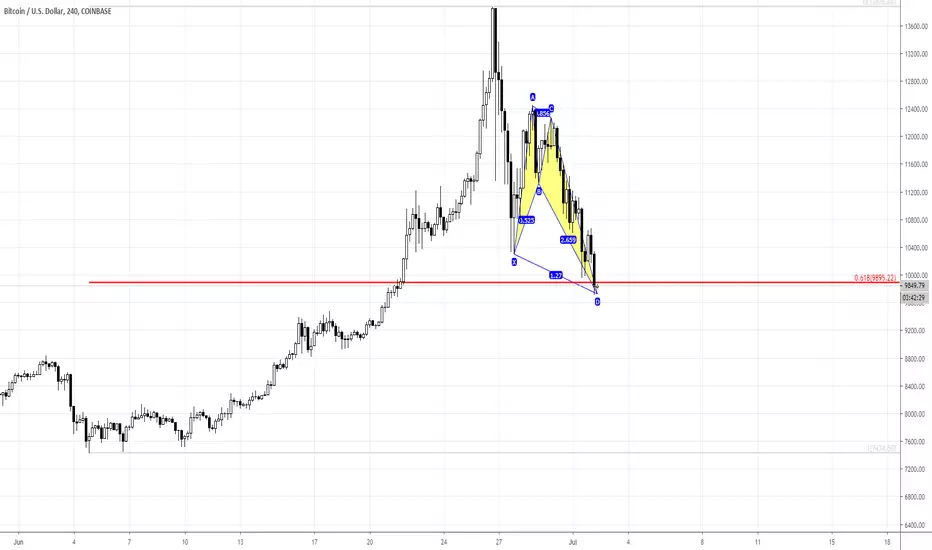

Market ignores strong technical issues. Yesterday it drops deeper in oversold and broken through intraday K-resistance area.

Now BTC stands at major daily K-support and OS area as well. On intraday charts our "222" Buy turns to Butterfly. Odds suggest minor pullback, 30% maybe a bit more.

As we have downside AB=CD target around 8900$, after pullback downside action should continue. This area also will be 1.618 butterfly extension. As soon as it will be reached -

price will complete huge weekly evening star pattern and the first leg of our predefined retracement. Second leg should follow to 6500-7000 area as we've suggested.

As we do not trade BTC short right now and mostly wait for strategical point to go long, we do not care much on the shape of retracement. It is possible probably to do some scalp long trades, based on

shown butterfly as well but we wait for strategical point. If you would like to go long right now, you should understand the risk, because bearish pressure is very strong as market drop despite oversold.

Odds suggest no short position as market at daily Oversold and strong K-support area.

It is difficult to express in one post the whole picture that we see. It would be better if you watch the video, where we cover all time frames...

Market ignores strong technical issues. Yesterday it drops deeper in oversold and broken through intraday K-resistance area.

Now BTC stands at major daily K-support and OS area as well. On intraday charts our "222" Buy turns to Butterfly. Odds suggest minor pullback, 30% maybe a bit more.

As we have downside AB=CD target around 8900$, after pullback downside action should continue. This area also will be 1.618 butterfly extension. As soon as it will be reached -

price will complete huge weekly evening star pattern and the first leg of our predefined retracement. Second leg should follow to 6500-7000 area as we've suggested.

As we do not trade BTC short right now and mostly wait for strategical point to go long, we do not care much on the shape of retracement. It is possible probably to do some scalp long trades, based on

shown butterfly as well but we wait for strategical point. If you would like to go long right now, you should understand the risk, because bearish pressure is very strong as market drop despite oversold.

Odds suggest no short position as market at daily Oversold and strong K-support area.

ForexPeaceArmy BTC analytics :

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

ForexPeaceArmy BTC analytics :

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

forexpeacearmy.com/r/author/11/sive-morten-blog

FX, GOLD:

forexpeacearmy.com/community/forums/sive-morten-currencies-and-gold-video-analysis.122/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.