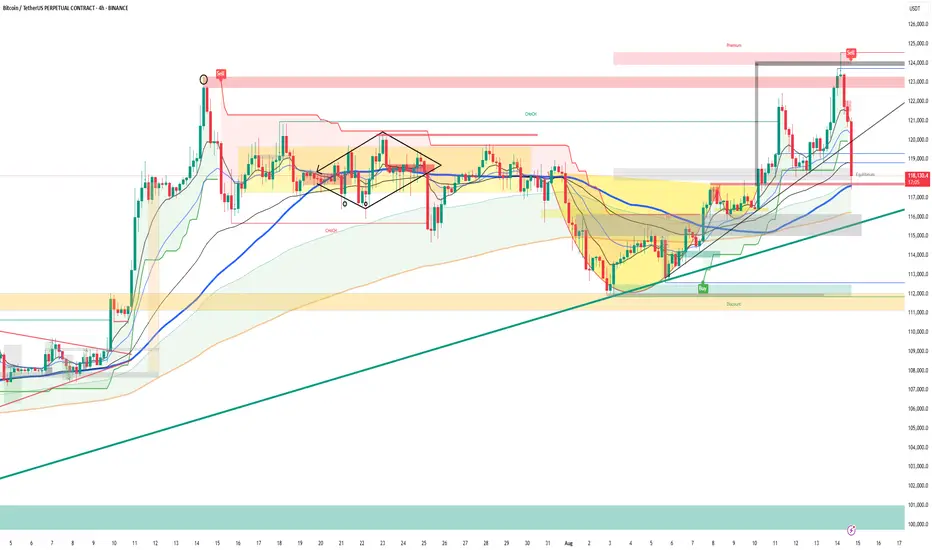

Summary: BTC tagged the 123.6–124.6k supply and reversed hard. Price is parked around 118k (prior base/equilibrium). Intraday structure = lower highs; 4H momentum neutral→bearish unless 120.6k is reclaimed.

Market check (now): Trading near 118k after a $124k spike and fast selloff.

News drivers (condensed): Fresh ATH headlines triggered profit-taking; macro tone supportive on rate-cut hopes; ETF/institutional demand remains a tailwind but near-term stretched conditions invited a fade.

Key levels

Resistance: 119.6–120.2k, 120.8–121.4k, 123.6–124.6k

Support: 117.6–118.0k, 116.2–116.8k, 114.5–115.2k, 112.0–112.8k

Bias & triggers

Bearish below 119.6–120.2k. Failure there keeps pressure toward 116s → 115s → 112s.

Bullish only on strong reclaim of 120.6k+. Acceptance above opens 121.4k → 122.4k → 123.6–124.6k.

Plan (idea)

Short setup: Look for rejection at 119.6–120.2k or a clean break/close <117.6k → targets 116.8k, 115.2k, 112.5k.

Long counter-trend: Only if price reclaims and holds >120.6k with momentum → 121.4k / 122.4k; stretch to 123.6–124.6k if demand persists.

Invalidation: Shorts invalid if price sustains >121.4k; longs invalid on a 4H close <117.6k.

Read: After the $124k sweep, the local uptrend line broke; 4H EMAs flatten and 30m prints lower highs. 118k is the pivot—acceptance below favors 116s–115s; swift reclaim of 120.6k signals bears losing grip.

Market check (now): Trading near 118k after a $124k spike and fast selloff.

News drivers (condensed): Fresh ATH headlines triggered profit-taking; macro tone supportive on rate-cut hopes; ETF/institutional demand remains a tailwind but near-term stretched conditions invited a fade.

Key levels

Resistance: 119.6–120.2k, 120.8–121.4k, 123.6–124.6k

Support: 117.6–118.0k, 116.2–116.8k, 114.5–115.2k, 112.0–112.8k

Bias & triggers

Bearish below 119.6–120.2k. Failure there keeps pressure toward 116s → 115s → 112s.

Bullish only on strong reclaim of 120.6k+. Acceptance above opens 121.4k → 122.4k → 123.6–124.6k.

Plan (idea)

Short setup: Look for rejection at 119.6–120.2k or a clean break/close <117.6k → targets 116.8k, 115.2k, 112.5k.

Long counter-trend: Only if price reclaims and holds >120.6k with momentum → 121.4k / 122.4k; stretch to 123.6–124.6k if demand persists.

Invalidation: Shorts invalid if price sustains >121.4k; longs invalid on a 4H close <117.6k.

Read: After the $124k sweep, the local uptrend line broke; 4H EMAs flatten and 30m prints lower highs. 118k is the pivot—acceptance below favors 116s–115s; swift reclaim of 120.6k signals bears losing grip.

A Haque

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

A Haque

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.