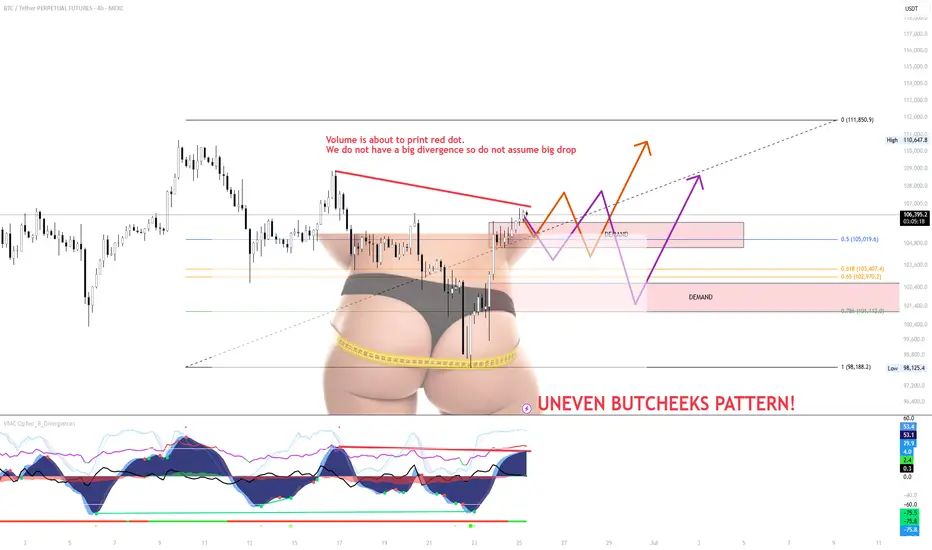

The small range forming just under local resistance is weak and showing signs of exhaustion. Despite a possible red dot printing soon, volume is not confirming a strong bearish divergence, so don’t assume a major drop is guaranteed just yet.

The “Uneven Butcheeks” pattern visually highlights imbalance

A fakeout back into the range, or

A flush to grab liquidity sitting beneath key demand zones.

Key Scenarios

Scenario A (Orange Path)

A breakout through the overhead supply zone could trigger upside continuation toward $111,850.

But unless it’s backed by strong volume and broader BTC strength, I’ll be fading this move.

Right now, this doesn’t look like conviction from bulls — it looks like exhaustion.

Scenario B (Purple Path)

A rejection at current levels or a weak fakeout could break back into the demand zone.

With thin structure below and low buy-side aggression, price could sweep down toward $102.9k–$101.1k, or even lower.

If we get this move, I’ll be watching how buyers behave around the lower demand — that’s where bulls need to prove themselves.

⚠️ Strategy:

Don’t front-run this — let the price confirm or invalidate.

Watch volume. Watch BTC dominance.

Until then, this zone is chop-heavy, and patience = protection.

The “Uneven Butcheeks” pattern visually highlights imbalance

A fakeout back into the range, or

A flush to grab liquidity sitting beneath key demand zones.

Key Scenarios

Scenario A (Orange Path)

A breakout through the overhead supply zone could trigger upside continuation toward $111,850.

But unless it’s backed by strong volume and broader BTC strength, I’ll be fading this move.

Right now, this doesn’t look like conviction from bulls — it looks like exhaustion.

Scenario B (Purple Path)

A rejection at current levels or a weak fakeout could break back into the demand zone.

With thin structure below and low buy-side aggression, price could sweep down toward $102.9k–$101.1k, or even lower.

If we get this move, I’ll be watching how buyers behave around the lower demand — that’s where bulls need to prove themselves.

⚠️ Strategy:

Don’t front-run this — let the price confirm or invalidate.

Watch volume. Watch BTC dominance.

Until then, this zone is chop-heavy, and patience = protection.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.