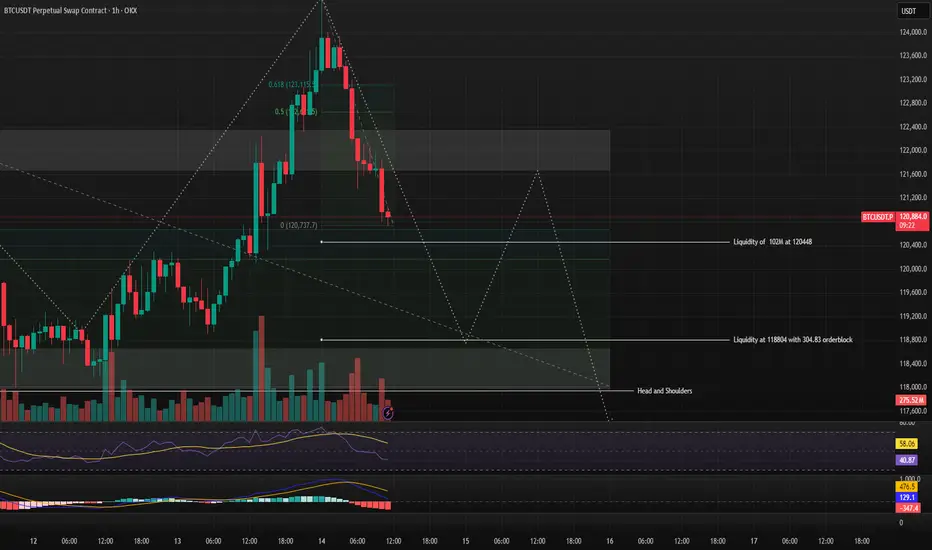

A confluence-based liquidity grab and reversal strategy using Fibonacci retracement, liquidity pools, and chart patterns to forecast high-probability reversal zones.

The thought process:

- Identify swing high & low → plot Fib retracement.

- Watch for price reaction in the 0.5–0.618 zone (golden pocket).

- Confirm with nearby liquidity pools (where price is likely to be attracted before reversal).

- Add extra confirmation from patterns (like Head and Shoulders).

- Plan for short entries if bearish confluence aligns, or long entries if bullish.

The thought process:

- Identify swing high & low → plot Fib retracement.

- Watch for price reaction in the 0.5–0.618 zone (golden pocket).

- Confirm with nearby liquidity pools (where price is likely to be attracted before reversal).

- Add extra confirmation from patterns (like Head and Shoulders).

- Plan for short entries if bearish confluence aligns, or long entries if bullish.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.