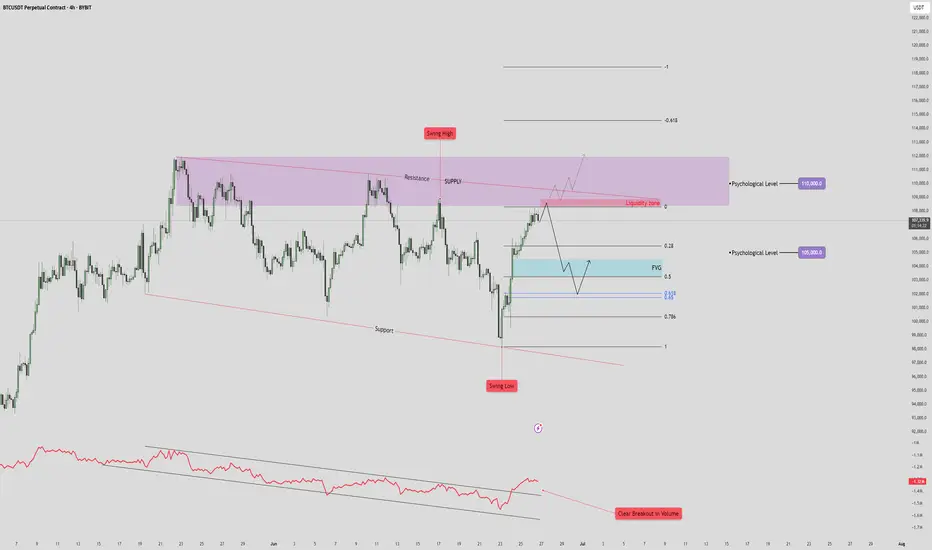

🧠 High Time Frame Context

Trend: Consolidation within a broad range (support and resistance clearly defined).

Key Psychological Levels:

105,000 USDT – minor level, acting as a magnet in short-term PA.

110,000 USDT – major supply confluence and liquidity target.

🟪 Supply & Resistance Zone

Zone: Marked in purple (108.5k-112k).

Key Observation:

Swing high formed inside this zone, indicating liquidity trap.

Potential fake-out or strong rejection from this area.

Strong confluence with a descending resistance trendline, adding to the selling pressure.

🔵 Fair Value Gap (FVG) & Retracement Targets

FVG identified just below the current price (~103.5k-104.5k).

Price is projected to:

Reject from the current high.

Drop to fill the FVG zone.

Possibly bounce between FVG and Fibonacci retracement levels:

0.5

0.618

0.786

🔴 Volume & RSI Divergence

Volume breakout is noted on the last push down (bottom red annotation), followed by a retrace.

OBV shows bullish divergence with price:

🔻 Support Structure

Lower red trendline is a key long-term support.

Previous swing low aligns with this trendline – buyers showed strong interest here.

If FVG fails to hold, expect a retest of this trendline near 97,000–98,000.

📈 Likely Scenarios

Base Case (Neutral-Bearish):

Price rejects current zone (~107,000).

Pullback into FVG (101–104K).

Bounce to 105K (minor resistance), then decide next direction.

Bullish Breakout:

If price breaks and closes above 110K, it invalidates supply zone.

Opens door to 115–118K range.

Bearish Breakdown:

Fails FVG zone.

Tests previous swing low and support (~97K).

Below that, structure becomes macro bearish.

🧩 Summary

Short-Term: Retracement into FVG likely. Monitor reaction.

Medium-Term: Bearish bias while price is below 110K.

Invalidation for bears: Clean break and hold above 110K.

Trend: Consolidation within a broad range (support and resistance clearly defined).

Key Psychological Levels:

105,000 USDT – minor level, acting as a magnet in short-term PA.

110,000 USDT – major supply confluence and liquidity target.

🟪 Supply & Resistance Zone

Zone: Marked in purple (108.5k-112k).

Key Observation:

Swing high formed inside this zone, indicating liquidity trap.

Potential fake-out or strong rejection from this area.

Strong confluence with a descending resistance trendline, adding to the selling pressure.

🔵 Fair Value Gap (FVG) & Retracement Targets

FVG identified just below the current price (~103.5k-104.5k).

Price is projected to:

Reject from the current high.

Drop to fill the FVG zone.

Possibly bounce between FVG and Fibonacci retracement levels:

0.5

0.618

0.786

🔴 Volume & RSI Divergence

Volume breakout is noted on the last push down (bottom red annotation), followed by a retrace.

OBV shows bullish divergence with price:

🔻 Support Structure

Lower red trendline is a key long-term support.

Previous swing low aligns with this trendline – buyers showed strong interest here.

If FVG fails to hold, expect a retest of this trendline near 97,000–98,000.

📈 Likely Scenarios

Base Case (Neutral-Bearish):

Price rejects current zone (~107,000).

Pullback into FVG (101–104K).

Bounce to 105K (minor resistance), then decide next direction.

Bullish Breakout:

If price breaks and closes above 110K, it invalidates supply zone.

Opens door to 115–118K range.

Bearish Breakdown:

Fails FVG zone.

Tests previous swing low and support (~97K).

Below that, structure becomes macro bearish.

🧩 Summary

Short-Term: Retracement into FVG likely. Monitor reaction.

Medium-Term: Bearish bias while price is below 110K.

Invalidation for bears: Clean break and hold above 110K.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.