__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Macro, Economic Calendar, On-chain & Risk Management

__________________________________________________________________________________

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

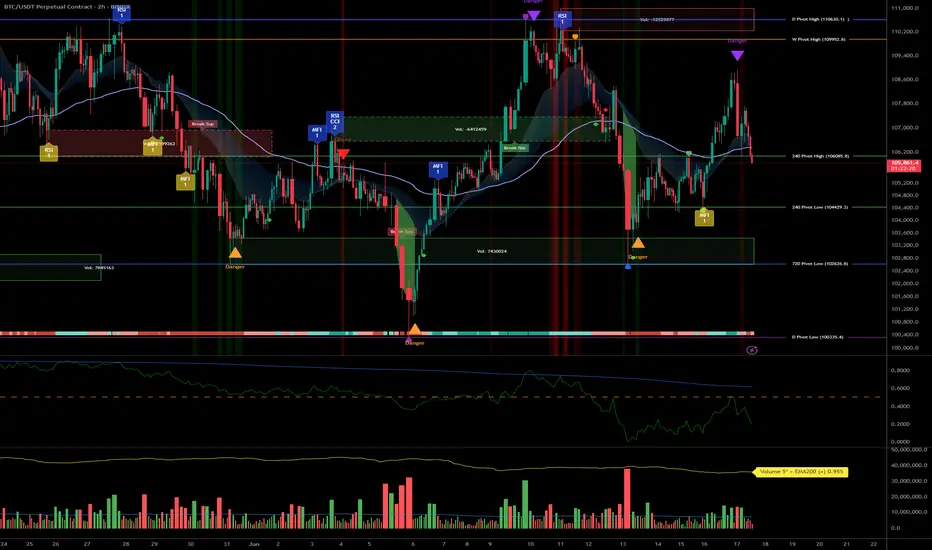

- Momentum: Dominant bullish structure across all major timeframes (MTFTI = Up).

- Supports/Resistances: No HTF pivot engaged; key on-chain support at $97.6k, resistance at $115.4k.

- Volume: Central oscillation within range; no major surges observed, consolidation on micro-TF.

- Multi-timeframe behaviors: Bullish structure dominates, technical pullback on 4H-1H-15min without major breaks.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Overall Bias: Structurally bullish as long as key supports hold (97.6k–104.5k zone).

- Opportunities: Buy confirmed dips on on-chain cluster/H4-H2 area, target 110–115k extension post-FOMC positive catalyst.

- Risk zones: Extreme volatility expected around FOMC (June 17–18); strict risk management, avoid overexposure.

- Macro catalysts: FOMC (rate decision, dot plot), Fed leadership stability, Israel-Iran geopolitical tensions.

- Action plan: Patience until FOMC; favor setups on clear price reaction, tight stops below 97.5k (on-chain support).

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D: Bullish momentum, price at range center ($106k). Watch for pivot break.

- 12H: Persistent bullish bias, confluence with 1D.

- 6H: Expected consolidation, bullish structure.

- 4H: Technical pullback, bullish structure remains. Key anticipated support 105k–104.5k.

- 2H: Likely move towards lower range. Up bias confirmed.

- 1H: Technical correction within overall Up trend.

- 30min/15min: Seller sequence, trend intact, no major break.

Risk On / Risk Off Indicator remains “Up” across all frames, boosting the positive view despite short-term correction.

- Executive summary:

- Strong bullish convergence from Daily → 15min timeframes.

- Ongoing short-term pullback, no HTF pivot breaks.

- Any break below $97.6k would invalidate the swing bullish scenario.

- Strong bullish convergence from Daily → 15min timeframes.

__________________________________________________________________________________

Macro, Economic Calendar, On-chain & Risk Management

__________________________________________________________________________________

- Macro:FOMC imminent (June 17–18): waiting – volatility on rate/dot plot.

Geopolitical risk (Iran-Israel): sustained global risk-off may escalate.

BTC shows strong resilience at 106k. - Economic calendar (key points):June 17–18: FOMC — maximum impact (stocks, FX, crypto)

June 17: Fed leadership rumors — potential volatility, BTC stable

June 17, 08:30 UTC: USA — retail sales (May/core) - On-chain:Key support at $97.6k (STH cost basis), resistance at $115.4k.

Long-term holders are distributing, but bullish accumulation pressure intact.

Clustering may amplify short-term directional moves. - Key scenarios:

- Bullish: Extension to 110–115k if FOMC positive, stop below 97.6k.

- Bearish: Break of 97.6k = risk of drop towards 92.9–95.4k.

- Management: Avoid exposure pre-FOMC, active monitoring, strict stops.

- Bullish: Extension to 110–115k if FOMC positive, stop below 97.6k.

Patience & discipline: Only size up with post-FOMC validated reaction or confirmed breakout. On-chain cluster = invalidation radar for bullish bias.

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.