🗓The Keltner Channel is a volatility-based technical indicator that helps traders identify market trends, breakout opportunities, and potential reversal zones. Built using an Exponential Moving Average (EMA) and the Average True Range (ATR), it adapts dynamically to price movement and provides a smoother alternative to Bollinger Bands.

📚 Introduction

The Keltner Channel is a versatile volatility-based trading indicator that helps traders identify trend direction, spot potential breakout opportunities, and determine overbought or oversold conditions.

Unlike Bollinger Bands, which use standard deviation, the Keltner Channel is built around the Average True Range (ATR), making it less reactive to sudden price spikes and better at adapting to steady market trends.

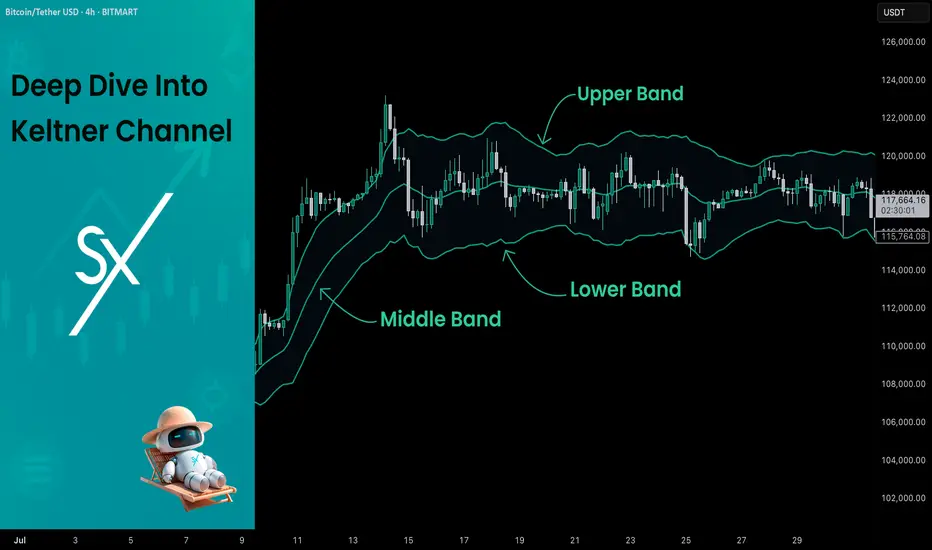

At its core, the channel consists of three lines:

- Middle Line – an Exponential Moving Average (EMA) of the price

- Upper Band – EMA plus a multiple of ATR

- Lower Band – EMA minus the same multiple of ATR

When price stays close to the upper band, it indicates strong bullish momentum.

When price hugs the lower band, bearish pressure dominates.

Periods of narrow channel width often precede breakouts, while wide channels may signal trend exhaustion.

📚 Calculation

The Keltner Channel is typically calculated as follows:

- Middle Line = EMA(n) , where n is the chosen period length (commonly 20)

- Upper Band = EMA(n) + ATR(m) * Multiplier, where m is chosen period length for ATR

- Lower Band = EMA(n) - ATR(m) * Multiplier, where m is chosen period length for ATR

EMA smooths price data while giving more weight to recent values. ATR measures volatility by accounting for true price ranges, including gaps. Multiplier (often 2) determines how far the bands are from the EMA.

📚 How to Use Keltner Channel in Trading Strategies

⚡️Keltner Channel Breakout Strategy

The Keltner Channel breakout strategy is built on the idea that the channel defines a normal range of price movement. The middle line reflects the average trend, while the upper and lower bands expand with volatility. Most of the time, price stays inside this range, so a close outside the channel signals unusual strength. A breakout above the upper band shows that buyers are strong enough to push price beyond what is typical, while a breakout below the lower band shows the same for sellers. This behavior suggests momentum is likely to continue, making it a potential point to join the trend.

Long Setup:

- Price candle shall be closed above 200-period EMA

- Candle closes above the Kelner's Upper Band, indicating strong bullish breakout

- Put your trailing stop-loss at the Middle Band, close trade only when candle closes below it

Short Setup:

- Price candle shall be closed below 200-period EMA

- Candle closes below the Kelner's Lower Band, indicating strong bearish breakdown

- Put your trailing stop-loss at the Middle Band, close trade only when candle closes above it

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have

2. Open long trade when price candle closed above the Keltner's Upper Band.

3. Close trade when price candle closes below the Middle Band

In our case we have 2:1 risk to reward trade if we compare initial stop loss and exit price.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have

2. Open short trade when price candle closed below the Ketlner's Lower Band.

3. Close trade when price candle closes above the Middle Band

In this case we have not a good trade. After closing short price continues dropping but then suddenly pumped and destroyed all gained profit. We think it's also important to show such trades it will make you more prepared for real market when you start trade using this strategy.

🧪Important: as you could see stop-loss on the candle close above/below Middle Band can't be the best decision in every case. It will help you to avoid the false trade close, but usually significantly cut your profit. As always we highly recommend to make your out backtest using different trade exit approaches. You can try 3:1 RR or close exactly at the Middle Band and compare the results with provided close only approach.

⚡️Pullback to the Middle Line

The pullback-to-the-middle-line strategy focuses on the EMA at the center of the Keltner Channel, which acts as dynamic support in uptrends and resistance in downtrends. In trending markets, price often retraces to this middle line before continuing in the direction of the prevailing move.

When the EMA is sloping upward, traders look for buying opportunities when price returns to the middle line, expecting the trend to resume. In a downtrend, the EMA slopes downward, and touches of the middle line can be used as selling points.

Exits are usually made at the opposite channel band, since price tends to extend from the EMA toward one of the outer boundaries. This gives the setup a favorable risk-to-reward profile: stops are placed near the middle line or the most recent swing, while profit targets are naturally defined by the channel structure. The key is to apply the strategy only in clear, directional markets, as pullbacks lose reliability in sideways or choppy conditions.

Long Setup:

- Middle Band's slope shall be upward indicating the short-term uptrend.

- Open long trade when price pulled back to the Middle Band.

- Put stop-loss below the Lower Band.

- Take profit at the Upper Band.

Short Setup:

- Middle Band's slope shall be downward indicating the short-term downtrend.

- Open short trade when price pulled back to the Middle Band.

- Put stop-loss above the Upper Band.

- Take profit at the Lower Band.

📈Long Trading Strategy Example

1. Middle Band's slope shall be positive. We use

2. Open long trade when the price pulled back to Middle Band.

3. Put initial stop loss at the Lower Band.

4. Take profit at the Upper Band.

📉Short trading strategy example

1. Middle Band's slope shall be negative. We use

2. Open short trade when the price pulled back to Middle Band.

3. Put initial stop loss at the Upper Band.

4. Take profit at the Lower Band.

🧪Important: this strategy provides high frequent fast trades with poor risk to reward. Typically it equals approximately 1:1, but this setup has the high probability to play out well. Moreover, this strategy can be used in conjunction with the strategy from point 1 described above. Conditions don't contradict to each other and can allow you to earn money on two different market conditions.

⚡️Mean Reversion Strategy

The mean reversion strategy with the Keltner Channel is based on the assumption that price tends to return toward its average after moving too far away. The outer bands of the channel serve as dynamic thresholds that help identify when the market is stretched.

When price closes near or beyond the upper band, it suggests temporary overextension to the upside, creating an opportunity to anticipate a move back toward the EMA. Conversely, when price touches or moves below the lower band, traders look for a rebound toward the middle line.

The trade idea is to enter counter to the extreme move, with exits placed around the central EMA. Stop losses are typically set just outside the channel to protect against strong breakouts. This approach works best in sideways or range-bound markets, where prices oscillate around a fair value, but it tends to underperform in strong trends.

Long Setup:

- Price candle shall be closed above 200-period EMA.

- Open long when price touches the Lower Band.

- Put initial stop-loss according to your money management system.

- Close trade the Upper Band.

Short Setup:

- Price candle shall be closed below 200-period EMA.

- Open short when price touches the Upper Band.

- Put initial stop-loss according to your money management system.

- Close trade the Lower Band.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have

2. Open long at the Lower Band

3. Put stop-loss. In our case we use 2%, you can use stop-loss based on your asset/time frame volatility and money-management.

4. Take profit at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have

2. Open short at the Upper Band

3. Put stop-loss. In our case we use 3%, you can use stop-loss based on your asset/time frame volatility and money-management.

4. Take profit at the Lower Band.

📚 Conclusion

The Keltner Channel is a versatile tool that adapts to different market conditions and trading styles. Whether applied as a breakout system to capture momentum, as a pullback framework to ride established trends, or as a mean reversion setup in ranging markets, it provides traders with a structured way to interpret price action. Like any strategy, its effectiveness depends on matching the approach to the prevailing market environment and applying consistent risk management. By understanding the underlying logic of each method and practicing disciplined execution, traders can make the Keltner Channel a valuable part of their technical toolkit.

Claim up to 600 USDT in welcome rewards & compete for a share of 5,000 USDT in BitMart Futures Contest!

➡ Register & Claim Bonus: bitmart.com/invite/VShg8M

➡ Join Contest: bitmart.com/futures-competition/Skyrexio/en-US

➡ Register & Claim Bonus: bitmart.com/invite/VShg8M

➡ Join Contest: bitmart.com/futures-competition/Skyrexio/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Claim up to 600 USDT in welcome rewards & compete for a share of 5,000 USDT in BitMart Futures Contest!

➡ Register & Claim Bonus: bitmart.com/invite/VShg8M

➡ Join Contest: bitmart.com/futures-competition/Skyrexio/en-US

➡ Register & Claim Bonus: bitmart.com/invite/VShg8M

➡ Join Contest: bitmart.com/futures-competition/Skyrexio/en-US

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.