Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

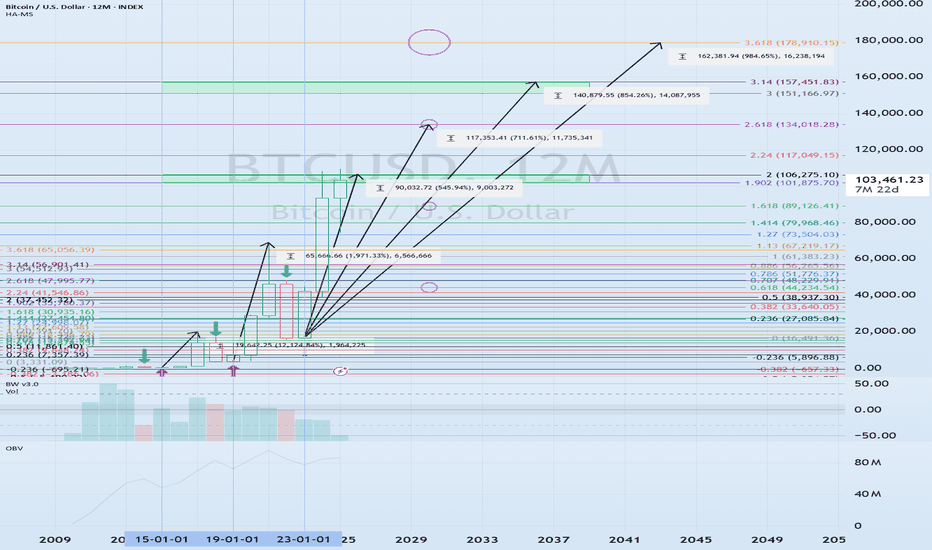

(BTCUSDT 1M chart)

A new month begins.

The OBV indicator is currently rising again near the High Line.

We need to see if it can continue to rise by breaking above the High Line.

If not, there is a possibility of a decline near the Fibonacci ratio of 1.902 (101978.54) ~ 2 (106178.85).

If it declines with strong trading volume, there is a possibility of a decline near the StochRSI 20 point of 97209.25.

Therefore, we need to respond depending on whether there is support in the Fibonacci ratio of 1.902 (101978.54) ~ 2 (106178.85).

The most important support and resistance area on the current 1M chart is 69000-73499.86.

-

(1D chart)

It is showing a downward trend below the M-Signal indicator of the 1D chart.

Accordingly, the possibility of a short-term downtrend is increasing.

However, as mentioned earlier, the key is whether it can rise with support in the right Fibonacci ratio 1.902 (101978.54) ~ 2 (106178.85) section.

If not, it is likely to fall to around 97226.92.

-

The next volatility period is expected to be around June 6.

Accordingly, the current trend is likely to be maintained until the next volatility period.

In order to turn into an upward trend, the price must rise above the M-Signal indicator of the 1D chart and maintain it.

However, since the HA-High indicator is formed at the point of 108316.90, it is highly likely that the uptrend will begin only when it rises above this point.

Therefore, we need to check if it rises above 108316.90 and receives support.

-

In my chart, the basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if it receives support from the HA-High indicator and rises, it is likely to show a stepwise uptrend, and if it receives resistance from the HA-Low indicator and falls, it is likely to show a stepwise downtrend.

The end of the stepwise uptrend is a downtrend, and the end of the stepwise downtrend is an uptrend.

Therefore, in order to establish a buying strategy, we need to meet the HA-Low indicator.

In other words, if the HA-Low indicator is newly created as the price falls, it is important to see whether there is support near it.

-

If it falls below the dotted line indicated on the OBV indicator, it will fall below the previous High Line, so there is a possibility that it will lead to an additional decline.

In particular, if it falls below the Low Line, the price is likely to fall.

However, since the channel of High Line ~ Low Line is still showing an upward trend, I think the overall movement is still maintaining an upward trend.

In order for the channel of High Line ~ Low Line to turn downward, it must fall to the area indicated by the arrow.

-

To summarize the above,

- Check for support in the right Fibonacci ratio 1.902(101978.54) ~ 2(106178.85) section

- The start of the uptrend is when the price rises above 108316.90 and maintains it

- Check for support near 97226.92 in the event of a further decline

- If the HA-Low indicator is newly generated in the event of a further decline, focus on finding the time to buy based on whether there is support near that area

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Trade active

#BTCUSDT 1WRenewed previous ATH, but testing support near 104463.99.

StochRSI 80 is formed at 100732.01, so if price holds above this level, there is a high chance of an uptrend.

The start of the uptrend is expected to start when the OBV indicator shows an upward breakout of the High Line.

However, since the HA-High indicator is formed at the 97226.92 point, if it shows a sharp decline, it is expected to touch the 97226.92 area.

The 97226.92, 100732.01, and 104463.99 points correspond to the high point range on the 1W chart.

Therefore, if it falls below the 97226.92-104463.99 range, it means that it has fallen from the high point range, so you should think about a countermeasure for the decline.

If it falls, since the M-Signal indicator on the 1W chart is rising near 97226.92, it is expected that the trend will be determined again while touching the M-Signal indicator on the 1W chart.

In any case, if it receives support at the high point and rises around the week including June 23, which is a volatile period on the 1W chart, it is expected to create a foundation for an increase near the right Fibonacci ratio 2.24 (116940.43).

Note

#BTCUSDTWe need to see if the price can hold above the M-Signal indicator on the 1D chart.

If it finds support at the 106133.74 point, it is expected to move up to renew the new ATH.

The OBV indicator should show an upward breakout of the High Line as a condition for the uptrend.

If it fails to move up, it is expected to re-determine the trend when it meets the M-Signal indicator on the 1W chart.

(30m chart)

It is showing a trend of rising higher than the M-Signal indicator on the 1D chart.

Therefore, it is necessary to check whether there is support.

If the price rises but the OBV indicator does not rise above the High Line or rises and then falls, it should be considered that the rise is restricted.

At this time, if the StochRSI indicator shows a trend of falling in the overbought zone, it will eventually show a trend of falling.

Therefore, we should not forget the basic trading strategy of buying near the HA-Low indicator and selling near the HA-High indicator.

However, if it is supported by the HA-High indicator and rises, it is possible that it will show a stepwise rise, and if it is resisted by the HA-Low indicator and falls, it is possible that it will show a stepwise fall.

The end of a step uptrend is a decline, and the end of a step downtrend is a rise.

That is, you should be able to create a trading strategy that splits sells near the HA-High indicator and splits buys near the HA-Low indicator.

Note

#BTCUSDTOBV Low indicator was created at 105725.52.

Therefore, in order to show an upward trend, the price must be maintained above 105725.52 at least.

The M-Signal indicator on the 1D chart is passing, so its importance is increasing.

Most of the indicators on my chart are paired.

That is, there are HA-Low and HA-High, DOM(60) and DOM(-60), OBV High and OBV Low indicators.

Within the paired indicator, you can trade in the box range, and when it deviates from the paired indicator, you can trade in the trend trading method.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.