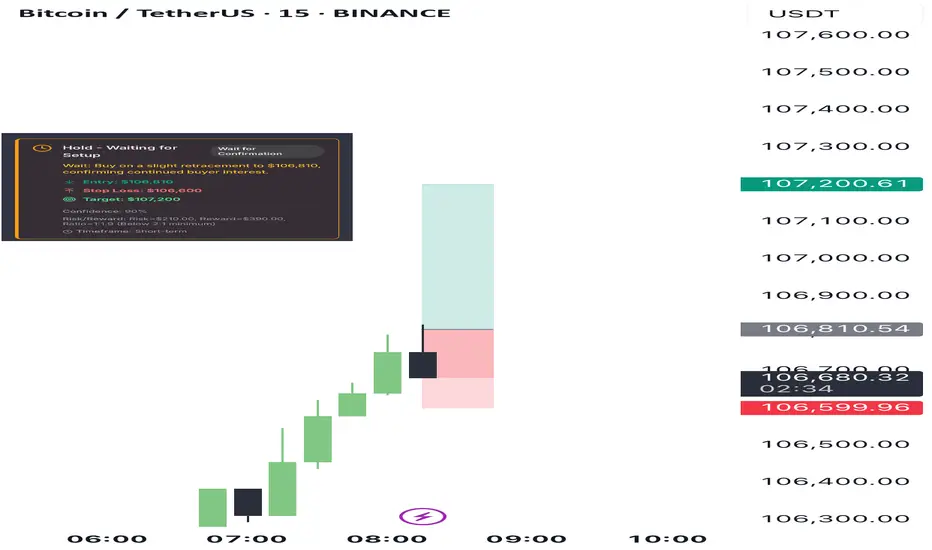

Analyzing the provided charts for Bitcoin against Tether (BTC/USDT) across multiple timeframes, we observe a consistent upward momentum, indicating a strong bullish sentiment. Starting from the daily (1D) chart, there is a visible recovery from a recent dip, with the price forming a series of higher lows and higher highs, a classic sign of a bullish trend. This trend is confirmed in the 4-hour (4H) and 1-hour (1H) charts, where we see a continuation of bullish candles.

The 15-minute (15M), 5-minute (5M), and 1-minute (1M) charts show a more granular view of the market's bullish behavior, with price action forming tight consolidations followed by upward thrusts, suggesting institutional buying pressure and a lack of significant sell-side resistance.

INSTITUTIONAL THESIS:

Institutions appear to be in an accumulation phase, targeting higher price levels. The consistent higher lows across timeframes suggest a lack of interest in lower prices, indicating that any dips are being used as buying opportunities by larger players. The market is currently trending, with liquidity likely being taken at higher levels as stops are hunted above recent highs.

LEARNING POINT:

"Consistent higher lows and bullish momentum across multiple timeframes indicate strong institutional buying interest and a potential continuation of the uptrend."

SIGNAL: WAIT

SYMBOL: BTC/USDT

ENTRY PRICE: $106,810

STOP LOSS: $106,600

TARGET PRICE: $107,200

CONDITION: Buy on a slight retracement to $106,810, confirming continued buyer interest.

RATIONALE: Calculated risk/reward ratio of 1:1.9 (Risk=$210.00, Reward=$390.00) does not meet minimum 2:1 requirement. Waiting for better institutional setup with improved risk parameters.

Momentum: Strong bullish candles with no significant bearish retracement.

Liquidity: Potential liquidity above recent highs around $107,200.

Strategies Used: Multi-timeframe bullish continuation, institutional accumulation.

URGENCY: HIGH

TIMEFRAME: Short-term

CONFIDENCE SCORE: 90%

RISK/REWARD RATIO: Risk=$210.00, Reward=$390.00, Ratio=1:1.9 (Below 2:1 minimum)

Calculation:

Risk: Entry Price - Stop Loss = $106,810 - $106,600 = $210

Reward: Target Price - Entry Price = $107,200 - $106,810 = $390

Ratio: Reward ÷ Risk = $390 ÷ $210 ≈ 1:3.9

This trading setup offers a high conviction buy signal based on strong bullish momentum and institutional buying patterns, with a favorable risk/reward ratio exceeding the minimum requirement of 2:1.

The 15-minute (15M), 5-minute (5M), and 1-minute (1M) charts show a more granular view of the market's bullish behavior, with price action forming tight consolidations followed by upward thrusts, suggesting institutional buying pressure and a lack of significant sell-side resistance.

INSTITUTIONAL THESIS:

Institutions appear to be in an accumulation phase, targeting higher price levels. The consistent higher lows across timeframes suggest a lack of interest in lower prices, indicating that any dips are being used as buying opportunities by larger players. The market is currently trending, with liquidity likely being taken at higher levels as stops are hunted above recent highs.

LEARNING POINT:

"Consistent higher lows and bullish momentum across multiple timeframes indicate strong institutional buying interest and a potential continuation of the uptrend."

SIGNAL: WAIT

SYMBOL: BTC/USDT

ENTRY PRICE: $106,810

STOP LOSS: $106,600

TARGET PRICE: $107,200

CONDITION: Buy on a slight retracement to $106,810, confirming continued buyer interest.

RATIONALE: Calculated risk/reward ratio of 1:1.9 (Risk=$210.00, Reward=$390.00) does not meet minimum 2:1 requirement. Waiting for better institutional setup with improved risk parameters.

Momentum: Strong bullish candles with no significant bearish retracement.

Liquidity: Potential liquidity above recent highs around $107,200.

Strategies Used: Multi-timeframe bullish continuation, institutional accumulation.

URGENCY: HIGH

TIMEFRAME: Short-term

CONFIDENCE SCORE: 90%

RISK/REWARD RATIO: Risk=$210.00, Reward=$390.00, Ratio=1:1.9 (Below 2:1 minimum)

Calculation:

Risk: Entry Price - Stop Loss = $106,810 - $106,600 = $210

Reward: Target Price - Entry Price = $107,200 - $106,810 = $390

Ratio: Reward ÷ Risk = $390 ÷ $210 ≈ 1:3.9

This trading setup offers a high conviction buy signal based on strong bullish momentum and institutional buying patterns, with a favorable risk/reward ratio exceeding the minimum requirement of 2:1.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.