Today is the last day of the month and the last day of the second quarter, so there may be some volatility in the markets between 🐂 VS 🐻

💰 The BTC chart shows an interesting picture — the price has reached the upper limit of the consolidation channel, and now:

BTC chart shows an interesting picture — the price has reached the upper limit of the consolidation channel, and now:

1️⃣ The scenario with an upward breakout is quite clear: a breakout from the channel upward and consolidation above $108-110k= a move to $125k during July.

2️⃣ A correction to $99k will mean that buyers have taken control of the

BTCUSDT price, preventing it from updating its lows. This will be a clear signal to buy, because further growth is inevitable.

BTCUSDT price, preventing it from updating its lows. This will be a clear signal to buy, because further growth is inevitable.

3️⃣ A deep correction to $91,660 (filling the GAP that formed on the CME BTC chart) or slightly lower. This is the last “unclosed” GAP, which, according to TA rules, should be filled for a full-fledged growth trend to begin.

So which scenario is closer to your heart, which one do you believe in?

Or write your version of events in the comments.

Interesting observations to think about:

◆ Over the past two weeks, the inflow of funds to #BTCETF has exceeded $5 billion, but the price of #BTCUSD on CEX exchanges has not been able to “break out” upward. Is this just ETF "property of numbers", or are spot #Bitcoin sales that strong?

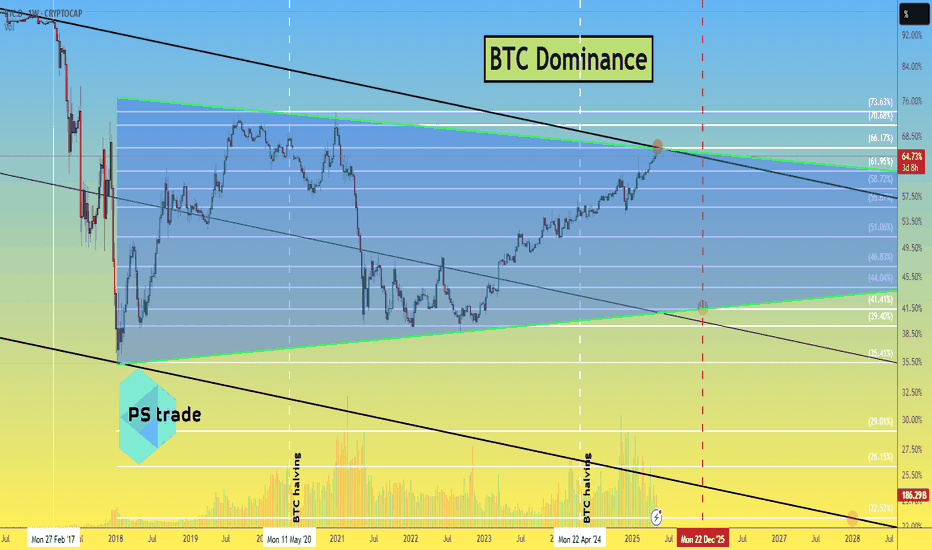

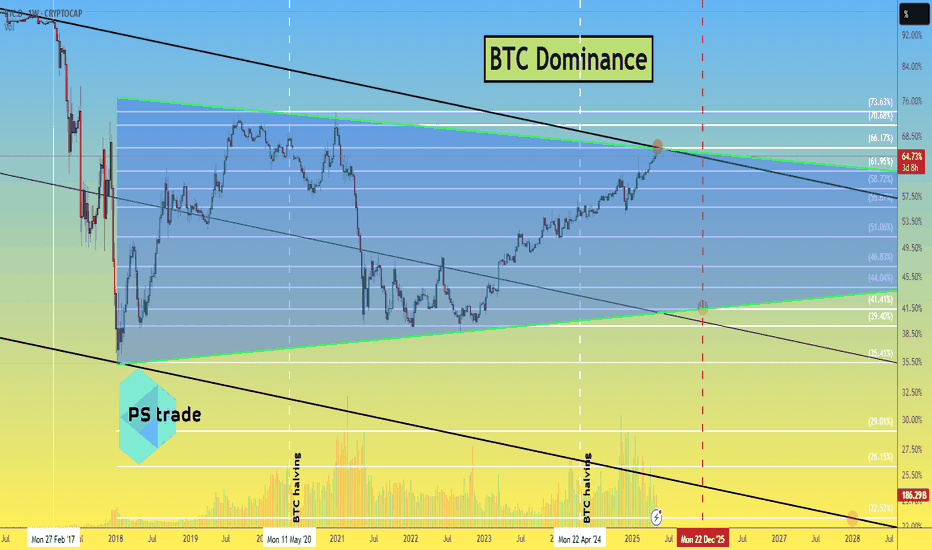

◆ The BTC.D indicator has reached a critical level of 66%, and it will be interesting to see whether it will give altcoins some breathing room next month.

(If there are a lot of likes and comments under the idea, we will additionally describe our thoughts on BTC.D and USDT.D.)

◆ SP 500, by the way, has updated its highs, and the last few months on the stock market are very similar to the beginning and middle of the COVID-19 pandemic in 2020.

◆ And in principle, July promises to be very eventful:

👉 By July 9, Trump is expected to make a statement regarding the tariff wars with the rest of the world, which he has put on hold.

👉 July 18 marks the beginning of Mercury retrograde, which “influences” people's behavior and ‘superstitions’ and forces them to be “more cautious” when making trading decisions (and trading bots don't care about emotions and beliefs)

👉 And on July 30, there will be a FOMC meeting, where Mr. Powell may announce a rate cut, as the US is in a recession, which is time to acknowledge.

If we have forgotten anything, please add it in the comments!

💰 The

1️⃣ The scenario with an upward breakout is quite clear: a breakout from the channel upward and consolidation above $108-110k= a move to $125k during July.

2️⃣ A correction to $99k will mean that buyers have taken control of the

3️⃣ A deep correction to $91,660 (filling the GAP that formed on the CME BTC chart) or slightly lower. This is the last “unclosed” GAP, which, according to TA rules, should be filled for a full-fledged growth trend to begin.

So which scenario is closer to your heart, which one do you believe in?

Or write your version of events in the comments.

Interesting observations to think about:

◆ Over the past two weeks, the inflow of funds to #BTCETF has exceeded $5 billion, but the price of #BTCUSD on CEX exchanges has not been able to “break out” upward. Is this just ETF "property of numbers", or are spot #Bitcoin sales that strong?

◆ The BTC.D indicator has reached a critical level of 66%, and it will be interesting to see whether it will give altcoins some breathing room next month.

(If there are a lot of likes and comments under the idea, we will additionally describe our thoughts on BTC.D and USDT.D.)

◆ SP 500, by the way, has updated its highs, and the last few months on the stock market are very similar to the beginning and middle of the COVID-19 pandemic in 2020.

◆ And in principle, July promises to be very eventful:

👉 By July 9, Trump is expected to make a statement regarding the tariff wars with the rest of the world, which he has put on hold.

👉 July 18 marks the beginning of Mercury retrograde, which “influences” people's behavior and ‘superstitions’ and forces them to be “more cautious” when making trading decisions (and trading bots don't care about emotions and beliefs)

👉 And on July 30, there will be a FOMC meeting, where Mr. Powell may announce a rate cut, as the US is in a recession, which is time to acknowledge.

If we have forgotten anything, please add it in the comments!

🎁 -20% for ALL trading fees at #OKX 👇

okx.com/join/20PSTRADE

🔥 V-I-P 👉 t.me/P_S_trade_menue_bot

🔵 Telegram 👉 t.me/pstrade_eng

🤖 Trading Bot 👉 copytrading.space/en/

📞 t.me/P_S_trades 📝

okx.com/join/20PSTRADE

🔥 V-I-P 👉 t.me/P_S_trade_menue_bot

🔵 Telegram 👉 t.me/pstrade_eng

🤖 Trading Bot 👉 copytrading.space/en/

📞 t.me/P_S_trades 📝

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁 -20% for ALL trading fees at #OKX 👇

okx.com/join/20PSTRADE

🔥 V-I-P 👉 t.me/P_S_trade_menue_bot

🔵 Telegram 👉 t.me/pstrade_eng

🤖 Trading Bot 👉 copytrading.space/en/

📞 t.me/P_S_trades 📝

okx.com/join/20PSTRADE

🔥 V-I-P 👉 t.me/P_S_trade_menue_bot

🔵 Telegram 👉 t.me/pstrade_eng

🤖 Trading Bot 👉 copytrading.space/en/

📞 t.me/P_S_trades 📝

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.