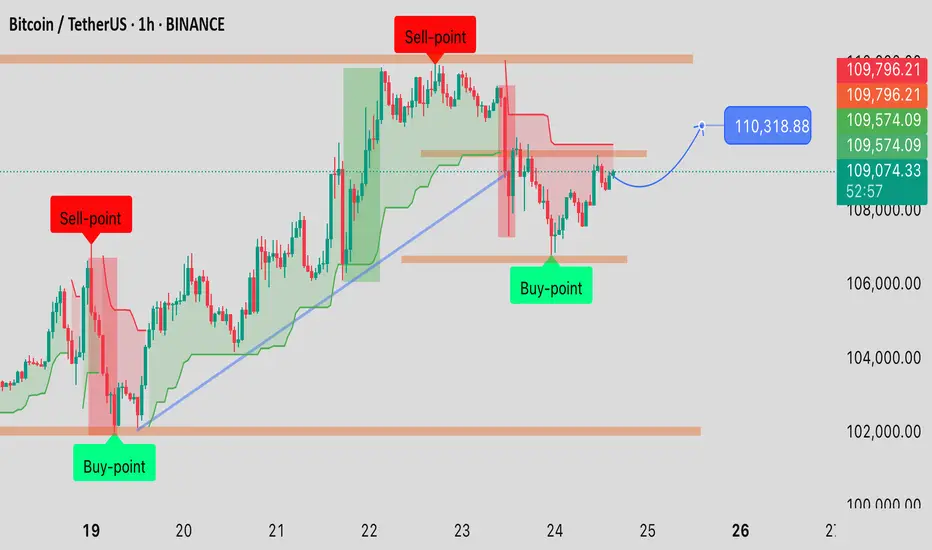

This chart provides a technical analysis of Bitcoin (BTC/USDT) on the 1-hour timeframe, highlighting key buy and sell points. Strong support and resistance zones are marked with orange bands, guiding traders through critical decision levels. Notable bullish momentum has been observed following the May 24 buy-point, with a projected price target of $110,318.88. The chart includes trendlines, Ichimoku elements, and momentum analysis for precision forecasting. Traders should watch the resistance near $109,796.21 and support at $106,000, as market reactions around these zones could dictate short-term direction.

Here’s a breakdown of the Bitcoin (BTC/USDT) chart analysis based on the image you provided:

---

1. Current Price Action

Price at time of chart: ~$109,000

Recent change: Upward movement of +1.57% (+$1,682.47)

Trend: Overall bullish momentum with higher lows forming a clear ascending trendline.

---

2. Key Levels

Support Zones:

Around $106,000: Marked as a recent "Buy-point", supported by historical consolidation.

Lower support near $102,000: Last strong bounce area.

Resistance Zones:

$109,574 – $109,796: This tight band has acted as resistance previously and coincides with a "Sell-point."

Target zone: $110,318.88: The projected breakout target if price clears immediate resistance.

---

3. Buy & Sell Points

Buy-Points: Well-timed after significant pullbacks into support zones. Each resulted in a strong rally.

Sell-Points: Identified at local peaks where momentum slowed and minor corrections occurred.

---

4. Indicators & Tools Used

Ichimoku Cloud / Bands: The green/red shaded zones likely reflect momentum and volatility bands.

Trendline: Ascending trendline confirms bullish structure — higher lows are intact.

Projection Arrow: Shows a likely scenario of short-term pullback and breakout toward $110K+.

Here’s a breakdown of the Bitcoin (BTC/USDT) chart analysis based on the image you provided:

---

1. Current Price Action

Price at time of chart: ~$109,000

Recent change: Upward movement of +1.57% (+$1,682.47)

Trend: Overall bullish momentum with higher lows forming a clear ascending trendline.

---

2. Key Levels

Support Zones:

Around $106,000: Marked as a recent "Buy-point", supported by historical consolidation.

Lower support near $102,000: Last strong bounce area.

Resistance Zones:

$109,574 – $109,796: This tight band has acted as resistance previously and coincides with a "Sell-point."

Target zone: $110,318.88: The projected breakout target if price clears immediate resistance.

---

3. Buy & Sell Points

Buy-Points: Well-timed after significant pullbacks into support zones. Each resulted in a strong rally.

Sell-Points: Identified at local peaks where momentum slowed and minor corrections occurred.

---

4. Indicators & Tools Used

Ichimoku Cloud / Bands: The green/red shaded zones likely reflect momentum and volatility bands.

Trendline: Ascending trendline confirms bullish structure — higher lows are intact.

Projection Arrow: Shows a likely scenario of short-term pullback and breakout toward $110K+.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.