Bitcoin(

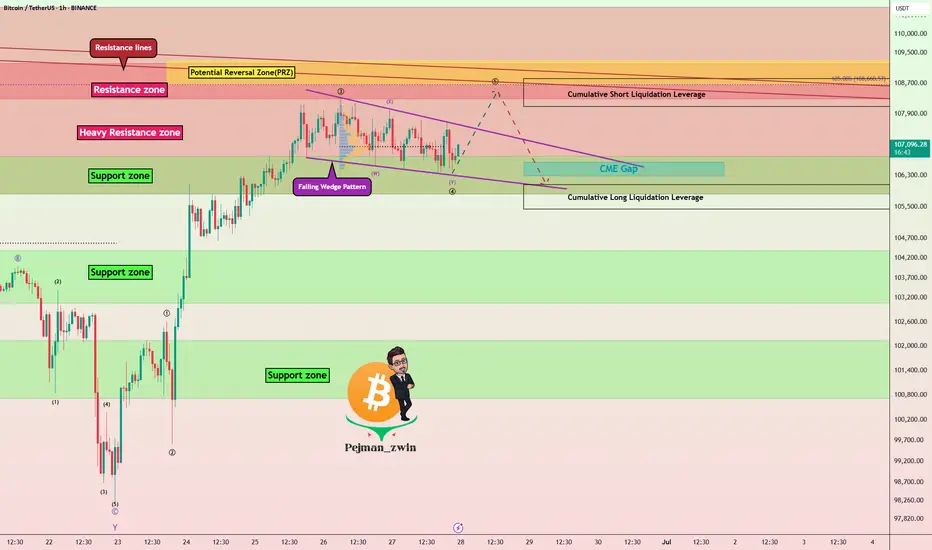

BTCUSDT) failed to break through the Support zone($106,800-$105,820) after attacking it five times, and started to rise again.

BTCUSDT) failed to break through the Support zone($106,800-$105,820) after attacking it five times, and started to rise again.

Bitcoin is currently moving near the Resistance zone($109,220-$108,280), Cumulative Short Liquidation Leverage($108,800-$108,085), Potential Reversal Zone(PRZ)[$109,300-$108,660], and Resistance lines.

From a Classical Technical Analysis perspective, Bitcoin's movements over the past two days seem to have formed a Falling Wedge Pattern.

From an Elliott Wave theory perspective, Bitcoin appears to have completed the main wave 4 within the Falling Wedge Pattern. The structure of the main wave 4 was a Double Three Correction(WXY).

I expect Bitcoin to attack the Resistance lines after breaking the upper line of the Falling Wedge Pattern. If Bitcoin fails to break the Resistance lines before the global markets close, we can expect Bitcoin to fall again. Because entering Saturday and Sunday, the trading volume is generally low, and I think Bitcoin needs a lot of volume to break the resistances.

Do you agree with me?

CME Gap: $106,645-$106,295

Cumulative Long Liquidation Leverage: $106,055-$105,430

Note: If Bitcoin manages to break the Support zone($106,800-$105,820), we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin is currently moving near the Resistance zone($109,220-$108,280), Cumulative Short Liquidation Leverage($108,800-$108,085), Potential Reversal Zone(PRZ)[$109,300-$108,660], and Resistance lines.

From a Classical Technical Analysis perspective, Bitcoin's movements over the past two days seem to have formed a Falling Wedge Pattern.

From an Elliott Wave theory perspective, Bitcoin appears to have completed the main wave 4 within the Falling Wedge Pattern. The structure of the main wave 4 was a Double Three Correction(WXY).

I expect Bitcoin to attack the Resistance lines after breaking the upper line of the Falling Wedge Pattern. If Bitcoin fails to break the Resistance lines before the global markets close, we can expect Bitcoin to fall again. Because entering Saturday and Sunday, the trading volume is generally low, and I think Bitcoin needs a lot of volume to break the resistances.

Do you agree with me?

CME Gap: $106,645-$106,295

Cumulative Long Liquidation Leverage: $106,055-$105,430

Note: If Bitcoin manages to break the Support zone($106,800-$105,820), we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Trade was activated near the lower line of the falling wedge🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.