One of the important news for Bitcoin(

BTCUSDT) that was released today was that "White House confirms first Bitcoin and crypto report will be released TOMORROW". Bitcoin is likely to rise with the release of the White House report.

BTCUSDT) that was released today was that "White House confirms first Bitcoin and crypto report will be released TOMORROW". Bitcoin is likely to rise with the release of the White House report.

What do you think? At least a temporary pump may be in store for Bitcoin.

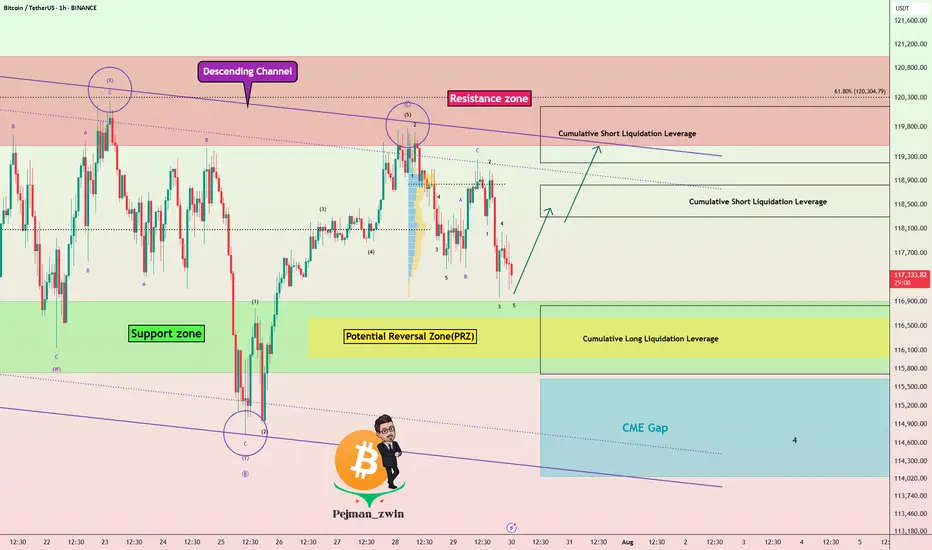

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea.

Bitcoin is currently moving near the Support zone($116,900-$115,730), Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ)[$116,620-$116,000].

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt).

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

What do you think? At least a temporary pump may be in store for Bitcoin.

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea.

Bitcoin is currently moving near the Support zone($116,900-$115,730), Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ)[$116,620-$116,000].

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt).

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Trade was activated near the Support zone($116,900-$115,730)Trade closed: target reached

First Target Done

Bitcoin's upward momentum has NOT been good so far, so the long position was closed near the Resistance lines and inside the Cumulative Short Liquidation Leverage($118,827-$118,298).

Another important index from the US will be released today, and there is a possibility of volatility in the financial markets.

ADP Non-Farm Employment Change

Advance GDP q/q

Federal Funds Rate

FOMC Statement

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.