Hi folks!

As you may have noticed, I was very bearish for a long time before the last dip - I closed my shorts at 43k due to the risk of the liquidation que on Binance (I had TP at 30k),

so I was lucky since I was mistaken about the magnitude of the drop (although I made a nice profit!).

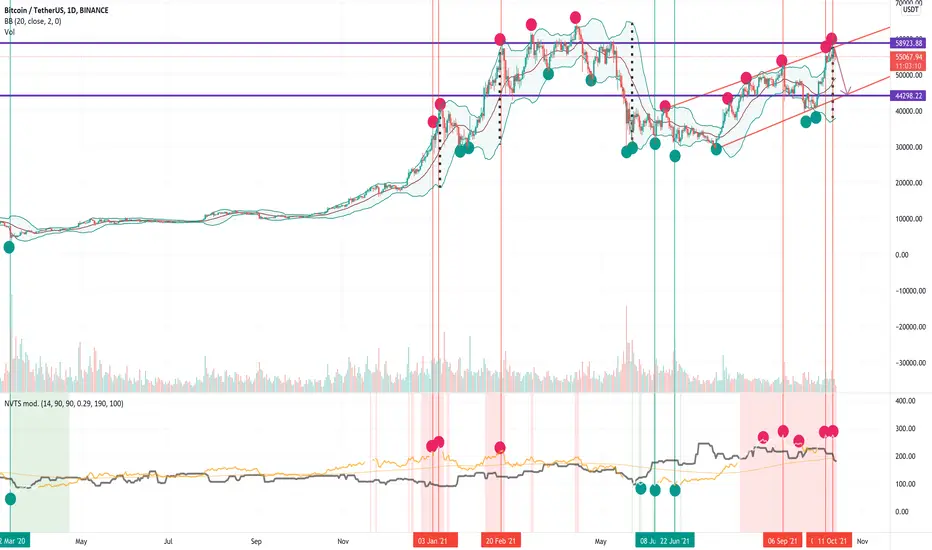

The Bollinger Bands on the 1D is usually a pretty strong indicator - both for small and large reversals.

The size of the reversal is also correlated with the gap between the bands.

As RSI and MACD are not giving us much info ATM (bearish div on 4h playing out, no div on 1h or 1D),

I wanted to see if it is possible to find som reliable signals by combining the old faithful NTVS and the 1D Bollinger Bands.

Based on a rather small sample, it seems that this combination may be quite powerful.

This also makes sense as the BB is in principle a confidence interval based on price action and the NVTS is a ratio of the market price and the on-chain transaction volume (i.e. the "underlying value") -

meaning that the signals are uncorrelated.

This needs to be tested statistically over a larger time period to really test is credibility, but I thought I would share my analysis nevertheless.

The current signal based on this combination is very clear: It is time to take profits/place shorts for now - we might also see a rather large correction according to the BB gap.

This also coincides with the solid resistance in the 57-59k area, the low volume during the uptrend and the fact that the next solid support lies around 44-45k

(which coincides with the support line in the ascending channel).

The margin long/short ratio on Binance is also very high, the Coinbase Pro premium is low etc., so it seems very likely that we will move towards the support line.

For the record, I have placed a short worth 2% of my portfolio from 57.4k with TP 45k and SL 66k, but this position is not for the faint of heart!

As you may have noticed, I was very bearish for a long time before the last dip - I closed my shorts at 43k due to the risk of the liquidation que on Binance (I had TP at 30k),

so I was lucky since I did not not expect the latest bounce, and would have taken a loss instead of å very nice profit.

Now, I am willing to buy at the support line as long as we do not see a USD-bounce and stock market weakness.

DYOR.

NFA.

I wish you all well!

Never take the word of others as a given, and never take advise from someone without skin in the game.

As you may have noticed, I was very bearish for a long time before the last dip - I closed my shorts at 43k due to the risk of the liquidation que on Binance (I had TP at 30k),

so I was lucky since I was mistaken about the magnitude of the drop (although I made a nice profit!).

The Bollinger Bands on the 1D is usually a pretty strong indicator - both for small and large reversals.

The size of the reversal is also correlated with the gap between the bands.

As RSI and MACD are not giving us much info ATM (bearish div on 4h playing out, no div on 1h or 1D),

I wanted to see if it is possible to find som reliable signals by combining the old faithful NTVS and the 1D Bollinger Bands.

Based on a rather small sample, it seems that this combination may be quite powerful.

This also makes sense as the BB is in principle a confidence interval based on price action and the NVTS is a ratio of the market price and the on-chain transaction volume (i.e. the "underlying value") -

meaning that the signals are uncorrelated.

This needs to be tested statistically over a larger time period to really test is credibility, but I thought I would share my analysis nevertheless.

The current signal based on this combination is very clear: It is time to take profits/place shorts for now - we might also see a rather large correction according to the BB gap.

This also coincides with the solid resistance in the 57-59k area, the low volume during the uptrend and the fact that the next solid support lies around 44-45k

(which coincides with the support line in the ascending channel).

The margin long/short ratio on Binance is also very high, the Coinbase Pro premium is low etc., so it seems very likely that we will move towards the support line.

For the record, I have placed a short worth 2% of my portfolio from 57.4k with TP 45k and SL 66k, but this position is not for the faint of heart!

As you may have noticed, I was very bearish for a long time before the last dip - I closed my shorts at 43k due to the risk of the liquidation que on Binance (I had TP at 30k),

so I was lucky since I did not not expect the latest bounce, and would have taken a loss instead of å very nice profit.

Now, I am willing to buy at the support line as long as we do not see a USD-bounce and stock market weakness.

DYOR.

NFA.

I wish you all well!

Never take the word of others as a given, and never take advise from someone without skin in the game.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.