Bitcoin (BTC) Technical Market Update

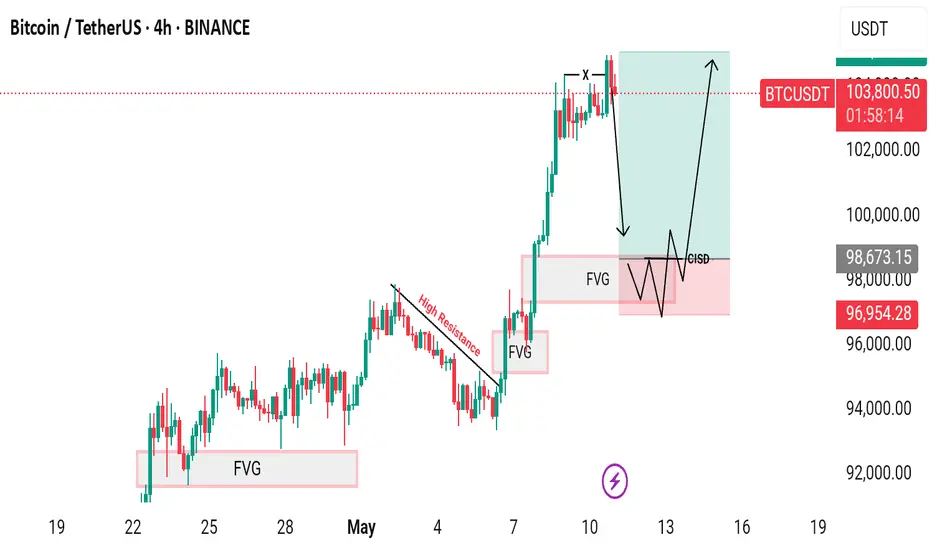

Over the past several trading sessions, Bitcoin (BTC) has demonstrated a pattern of strength, particularly visible on the 4-hour chart. Price action has consistently respected the Fair Value Gap (FVG) zones on this timeframe, taking support from these areas without breaching any significant downside levels. This repeated behavior indicates a strong underlying bullish sentiment, suggesting that market participants are actively defending key support zones.

Furthermore, Bitcoin recently approached a high-liquidity resistance zone—a level that historically acts as a supply barrier—and not only absorbed the liquidity but also decisively broke through it. This move implies that bullish momentum is firmly in control, and short-term resistance levels are being invalidated one after another. The market structure remains intact, with higher highs and higher lows supporting the current trend.

As of now, BTC has just bounced from a 4H FVG and is trading above that support. However, a short-term pullback remains possible. If such a retracement occurs, it is expected to revisit the next significant 4H FVG support zone, which lies approximately between $98,800 and $97,400. This area could act as a strong accumulation zone for buyers, potentially fueling another bullish wave. In the case of renewed upward momentum from this level, Bitcoin could target the $101,000 to $105,000 range in the short to mid-term.

Market participants are advised to remain cautious and observe price behavior as it unfolds in the coming days. Technical setups are aligning in favor of the bulls, but volatility may increase near key resistance and support levels. Always base your trades and investment decisions on thorough analysis, and keep in mind that no setup guarantees results.

Disclaimer: This is not financial advice. Please ensure you conduct your own independent research and analysis (DYOR) before making any trading or investment decisions.

Over the past several trading sessions, Bitcoin (BTC) has demonstrated a pattern of strength, particularly visible on the 4-hour chart. Price action has consistently respected the Fair Value Gap (FVG) zones on this timeframe, taking support from these areas without breaching any significant downside levels. This repeated behavior indicates a strong underlying bullish sentiment, suggesting that market participants are actively defending key support zones.

Furthermore, Bitcoin recently approached a high-liquidity resistance zone—a level that historically acts as a supply barrier—and not only absorbed the liquidity but also decisively broke through it. This move implies that bullish momentum is firmly in control, and short-term resistance levels are being invalidated one after another. The market structure remains intact, with higher highs and higher lows supporting the current trend.

As of now, BTC has just bounced from a 4H FVG and is trading above that support. However, a short-term pullback remains possible. If such a retracement occurs, it is expected to revisit the next significant 4H FVG support zone, which lies approximately between $98,800 and $97,400. This area could act as a strong accumulation zone for buyers, potentially fueling another bullish wave. In the case of renewed upward momentum from this level, Bitcoin could target the $101,000 to $105,000 range in the short to mid-term.

Market participants are advised to remain cautious and observe price behavior as it unfolds in the coming days. Technical setups are aligning in favor of the bulls, but volatility may increase near key resistance and support levels. Always base your trades and investment decisions on thorough analysis, and keep in mind that no setup guarantees results.

Disclaimer: This is not financial advice. Please ensure you conduct your own independent research and analysis (DYOR) before making any trading or investment decisions.

Join My Telegram Channel For Getting Free Signals and Analysis 👇👇

t.me/fxinsighthub7

t.me/fxinsighthub7

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join My Telegram Channel For Getting Free Signals and Analysis 👇👇

t.me/fxinsighthub7

t.me/fxinsighthub7

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.