The Williams %R is a fast, sensitive momentum oscillator ideal for short-term trading strategies. It provides early signals of overbought and oversold conditions by comparing the current close to the high-low range over a defined lookback period (typically 14 bars).

By understanding where Williams %R fits among other oscillators, traders can better utilize it within a well-rounded, context-aware strategy.

✅ 1. What Are Momentum Indicators?

Momentum indicators are technical analysis tools used to measure the speed and strength of a price movement over time. Rather than focusing on absolute price direction, momentum indicators assess how quickly prices are changing and help traders identify potential turning points, continuation patterns, or overbought/oversold conditions.

They are particularly useful in sideways or ranging markets, where momentum shifts often precede breakouts or reversals.

Key characteristics of momentum indicators:

✅ 2. Understanding the Williams %R Indicator

≫ The Origin: Developed by Larry Williams

The Williams %R indicator was developed by Larry Williams, a renowned trader and author, in the late 1970s. Williams introduced this tool to identify potential market turning points by measuring a security’s momentum relative to its recent high-low range.

Originally intended for short-term futures trading, the indicator has since become a staple for both day traders and swing traders across various markets, including stocks, forex, and crypto.

Larry Williams famously used this indicator in his trading system when he won the 1987 World Cup Trading Championship, turning $10,000 into over $1 million in a single year—demonstrating its real-world impact when used effectively.

≫ Formula Breakdown

The Williams %R formula is as follows:

This formula normalizes the current price within its recent trading range and expresses it as a negative percentage between 0 and -100.

Example:

This inverted scale (compared to RSI) helps traders see how close the current price is to the top or bottom of the recent range, providing clues about potential reversal zones.

Williams %R in Pinescript:

Pine Script®

≫ Key Settings: 14-Period Default and Customizations

The default setting for Williams %R is 14 periods, which Larry Williams originally recommended. However, this lookback period can be customized based on your trading style and timeframe.

Here’s how different settings can be applied:

❖ Intraday Trading (5-minute to 15-minute charts):

❖ Swing Trading (1-hour to Daily charts):

❖ Position/Long-Term Trading (Weekly charts or higher):

🔁 Customization Tip:

You can also use multiple %R settings (e.g., 14 and 50) together to analyze short-term momentum inside longer-term trend cycles, adding depth and context to your strategy.

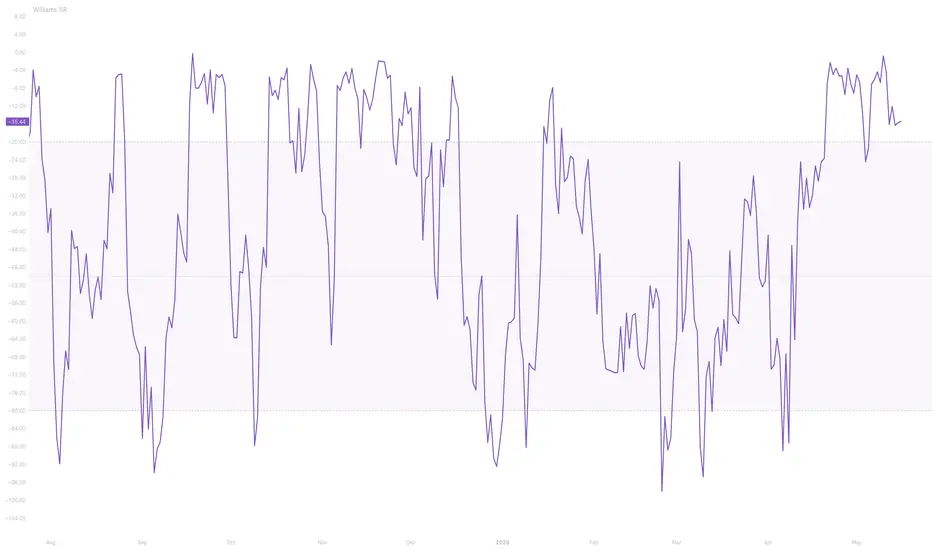

≫ Interpretation: Overbought and Oversold Conditions

The Williams %R scale ranges from 0 to -100 and is interpreted as follows:

❖ Overbought: %R above -20

❖ Oversold: %R below -80

✅ 3. Using Williams %R Effectively

≫ Entry Signals

Williams %R can be used to time entries based on shifts in momentum, especially around key overbought and oversold zones.

❖ Overbought/Oversold Reversals

This is the most common use of Williams %R - identifying turning points when price reaches extreme levels in its recent range:

Overbought Zone (above -20):

Oversold Zone (below -80):

❖ Pullback Continuations

Williams %R can also support trend-following strategies by identifying momentum retracements within an ongoing trend:

This technique helps you buy the dip or sell the rally with better timing and risk control.

≫ Exit Signals

Williams %R can also guide exit timing by showing when momentum is weakening, especially as price moves away from extremes.

❖ Returning to Neutral Zones

When Williams %R moves back toward the -50 midpoint, it can signal that the current move is losing steam.

Exiting before full reversals can help you lock in gains while reducing risk exposure.

❖ Crossovers at Extremes

Some traders look for quick crossovers back through key thresholds (-80 and -20) as exit or reversal alerts:

These sharp shifts often precede momentum flips, making them useful for both exit timing and new trade setups in the opposite direction.

❖ False Signal Filtering Techniques

Williams %R can produce false signals, especially in trending or volatile markets. To improve signal quality, consider these filters:

Use with Trend Filters:

Add Price Action Confirmation: Look for candlestick patterns (e.g., engulfing, pin bars) or support/resistance reactions before acting on %R signals

Volume Analysis: Confirm signals with volume spikes or divergences to validate strength or weakness in a move

Multiple Timeframe Confluence: Use Williams %R on a higher timeframe (e.g., 4H or daily) to establish the broader context, then align trades on a lower timeframe

Avoid during High Volatility Events: News releases and earnings reports can create erratic spikes that cause misleading %R readings

❖ Best Market Conditions: Ranging vs Trending Markets

Williams %R performs best under specific market conditions. Understanding when to use it—and when to avoid it—is key to success.

Ranging Markets: Ideal Conditions

Trending Markets: Use With Caution

✅ 4. Optimizing the Period Setting (5, 9, 14, 21, etc.)

The length of the lookback period in Williams %R significantly affects signal behavior:

Shorter periods (5, 9):

Default period (14):

Longer periods (21+):

🔍 To optimize:

✅ 4. Key Takeaways

Williams %R is a simple yet deeply insightful momentum oscillator. While often overlooked in favor of more complex indicators, it provides a unique lens into market sentiment and price extremes. Its greatest strength lies in its clarity — helping traders time entries and exits with greater confidence when paired with context.

By understanding where Williams %R fits among other oscillators, traders can better utilize it within a well-rounded, context-aware strategy.

✅ 1. What Are Momentum Indicators?

Momentum indicators are technical analysis tools used to measure the speed and strength of a price movement over time. Rather than focusing on absolute price direction, momentum indicators assess how quickly prices are changing and help traders identify potential turning points, continuation patterns, or overbought/oversold conditions.

They are particularly useful in sideways or ranging markets, where momentum shifts often precede breakouts or reversals.

Key characteristics of momentum indicators:

- Often bounded within fixed ranges (e.g., 0–100 or -100 to 0)

- Typically leading indicators, aiming to provide early entry/exit signals

- Help spot divergence between price and momentum — a common sign of weakening trends

✅ 2. Understanding the Williams %R Indicator

≫ The Origin: Developed by Larry Williams

The Williams %R indicator was developed by Larry Williams, a renowned trader and author, in the late 1970s. Williams introduced this tool to identify potential market turning points by measuring a security’s momentum relative to its recent high-low range.

Originally intended for short-term futures trading, the indicator has since become a staple for both day traders and swing traders across various markets, including stocks, forex, and crypto.

Larry Williams famously used this indicator in his trading system when he won the 1987 World Cup Trading Championship, turning $10,000 into over $1 million in a single year—demonstrating its real-world impact when used effectively.

≫ Formula Breakdown

The Williams %R formula is as follows:

Williams %R= = (HighestHigh − Close) / (HighestHigh - LowerLow) × −100

- Highest High = The highest price over the lookback period (typically 14 periods)

- Lowest Low = The lowest price over the same lookback period

- Close = The current closing price

This formula normalizes the current price within its recent trading range and expresses it as a negative percentage between 0 and -100.

Example:

- If price is at the highest point in the range → %R = 0 (overbought)

- If price is at the lowest point in the range → %R = -100 (oversold)

This inverted scale (compared to RSI) helps traders see how close the current price is to the top or bottom of the recent range, providing clues about potential reversal zones.

Williams %R in Pinescript:

//@version=5

indicator("Custom Williams %R", overlay=false)

length = input.int(14, title="Period")

highestHigh = ta.highest(high, length)

lowestLow = ta.lowest(low, length)

williamsR = (highestHigh - close) / (highestHigh - lowestLow) \* -100

plot(williamsR, title="%R", color=color.purple)

hline(-20, "Overbought", color=color.red)

hline(-80, "Oversold", color=color.green)

≫ Key Settings: 14-Period Default and Customizations

The default setting for Williams %R is 14 periods, which Larry Williams originally recommended. However, this lookback period can be customized based on your trading style and timeframe.

Here’s how different settings can be applied:

❖ Intraday Trading (5-minute to 15-minute charts):

- Use a 9 to 14-period setting for faster, more responsive signals.

- Ideal for scalpers or short-term traders seeking quick entries and exits.

❖ Swing Trading (1-hour to Daily charts):

- Stick with the standard 14 to 21-period range.

- Balances sensitivity and reliability; helps capture short- to mid-term reversals.

❖ Position/Long-Term Trading (Weekly charts or higher):

- Use 21-period or longer to smooth out signals and reduce noise.

- Best for spotting high-conviction turning points with less frequent trades.

🔁 Customization Tip:

You can also use multiple %R settings (e.g., 14 and 50) together to analyze short-term momentum inside longer-term trend cycles, adding depth and context to your strategy.

≫ Interpretation: Overbought and Oversold Conditions

The Williams %R scale ranges from 0 to -100 and is interpreted as follows:

❖ Overbought: %R above -20

- Indicates that price is near the top of its recent range

- Suggests potential for a pullback or reversal downward

❖ Oversold: %R below -80

- Indicates price is near the bottom of its recent range

- Suggests potential for a bounce or reversal upward

⚠️ Important: Overbought does not mean “time to sell” and oversold does not mean “time to buy.” These are conditions, not signals. Use them with confirmation tools like support/resistance zones, candlestick patterns, volume analysis, divergences and more.

✅ 3. Using Williams %R Effectively

≫ Entry Signals

Williams %R can be used to time entries based on shifts in momentum, especially around key overbought and oversold zones.

❖ Overbought/Oversold Reversals

This is the most common use of Williams %R - identifying turning points when price reaches extreme levels in its recent range:

Overbought Zone (above -20):

- Signals potential bearish reversal

- Look for confluence with resistance levels or bearish candlestick patterns

- Confirmation often comes as %R drops back below -20

Oversold Zone (below -80):

- Indicates a possible bullish reversal

- Stronger when aligned with support or demand zones

- Confirmation often comes when %R climbs back above -80

⚠️ Note: These are signals of potential exhaustion, not guaranteed reversals. Always pair with price action context or volume.

❖ Pullback Continuations

Williams %R can also support trend-following strategies by identifying momentum retracements within an ongoing trend:

- In an uptrend, wait for Williams %R to dip below -80 (short-term oversold) and then re-enter above -80 as the trend resumes

- In a downtrend, look for a rally where %R rises above -20 (short-term overbought), then re-enters below -20 to confirm trend continuation

This technique helps you buy the dip or sell the rally with better timing and risk control.

≫ Exit Signals

Williams %R can also guide exit timing by showing when momentum is weakening, especially as price moves away from extremes.

❖ Returning to Neutral Zones

When Williams %R moves back toward the -50 midpoint, it can signal that the current move is losing steam.

- In a long position, if %R returns from oversold to above -50 but then flattens or dips again, it may be time to take profit

- In a short position, if %R rises from overbought back below -50, it suggests selling pressure is decreasing

Exiting before full reversals can help you lock in gains while reducing risk exposure.

❖ Crossovers at Extremes

Some traders look for quick crossovers back through key thresholds (-80 and -20) as exit or reversal alerts:

- If %R drops from above -20 back below it, the overbought condition may be ending

- If %R rises from below -80 back above it, the oversold condition may be ending

These sharp shifts often precede momentum flips, making them useful for both exit timing and new trade setups in the opposite direction.

❖ False Signal Filtering Techniques

Williams %R can produce false signals, especially in trending or volatile markets. To improve signal quality, consider these filters:

Use with Trend Filters:

- Apply moving averages (e.g., 50- or 200-period MA) to define trend direction and avoid counter-trend trades

- Only trade overbought signals in a downtrend and oversold signals in an uptrend

Add Price Action Confirmation: Look for candlestick patterns (e.g., engulfing, pin bars) or support/resistance reactions before acting on %R signals

Volume Analysis: Confirm signals with volume spikes or divergences to validate strength or weakness in a move

Multiple Timeframe Confluence: Use Williams %R on a higher timeframe (e.g., 4H or daily) to establish the broader context, then align trades on a lower timeframe

Avoid during High Volatility Events: News releases and earnings reports can create erratic spikes that cause misleading %R readings

❖ Best Market Conditions: Ranging vs Trending Markets

Williams %R performs best under specific market conditions. Understanding when to use it—and when to avoid it—is key to success.

Ranging Markets: Ideal Conditions

- Williams %R excels in sideways or consolidating markets

- In ranges, price frequently oscillates between support and resistance, making overbought/oversold signals highly effective

- Reversals from the -20 or -80 zones often align with the top and bottom of a trading range

Trending Markets: Use With Caution

- During strong trends, Williams %R can stay in the overbought or oversold zone for extended periods

- This makes reversal signals less reliable and more prone to false exits

- In trending conditions, it’s better to:

- Use Williams %R for pullback entries

- Combine it with a trend filter to stay on the dominant side of momentum

- Use Williams %R for pullback entries

✅ 4. Optimizing the Period Setting (5, 9, 14, 21, etc.)

The length of the lookback period in Williams %R significantly affects signal behavior:

Shorter periods (5, 9):

- Produce faster, more frequent signals

- Best for scalping and intraday trading

- More sensitive but can result in higher noise and false signals

Default period (14):

- Balanced responsiveness

- Suitable for swing trading and multi-hour charting

Longer periods (21+):

- Generate fewer but more stable signals

- Best for position trading or slower-moving markets

- Reduced noise but may lag in volatile conditions

🔍 To optimize:

- Test various period values under consistent rules (e.g., entry/exit and risk management stay the same)

- Compare outcomes across different market environments (trending, ranging, volatile)

✅ 4. Key Takeaways

- Williams %R is a momentum oscillator that measures the close relative to the recent high-low range on a scale from 0 to -100.

- It was developed by Larry Williams to help identify short-term overbought and oversold market conditions.

- A reading above -20 suggests overbought conditions, while a reading below -80 indicates oversold conditions.

- The default 14-period setting balances signal responsiveness and stability for most traders.

- Shorter periods generate faster signals with more noise, while longer periods produce smoother signals with more lag.

- Williams %R works best in ranging or sideways markets rather than strongly trending environments.

- Traders can use %R for reversal signals or to confirm pullbacks within a broader trend.

- Filtering signals with price action, support/resistance, or volume improves accuracy.

- The indicator is not meant to be used in isolation and requires confirmation before acting on signals.

- Backtesting across different timeframes and period settings is essential for identifying optimal usage.

- Performance metrics such as win rate, R:R ratio, and drawdown help evaluate the indicator’s reliability.

- Williams %R is easy to code and automate in platforms like TradingView using Pine Script.

- The indicator adds value when used as part of a broader, disciplined trading system.

Williams %R is a simple yet deeply insightful momentum oscillator. While often overlooked in favor of more complex indicators, it provides a unique lens into market sentiment and price extremes. Its greatest strength lies in its clarity — helping traders time entries and exits with greater confidence when paired with context.

Get access to our exclusive tools: candelacharts.com

Join our community: discord.gg/etGSTepqbu

All content provided by CandelaCharts is for informational & educational purposes only.

Join our community: discord.gg/etGSTepqbu

All content provided by CandelaCharts is for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Get access to our exclusive tools: candelacharts.com

Join our community: discord.gg/etGSTepqbu

All content provided by CandelaCharts is for informational & educational purposes only.

Join our community: discord.gg/etGSTepqbu

All content provided by CandelaCharts is for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.