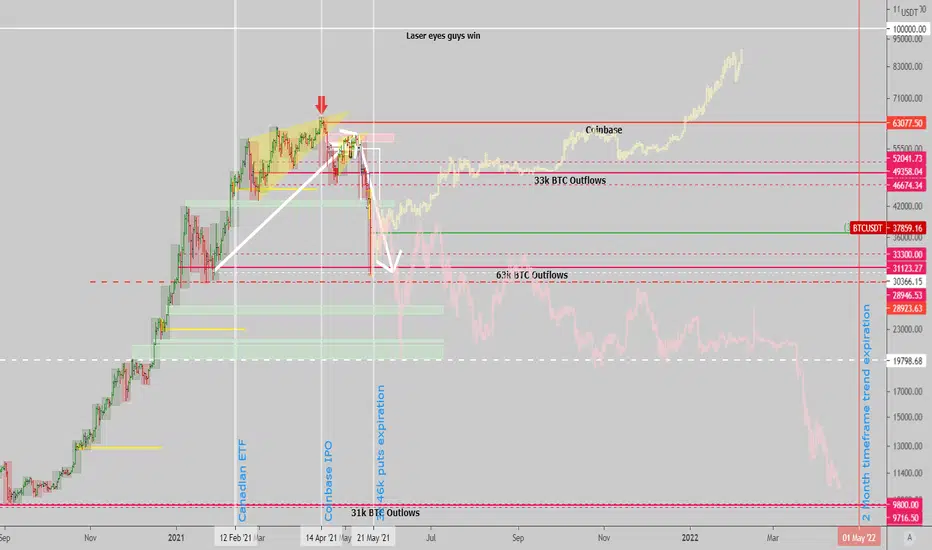

We either started a bear market here, since the break down from the lower high (and the 2nd and smaller rising wedge concluded) OR we are at a nice retracement to rejoin the bullish trend which is still active, which could culminate with a rally topping short of 100k, by May 2022. I can confirm which is more likely over the coming days and weeks, and will give my clients the cue to buy when it is low risk, if the bull case is more probable. We sit in cash for now, since we sidestepped the decline from 54200 roughly. Altcoins have topped against #BTC as I explained in my dominance and

ETHBTC post, so the best bet is to rotate away from them if you didn't already do it, and probably a good time to hunt for short ALTBTC ops, whatever the trend direction may be. In both scenarios, altcoins lose.

ETHBTC post, so the best bet is to rotate away from them if you didn't already do it, and probably a good time to hunt for short ALTBTC ops, whatever the trend direction may be. In both scenarios, altcoins lose.

Cheers,

Ivan Labrie.

Cheers,

Ivan Labrie.

Trade active

Siding towards bullish outcome, back to 55k area next, by June 7th, best case scenario. Else it is a dead cat bounce, for no short term implies we tag 46k in 12hs.If bullish we will break out above the top in a few weeks and move towards 119k after. Strange moves, as we never had corrections as large as this in a bull market after the 2015 bottom. It could be the case, so, worth a shot with defined risk. I'm long again from 41850. (was short from 54200)

if dead cat bounce, and down trend resumes we will know it in a few days, for now the daily down trend effect seems to be over. It can coil and form another distribution pattern in a few days too, I will be on the lookout for that.

Note

As I expected prices crashed again towards 31k before rebounding again now.Seems like sideways action next, before breaking lower again judging by the overwhelming bullish consensus, sentiment wise.

Note

More likely to get bearish continuation it seems. We had a stream of negative regulatory news and some 'good' news from Coindesk's Consensus event in Miami but sentiment remains hopium filled and good news did nothing for price here.Note

Note

(i don't endorse dumb triangles drawn with simple lines like that btw, but everyone is looking to buy a breakout above the upper line, I think it'll end badly)Note

This could be where it rebounds a bit if people shorted down here, else it might stay sideways a couple days until a fundamental catalyst emerges that causes price to move out of this range: One possible event would be if

Note

I figured we would retest the top of the range and break out above the trendline people were watching, that got people to fomo into longs at the top again. Now we go down to margin call them, then could keep falling, or bounce again. It won't move big out of this range until we get some more fundamental developments hitting crypto negatively. Current fundamental events with El Salvador and other countries adopting it are not particularly bullish as they won't generate demand for buy and hold. They simply are more ways for current holders to spend their crypto and incentivize foreign investors to bring money to El Salvador...Not bullish for BTC necessarily, despite everyone's excitement.Note

Notice the effect of news on short term price action, key levels formed after each big news event are a lasting important reference level for price.

I think market will remain sideways before breaking down, can take a while to sort itself out, I don't see evidence of a bottom here, sentiment is totally wrong for that and fundamental developments give the illusion of bullishness but there is no substance to it. None of the current developments (other than Saylor buying 500m worth of

Note

Saylor himself seems to have bot today, chose the lowest volume day of the week to buy to try and squeeze shorts and rescue his underwater bonds.Daily triggered an uptrend to 47k, invalid if below 36420.

I'm not long yet, hate the sentiment, I suspect price will drop again even if it jumps here. Market likely won't make a new ATH until 2023.

Note

My bad, target is 50-53k if this doesn't fall below 36419 until July 3rd.Note

Had bought a 15% position but I suspect this is still range bound.There's two possible scenarios:

1-Market bottomed but it'll go sideways until mid 2023

2-The bottom will be lower over time.

I don't think things can recover so easily.

Order cancelled

Something like this. I included the S2F forecasts. I suspect belief in it will be destroyed alongside Saylor being forced out of

Note

Left price scale is Btc prices. It's an analogy to Trade active

Bot back my position after hearing from Saylor's 1b stock offering. I sold 40600 ish and bot back 40230.

Note

I will publish a new chart, with my up to date views.'brgod, I think price can go higher in the short term, near 49-51k before falling back to 35k again, if it doesn't fall below 36420 before July 3rd. This daily timeframe signal didn't exist until yesterday. So I couldn't have seen it coming before confirmation.

The longer term view, I base it on the fact price reacted to the long term target at 57k by falling dramatically after confirming a terminal triangle pattern at the top. This implies a long term trend ended. To restart another bull cycle, it will take a long time, despite what shape the bear market pattern takes.

I was not sure if price had bottomed and could rally higher than the existing sideways range before yesterday, it could have fallen further towards 25k, had it stayed down on prior attempts at breaking down.

Saylor's bond offering combined with El Salvador news, and now his 1b stock offering allow him to buy and send price higher potentially, big sellers might choose to sidestep this buying and instead short higher after he is out of ammo. That said, it is unlikely the worst of the risk is over, as fundamentals of supply and demand are bad, since we lost the GBTC premium, and corporate treasurer demand dried up.'

Trade closed manually

Sold my long position for a small loss, last trade was profitable so that's a small profit combined with this losing one. I'm not taking risks here, this could break down once again. Saylor's stock offering is reserved for the future in case they consider it's vital to play that card. Until then it'll be an ace up his sleeve but won't have an impact on the market. Price is below the key level for the news, and it seems like the market will force Saylor to spend his 500m, lower. He doesn't seem keen on buying 'high'.

Order cancelled

Open interest has been increasing lately, we didn't really have fuel from long liquidations to crash lower before but now we probably do.Note

Note

If this doesn't stay near the lows, it will rebound again, and fail to trend and break away from the range. We should get follow through in the next 3 days.Note

New lows, the sideways thesis is probably out by now. The level below in green is a wide support area in the long term chart, won't be easy to cross, but once below the previous ATH level, nothing stops price from falling to 9485 potentially over time. This can be under pressure for 2 years easily.

Note

The original outlook ended up fitting the action better.🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.