Hi friends, hope you are well and welcome to the new update on Bitcoin ( BTC ).

Channel oscillator:

On a daily time frame Bitcoin has formed a down channel. Now it is reached the support of this channel again. In the meanwhile the RSI is also oversold. Now if the priceline of BTC reaches the resistance then it can move to $45K.

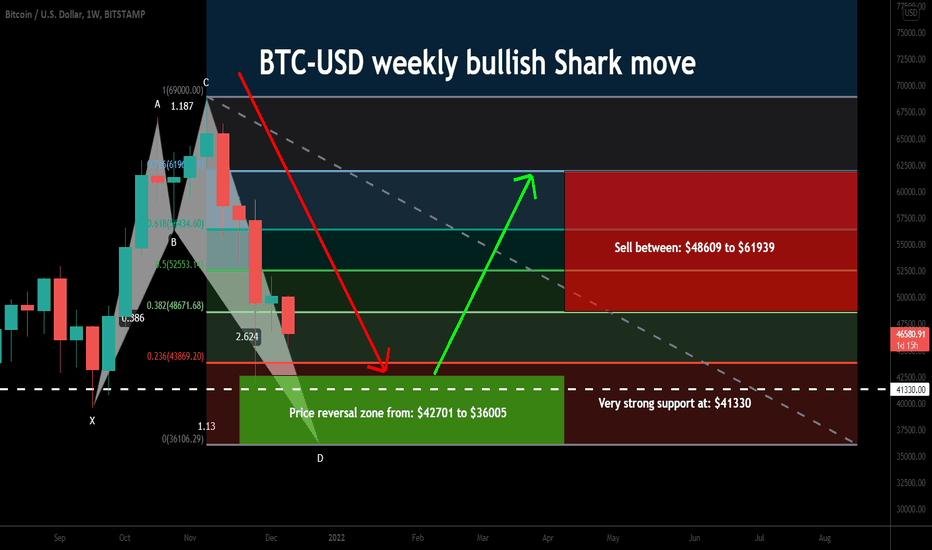

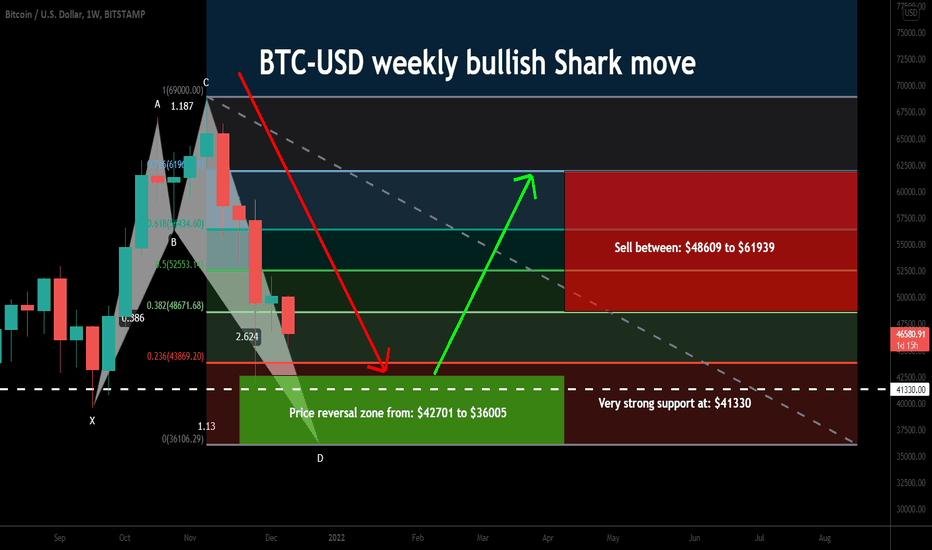

Bullish harmonic pattern.

On a weekly time frame chart, the BTC has formed bullish Shark . There is also very strong support from $41330 to $39500, therefore the price may start a reversal move above this level. However, the maximum potential reversal zone is at $36K.

In order to trade this patter the targets can be as below:

Buy between: $42701 to $36005

Sell between: $48609 to $61939

Stop loss:

The maximum extent of the buying zone $36005 can be used as a stop loss.

Possible profit and loss ratio:

As per the above targets, this trade has a profit possibility of up to 72%, and the loss possibility is 16%.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

Channel oscillator:

On a daily time frame Bitcoin has formed a down channel. Now it is reached the support of this channel again. In the meanwhile the RSI is also oversold. Now if the priceline of BTC reaches the resistance then it can move to $45K.

Bullish harmonic pattern.

On a weekly time frame chart, the BTC has formed bullish Shark . There is also very strong support from $41330 to $39500, therefore the price may start a reversal move above this level. However, the maximum potential reversal zone is at $36K.

In order to trade this patter the targets can be as below:

Buy between: $42701 to $36005

Sell between: $48609 to $61939

Stop loss:

The maximum extent of the buying zone $36005 can be used as a stop loss.

Possible profit and loss ratio:

As per the above targets, this trade has a profit possibility of up to 72%, and the loss possibility is 16%.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.