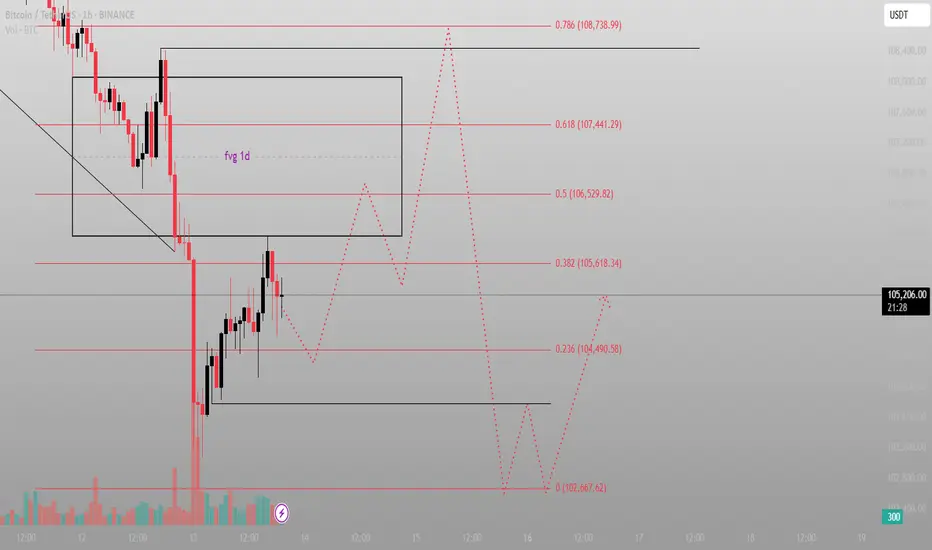

This is a classic Smart Money sequence. Most are watching the imbalance at 106.5k–108.7k and expecting immediate delivery. But that’s not how this game works.

The setup:

Price broke down violently, then reversed with momentum — stopping right beneath the daily FVG block. That alone tells me it’s not ready. It’s gathering.

Below? Multiple fib levels that haven’t been tested — 104.4k (0.236), 102.6k (0.0), and a volume-backed rejection wick that still holds weight.

The market is likely to dip again — pull into deeper discount, reset the low timeframe narrative — and only then attack the FVG and upper sweep zones.

What I expect:

Sweep of 102.6k (final liquidity run)

Reaction → reclaim 104.4k

Push into the FVG toward 106.5k (0.5) and possibly 107.4k (0.618)

No emotional reaction to the red candles — this is structure playing out, not weakness unfolding.

Plan:

Ideal Entry: 102.8k–103.2k range

SL: Below 102.6k

TP1: 105.6k

TP2: 107.4k

Final: 108.7k clean inefficiency fill

Let it dip. Let it breathe. That’s where conviction is built.

Final thought:

“The real move starts when they convince you it’s done.”

The setup:

Price broke down violently, then reversed with momentum — stopping right beneath the daily FVG block. That alone tells me it’s not ready. It’s gathering.

Below? Multiple fib levels that haven’t been tested — 104.4k (0.236), 102.6k (0.0), and a volume-backed rejection wick that still holds weight.

The market is likely to dip again — pull into deeper discount, reset the low timeframe narrative — and only then attack the FVG and upper sweep zones.

What I expect:

Sweep of 102.6k (final liquidity run)

Reaction → reclaim 104.4k

Push into the FVG toward 106.5k (0.5) and possibly 107.4k (0.618)

No emotional reaction to the red candles — this is structure playing out, not weakness unfolding.

Plan:

Ideal Entry: 102.8k–103.2k range

SL: Below 102.6k

TP1: 105.6k

TP2: 107.4k

Final: 108.7k clean inefficiency fill

Let it dip. Let it breathe. That’s where conviction is built.

Final thought:

“The real move starts when they convince you it’s done.”

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.