🔸Introduction:

In financial markets in general—and the crypto market in particular—understanding market liquidity and imbalance zones is essential for building successful trading strategies. One of the most prominent modern price analysis concepts, especially within the Smart Money Concepts (SMC) framework, is the Fair Value Gap (FVG). This refers to a price imbalance between buyers and sellers.

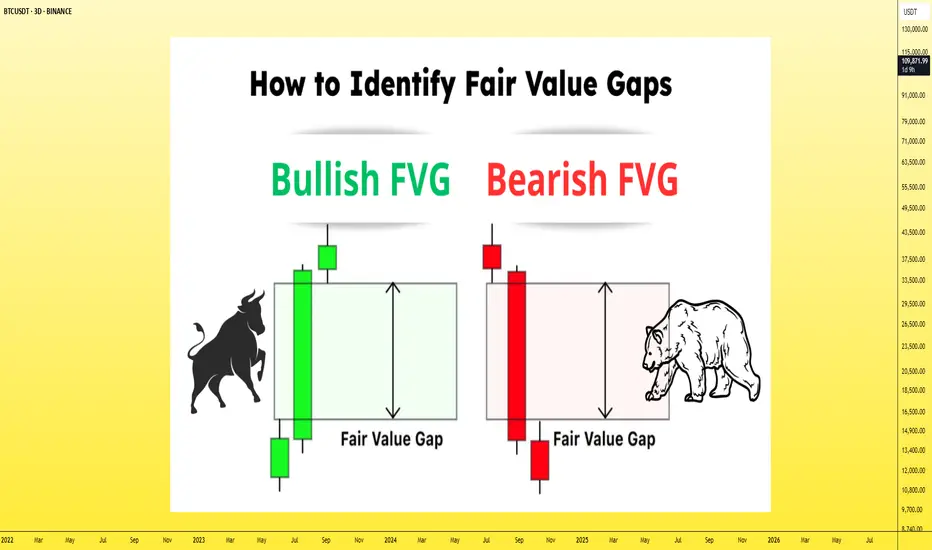

🔸What is the Fair Value Gap (FVG)?

A Fair Value Gap is an area on the price chart that shows an imbalance between supply and demand. It occurs when the price moves rapidly in one direction without being fairly traded within a balanced price range. This usually happens due to the entry of large players or “smart money,” creating a gap between three consecutive candlesticks on the chart.

Classic Bullish FVG Setup:

Candle 1: A bearish or neutral candle.

Candle 2: A strong bullish candle (usually large).

Candle 3: A bullish or neutral candle.

🔸Where is the Gap?

The gap lies between the high of candle 1 and the low of candle 3.

If candle 3 does not touch the high of candle 1, an unfilled price gap (FVG) is present.

🔸How is FVG Used in Market Analysis?

Traders use Fair Value Gaps as potential areas for:

Entering trades when the price returns to retest the gap.

Identifying zones of institutional interest.

Setting potential targets for price movement.

🔸Common Scenario:

If a strong bullish candle creates a Fair Value Gap, the price often returns later to retest that gap before continuing its upward movement.

The gap can be considered "delayed demand" or "delayed supply".

🔸🔸Types of FVG:🔸🔸

🔸Bullish FVG:

Indicates strong buying pressure.

The price is expected to return to the gap, then bounce upwards.

🔸Bearish FVG:

Indicates strong selling pressure.

The price is expected to return to the gap, then continue downward.

🔸Relationship Between FVG and Liquidity:

Fair Value Gaps are often linked to untapped liquidity zones, where buy or sell orders have not yet been fulfilled. When the price returns to these areas:

Institutional orders are activated.

The price is pushed again in the primary direction.

🔸How to Trade Using FVG (Simple Entry Plan):

Steps:

Identify the overall trend (bullish or bearish).

Observe the formation of an FVG in the same direction.

Wait for the price to return and test the gap.

Look for entry confirmation (like a reversal candle or a supporting indicator).

Set your stop loss below or above the gap.

Take profit at a previous structure level or the next FVG.

🔸🔸Real-World Examples (Simplified):🔸🔸

🔸Bullish Example:

A strong bullish candle appears on BTC/USD.

A gap forms between $74K and $80K.

The price rises to $108K, then returns to 74K$ (inside the gap).

From there, it begins to rise again.

🔸Important Tips When Using FVG:

Don’t rely on FVGs alone—combine them with:

-Market Structure.

-Support and resistance zones.

-Confirmation indicators like RSI or Volume Profile.

-Best used on higher timeframes (15m, 1H, 4H, Daily).

-The gap can be filled the same day or after days/weeks.

🔸Conclusion

The Fair Value Gap is a powerful analytical tool used to identify zones of institutional interest. It plays a key role in the toolset of professional traders who follow smart money principles. By mastering this concept, traders can improve entry and exit timing, reduce risk, and increase their chances of success.

Best regards Ceciliones🎯

In financial markets in general—and the crypto market in particular—understanding market liquidity and imbalance zones is essential for building successful trading strategies. One of the most prominent modern price analysis concepts, especially within the Smart Money Concepts (SMC) framework, is the Fair Value Gap (FVG). This refers to a price imbalance between buyers and sellers.

🔸What is the Fair Value Gap (FVG)?

A Fair Value Gap is an area on the price chart that shows an imbalance between supply and demand. It occurs when the price moves rapidly in one direction without being fairly traded within a balanced price range. This usually happens due to the entry of large players or “smart money,” creating a gap between three consecutive candlesticks on the chart.

Classic Bullish FVG Setup:

Candle 1: A bearish or neutral candle.

Candle 2: A strong bullish candle (usually large).

Candle 3: A bullish or neutral candle.

🔸Where is the Gap?

The gap lies between the high of candle 1 and the low of candle 3.

If candle 3 does not touch the high of candle 1, an unfilled price gap (FVG) is present.

🔸How is FVG Used in Market Analysis?

Traders use Fair Value Gaps as potential areas for:

Entering trades when the price returns to retest the gap.

Identifying zones of institutional interest.

Setting potential targets for price movement.

🔸Common Scenario:

If a strong bullish candle creates a Fair Value Gap, the price often returns later to retest that gap before continuing its upward movement.

The gap can be considered "delayed demand" or "delayed supply".

🔸🔸Types of FVG:🔸🔸

🔸Bullish FVG:

Indicates strong buying pressure.

The price is expected to return to the gap, then bounce upwards.

🔸Bearish FVG:

Indicates strong selling pressure.

The price is expected to return to the gap, then continue downward.

🔸Relationship Between FVG and Liquidity:

Fair Value Gaps are often linked to untapped liquidity zones, where buy or sell orders have not yet been fulfilled. When the price returns to these areas:

Institutional orders are activated.

The price is pushed again in the primary direction.

🔸How to Trade Using FVG (Simple Entry Plan):

Steps:

Identify the overall trend (bullish or bearish).

Observe the formation of an FVG in the same direction.

Wait for the price to return and test the gap.

Look for entry confirmation (like a reversal candle or a supporting indicator).

Set your stop loss below or above the gap.

Take profit at a previous structure level or the next FVG.

🔸🔸Real-World Examples (Simplified):🔸🔸

🔸Bullish Example:

A strong bullish candle appears on BTC/USD.

A gap forms between $74K and $80K.

The price rises to $108K, then returns to 74K$ (inside the gap).

From there, it begins to rise again.

🔸Important Tips When Using FVG:

Don’t rely on FVGs alone—combine them with:

-Market Structure.

-Support and resistance zones.

-Confirmation indicators like RSI or Volume Profile.

-Best used on higher timeframes (15m, 1H, 4H, Daily).

-The gap can be filled the same day or after days/weeks.

🔸Conclusion

The Fair Value Gap is a powerful analytical tool used to identify zones of institutional interest. It plays a key role in the toolset of professional traders who follow smart money principles. By mastering this concept, traders can improve entry and exit timing, reduce risk, and increase their chances of success.

Best regards Ceciliones🎯

🔻 free crypto signals🔻

t.me/itradeoncrypto

We're confident in our premium service — if you don't recover your subscription fee within 48 hours, we'll refund you.🎯

Message me on Telegram for full details.

t.me/Cecilion1

t.me/itradeoncrypto

We're confident in our premium service — if you don't recover your subscription fee within 48 hours, we'll refund you.🎯

Message me on Telegram for full details.

t.me/Cecilion1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔻 free crypto signals🔻

t.me/itradeoncrypto

We're confident in our premium service — if you don't recover your subscription fee within 48 hours, we'll refund you.🎯

Message me on Telegram for full details.

t.me/Cecilion1

t.me/itradeoncrypto

We're confident in our premium service — if you don't recover your subscription fee within 48 hours, we'll refund you.🎯

Message me on Telegram for full details.

t.me/Cecilion1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.