I think we can all agree that the price is contracting as we near the end of this wedge.

The bulls are saying "This is Wykoff Accumulation", and "The price will fire off to the upside".

The bears are saying "The price will fire off to the down side, merrrr"; but will they take profit if we do?

Hopefully they do, because it's going to happen Very quickly when we least expect it. That's just how squeezes work.

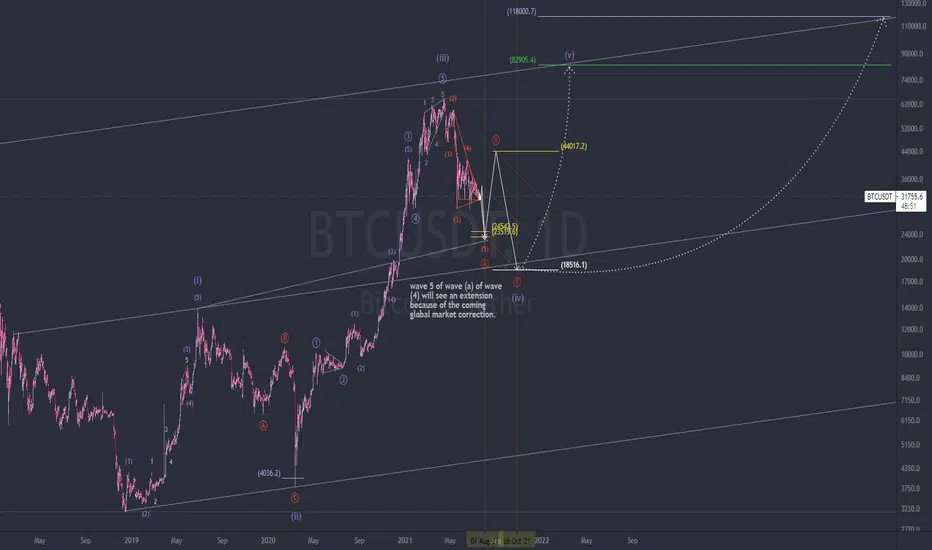

Elliott Wave Theory says that we are going to see an extended Wave 5 of this Wave (A). My reasoning behind this move is the global market correction which is going to last through the end of September.

When Spx500 goes down for it's initial Wave (A), that should be when Bitcoin finishes it's Wave (A) as well, as markets tend to flow harmoniously with each other.

Keep some long orders between 23.6~24.5 just in case, and if we do happen to get down there, your orders will fill & you will be a very happy human.

We are nearing extremely oversold levels on the 1,3,12h time-frames. The indicator I use regularly is getting into the area where we are ready for a strong rip up, but in my opinion - not before this last rip down to massacre everyone who has been buying in this lower range. The market is relentless, and the market makers do not want us to profit from the parabolic Wave B; so they will do everything in their power to shake us out before it happens.

Spot buys are the safest, lower leverage works too. High leverage trades are risky down there, as we could see one hell of a liquidation wick when the time comes.

Stop losses are your friend, they will protect you from some serious losses, if we get a huge liquidation\scam wick one of these days.

I'm genuinely ready for this Wave B play, and I have been for quite some time now. The areas of confluence I found on my chart today really resonate with me, and they meet exactly at the bottom of the bear channel on August 1st. All of these trendlines converge in the center of the 1.618~1.75 extension (extended Wave 5 target), as well as a horizontal trendline from the previous 2019 high. That trendline previously acted as resistance at some point, but was eventually flipped into support back in December of 2020.

-----

I have outlined two possible pathways after we finish this correction in late October. The first one gives us a quick and easy parabolic move to about 83k before topping out. This could be the quickest move we've seen yet, and the most profitable with a safe high leveraged setup. The second scenario would take a lot longer to play out, while some serious accumulation occurs - once accumulation is complete, we begin a rise to that 120k level.

Scenario #3, I did not map out in this picture, but we can talk about it briefly. Since none of the waves have seen extensions on the larger count yet, we could see a Wave 5 extension which takes us all the way to 200~250k. I have seen some beautiful extensions in these markets before, and it is not unlikely that we will see it for this final run.

Taking it one day at a time / analyzing these charts every single day, just in case something changes. If anything does, I will be quick to update you all so stay tuned in. Stay well, trade safe, and expect the unexpected in these wicked markets.

✌💸

The bulls are saying "This is Wykoff Accumulation", and "The price will fire off to the upside".

The bears are saying "The price will fire off to the down side, merrrr"; but will they take profit if we do?

Hopefully they do, because it's going to happen Very quickly when we least expect it. That's just how squeezes work.

Elliott Wave Theory says that we are going to see an extended Wave 5 of this Wave (A). My reasoning behind this move is the global market correction which is going to last through the end of September.

When Spx500 goes down for it's initial Wave (A), that should be when Bitcoin finishes it's Wave (A) as well, as markets tend to flow harmoniously with each other.

Keep some long orders between 23.6~24.5 just in case, and if we do happen to get down there, your orders will fill & you will be a very happy human.

We are nearing extremely oversold levels on the 1,3,12h time-frames. The indicator I use regularly is getting into the area where we are ready for a strong rip up, but in my opinion - not before this last rip down to massacre everyone who has been buying in this lower range. The market is relentless, and the market makers do not want us to profit from the parabolic Wave B; so they will do everything in their power to shake us out before it happens.

Spot buys are the safest, lower leverage works too. High leverage trades are risky down there, as we could see one hell of a liquidation wick when the time comes.

Stop losses are your friend, they will protect you from some serious losses, if we get a huge liquidation\scam wick one of these days.

I'm genuinely ready for this Wave B play, and I have been for quite some time now. The areas of confluence I found on my chart today really resonate with me, and they meet exactly at the bottom of the bear channel on August 1st. All of these trendlines converge in the center of the 1.618~1.75 extension (extended Wave 5 target), as well as a horizontal trendline from the previous 2019 high. That trendline previously acted as resistance at some point, but was eventually flipped into support back in December of 2020.

-----

I have outlined two possible pathways after we finish this correction in late October. The first one gives us a quick and easy parabolic move to about 83k before topping out. This could be the quickest move we've seen yet, and the most profitable with a safe high leveraged setup. The second scenario would take a lot longer to play out, while some serious accumulation occurs - once accumulation is complete, we begin a rise to that 120k level.

Scenario #3, I did not map out in this picture, but we can talk about it briefly. Since none of the waves have seen extensions on the larger count yet, we could see a Wave 5 extension which takes us all the way to 200~250k. I have seen some beautiful extensions in these markets before, and it is not unlikely that we will see it for this final run.

Taking it one day at a time / analyzing these charts every single day, just in case something changes. If anything does, I will be quick to update you all so stay tuned in. Stay well, trade safe, and expect the unexpected in these wicked markets.

✌💸

Note

i've got some long orders at 30,888 \ 30,825 \ 30,850 \ 30800 for a short term swing from the bottom of this wedge. indicators look ripe for a pop from herestops on the other side of it.

i only share a tiny fragment of my ideas on this platform. to view my daily work, join the lunar syndicate 9 👇

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

i only share a tiny fragment of my ideas on this platform. to view my daily work, join the lunar syndicate 9 👇

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.