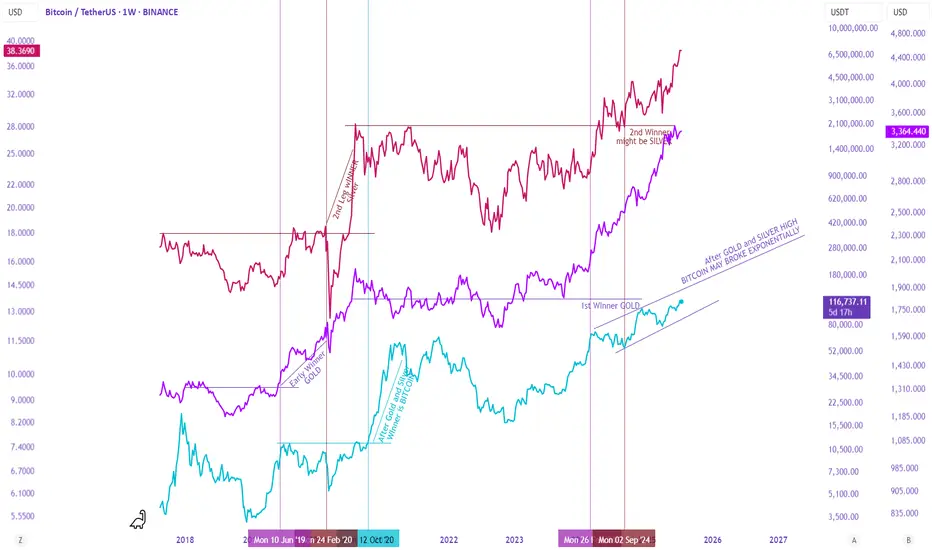

There seems to be a complex yet recurring relationship between Gold, Silver, and Bitcoin during anti-currency phases (when fiat weakens).

First Leg – Gold Leads

Gold typically leads the first leg, breaking out to new highs. Silver follows but lags—trending up without breaking major resistance. During this phase, the Gold/Silver ratio expands.

Second Leg – Silver Takes Over

Eventually, Silver breaks resistance and becomes the second leg leader. As it outperforms Gold, the Gold/Silver ratio contracts back to mean.

Bitcoin, during this time, is usually bottoming or entering Stage 2 (early uptrend). This time, it has already broken resistance but is rising slower than in past cycles.

Third Leg – Bitcoin Dominates

As Gold and Silver peak and begin to correct, Bitcoin accelerates, often making new all-time highs (ATH).

This staggered rotation played out during the 2018–2022 cycle. Let's see if history rhymes in this cycle.

First Leg – Gold Leads

Gold typically leads the first leg, breaking out to new highs. Silver follows but lags—trending up without breaking major resistance. During this phase, the Gold/Silver ratio expands.

Second Leg – Silver Takes Over

Eventually, Silver breaks resistance and becomes the second leg leader. As it outperforms Gold, the Gold/Silver ratio contracts back to mean.

Bitcoin, during this time, is usually bottoming or entering Stage 2 (early uptrend). This time, it has already broken resistance but is rising slower than in past cycles.

Third Leg – Bitcoin Dominates

As Gold and Silver peak and begin to correct, Bitcoin accelerates, often making new all-time highs (ATH).

This staggered rotation played out during the 2018–2022 cycle. Let's see if history rhymes in this cycle.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.