Hi Traders,

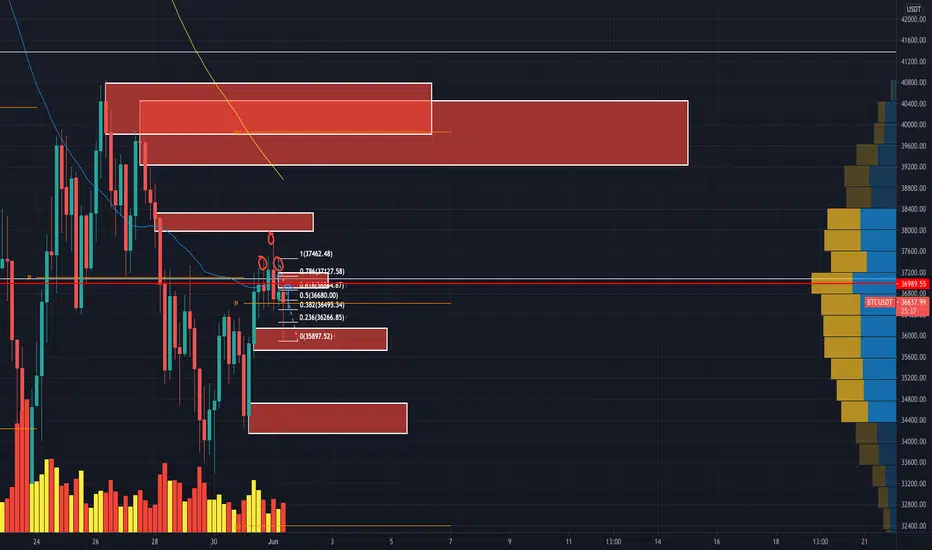

So on the most recent leg up we saw prices find some sensitivity in the markets as prices edged closer to the order block where a rejection occurred and prices pullback with a follow up of a new lower high. Currently we are now seeing prices going back up to form a new lower high at the order block which lies between the the 0.618 and 0.786 FIB levels. We will watch prices as it completes the new lower high within that zone for a potential pullback to the 0.382 fib level where then prices go up to the top order block where R1 pivot lies and the 100MA 4HR can be seen. If this series of events occur then we can expect prices to push back up and look bullish again.

However, if we fail to create new higher highs not he 4HR then we will look for prices to tap into more liquidity at the lower 2 zones for prices to then go back up.

A lot of money has been pulled out of the market and there needs to be a period of time where liquidity/positions are built up for prices to go back to their normal bullish motive. Due to the recent event where we have seen such a huge sell off we will need to keep in mind that we could see a big rise in prices for the institutions to trap LONG traders in the market and give the perceptions that the market has recovered to then push prices to create new lower lows on the higher timeframes.

As always if you enjoy the content don't forget to click the like button and make a comment on your opinion.

Thanks

MS

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

So on the most recent leg up we saw prices find some sensitivity in the markets as prices edged closer to the order block where a rejection occurred and prices pullback with a follow up of a new lower high. Currently we are now seeing prices going back up to form a new lower high at the order block which lies between the the 0.618 and 0.786 FIB levels. We will watch prices as it completes the new lower high within that zone for a potential pullback to the 0.382 fib level where then prices go up to the top order block where R1 pivot lies and the 100MA 4HR can be seen. If this series of events occur then we can expect prices to push back up and look bullish again.

However, if we fail to create new higher highs not he 4HR then we will look for prices to tap into more liquidity at the lower 2 zones for prices to then go back up.

A lot of money has been pulled out of the market and there needs to be a period of time where liquidity/positions are built up for prices to go back to their normal bullish motive. Due to the recent event where we have seen such a huge sell off we will need to keep in mind that we could see a big rise in prices for the institutions to trap LONG traders in the market and give the perceptions that the market has recovered to then push prices to create new lower lows on the higher timeframes.

As always if you enjoy the content don't forget to click the like button and make a comment on your opinion.

Thanks

MS

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.