From a macro policy perspective, Bitcoin's development is ushering in a potentially favorable environment. Take the United States as an example, discussions around cryptocurrency policies have gradually increased in recent years. Although the direction has not been fully clarified, some positive signals continue to emerge. For instance, certain U.S. legislators have proposed bills to promote the compliant development of the cryptocurrency industry, aiming to establish a clearer regulatory framework for digital currencies like Bitcoin. Once these policies are implemented, they will attract more traditional financial institutions and compliant funds to enter the market. Additionally, globally, more and more countries are researching and exploring the application of digital currencies, and the acceptance of Bitcoin is gradually increasing. This improvement in the policy environment provides a solid foundation for Bitcoin's price increase.

Bitcoin's macro policy environment is transitioning from "unregulated chaos" to "compliance-driven order." The clarification of regulatory frameworks in the U.S. and the advancement of global central bank digital currencies (CBDCs) form a long-term bullish logic. With the current price correction to the key support level of 105,988 USD and technical signs of stabilizing, this presents an ideal window to position for both "policy dividends" and a "technical rebound."

Today's BTC trading strategy, I hope it will be helpful to you

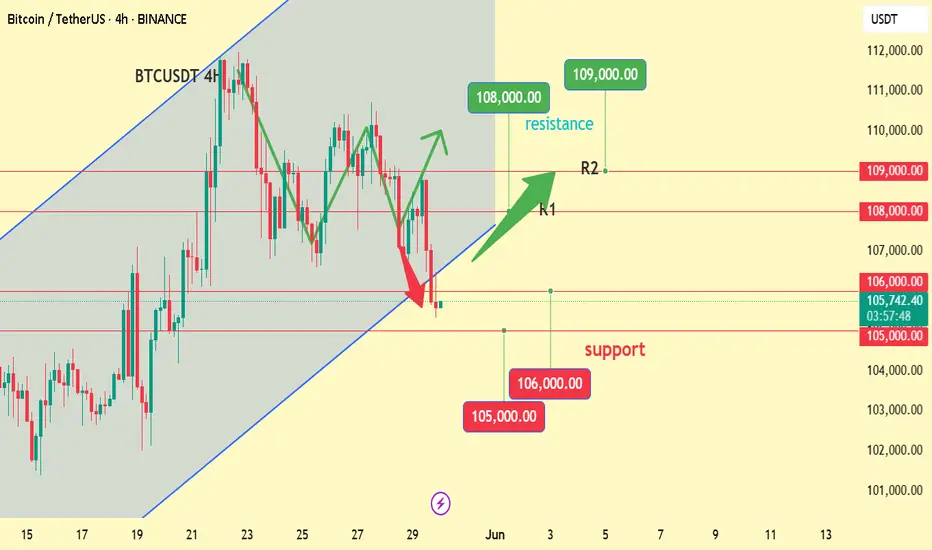

BTCUSDT BUY@105000~106000

SL:103000

TP:108000~109000

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.