BZUN has been a price action dream

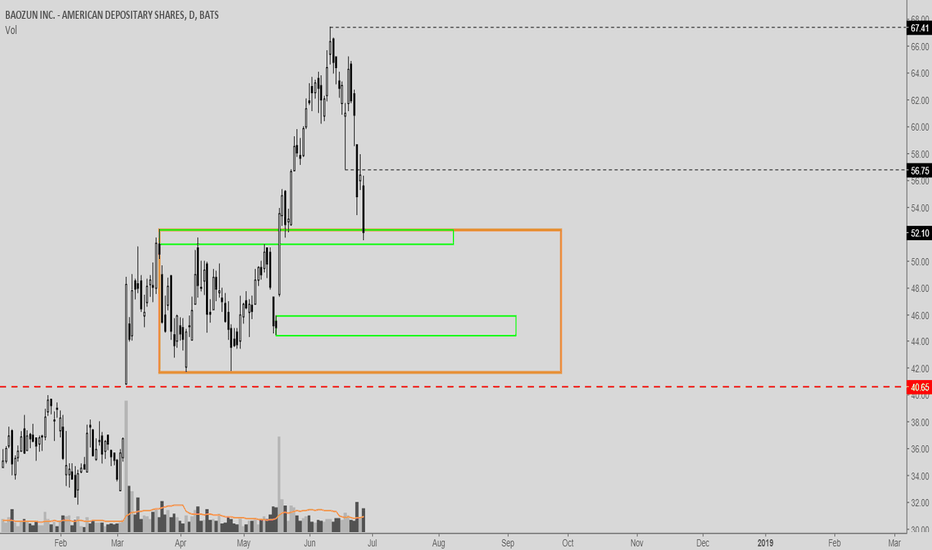

Similar setup to last earnings, bull div on daily going into earnings on 8/14

Buy in anticipation or buy the retest

Similar setup to last earnings, bull div on daily going into earnings on 8/14

Buy in anticipation or buy the retest

Note

That said it looks toppy as hell with that giant profit taking candle, weekly EMA downtrending, generally low volumeNote

Trying to make sense of this price action

If daily candle closes neutral, this action was to stop out shorts, then longs, then reverse at .705 OTE leaving retail behind

If candle still looks this ugly EOD, probable push lower to 200 EMA / .786 fib / FTR EQ / Gap Fill before bounce. Whether it's sustainable or not is a different question.

Note

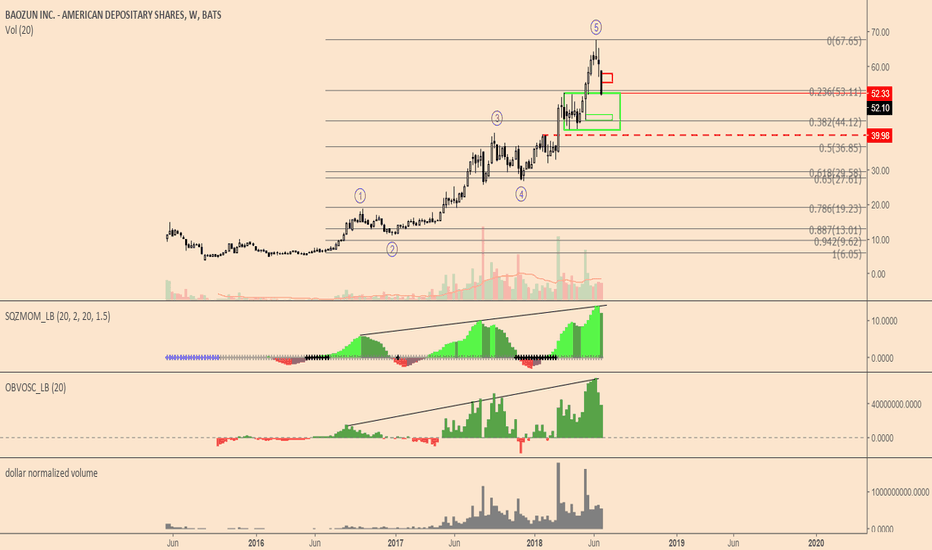

If you like Elliott Waves, interesting confluence

Clear 5 waves up

Currently making a zigzag, extension in yellow

Gap we just filled corresponds to 1.272 extension

Black fib retrace, areas I'm interested in in white

.382 corresponds to 55W EMA

.5 corresponds to 89W EMA + Gap on daily

.65 corresponds to low of wave 4

.705 corresponds to 2.618 ext of current zigzag

All would make for good bounces

Note

Bias:

Bull volume MIA, likely going down

Probably bounce from 200D EMA on second test, if weaker bounce than current one, likely to go deeper into this weekly demand zone (FTR used in previous analysis is redundant with this weekly demand zone so taken off)

Weekly market structure is bearish so I'm leaning toward price going lower

If we go lower:

Clean lows at 44.55, expecting sweep of sell stops under and bounce from 55W EMA

Note

Bull Case:

Almost at historical weekly RSI support

Breakout and retest of it started the parabolic run

Nicely proportioned zigzag since the top could mark a reversal

BUT would be less than a .382 retracement which is very rare and only in very bullish cases; this doesn't look that bullish to me

Breakout down from 48 RSI and retest seems more likely

Interesting to note: RSI caught the bear div at the top, OBVOSC didn't

Note

That low volume double top is clearly distribution in hindsightNote

Biggest mistake so far was to underestimate the bounce and expecting resistance at a low TF structure.

Weekly perspective shows a clear 'Nose' acting as resistance from the bounce off 200D EMA.

Anemic volume to the upside suggests relief rally before continuation.

Bias is down until proven otherwise, re-evaluating after a close above 58.66

Note

Market bought into that big dip into 43's, how confident are you in your game plan?Note

Ran out of free indicator space on my main layout so opened up this old one from August to throw ATR bands (20,20) on top

First red circle is tap of -3 ATR before bounce to slightly below +1 ATR

Second circle is our current tweezer bottom + hammers + swing failure pattern which is obviously bullish af, wicked to slightly above -3 ATR, target previously mentioned is consistent with a bounce to +1 ATR

All in tomorrow ^^

Note

Looks like price is running away premarket, not gonna get to add :'( Already sized pretty aggressively so not the biggest deal

Note

Adding in blue sd flip if price lets me

+9% in 2 days

Keep in mind your HTF bias and don't let it be shaken by what you see on LTF, I was 75% confident that the 15 min bear div would not invalidate my HTF bias, so that dip yday should logically be just to shake out late longs

Didn't TP at 47.5 like planned, this move is very likely going to >52, I'll just trail some stops

Note

Most volatility is in opening and closing hour, probably won't get to add where I wantNote

E: 46.05T: 52

S: Under 4H SFP

Think that's about double digit RRR...

Note

Bear engulfing daily has something like a 70% strike rate for more downside on BZUN, want to see close at least above 50% of this weekly range. On the flipside, this bearish engulfing is on low volume, potential shakeout. Staying in positions over the weekend.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.