Previous idea:

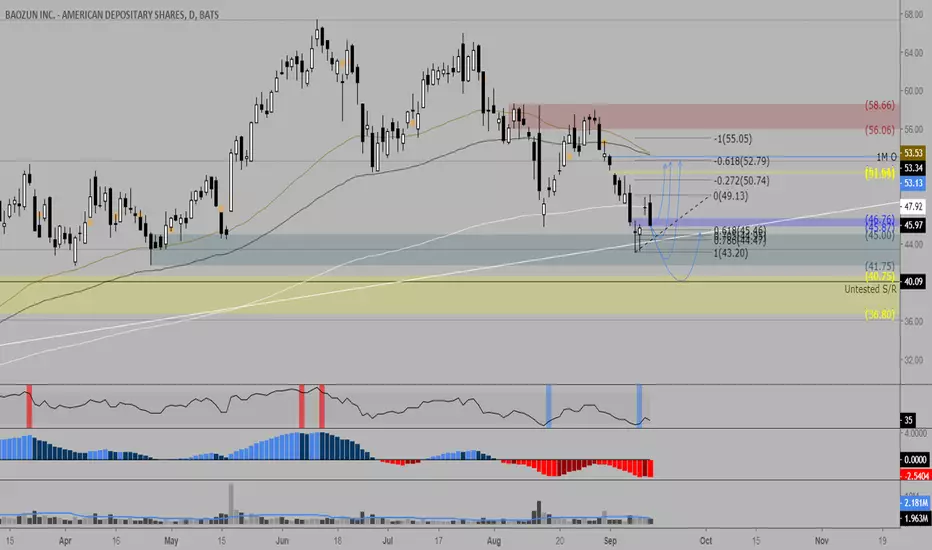

Scenarios that make sense to me:

1) Rally from 1H SD flip that was the premise of my second entry (unlikely because of the drift into the bottom of this SDF when price should have reacted more strongly if buyers were stepping up)

2) Bear engulfing plays out and price drops to top of flag that was the premise of my first entry, confluent with .705 of this leg up before rally to 1M O/.236 of entire 5 waves/-.618 of current leg, though there is a small 1D gap in the 51's that might be the top (likely)

3) Bear engulfing plays out and sweeps stops under clean lows / reaching deeper in demand zone for liquidity before bounce to target or to top of flag for breakeven exit, coinciding with LT trendline breakdown and retest (likely)

4) Bear engulfing plays out and price goes to 40.75 gap before bounce to top of demand flipped supply / trendline retest for breakeven exit (worst case)

1W shows a swing failure, wick through lowest body but closes above, obvious target is middle ATR band

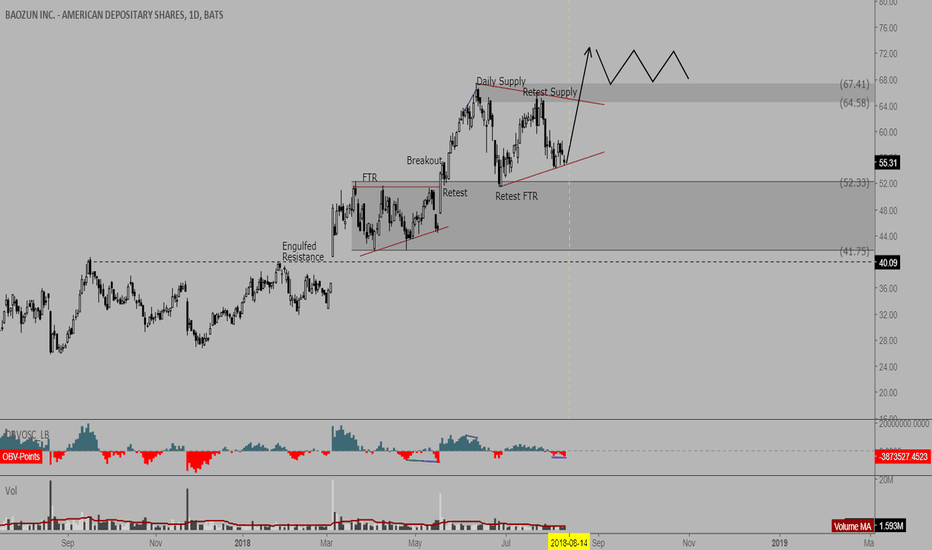

Scenarios that make sense to me:

1) Rally from 1H SD flip that was the premise of my second entry (unlikely because of the drift into the bottom of this SDF when price should have reacted more strongly if buyers were stepping up)

2) Bear engulfing plays out and price drops to top of flag that was the premise of my first entry, confluent with .705 of this leg up before rally to 1M O/.236 of entire 5 waves/-.618 of current leg, though there is a small 1D gap in the 51's that might be the top (likely)

3) Bear engulfing plays out and sweeps stops under clean lows / reaching deeper in demand zone for liquidity before bounce to target or to top of flag for breakeven exit, coinciding with LT trendline breakdown and retest (likely)

4) Bear engulfing plays out and price goes to 40.75 gap before bounce to top of demand flipped supply / trendline retest for breakeven exit (worst case)

1W shows a swing failure, wick through lowest body but closes above, obvious target is middle ATR band

Note

Volume spread analysis on 15 min

Highlighted three candles

1) High volume for relatively little drop -> Absorption

2) Low volume for relatively large drop

3) High volume for relatively little drop -> Absorption, buyers getting their bids filled at this level, possibly 2 was to allow 3 to occur

If that's the case we should see price go higher Monday

Note

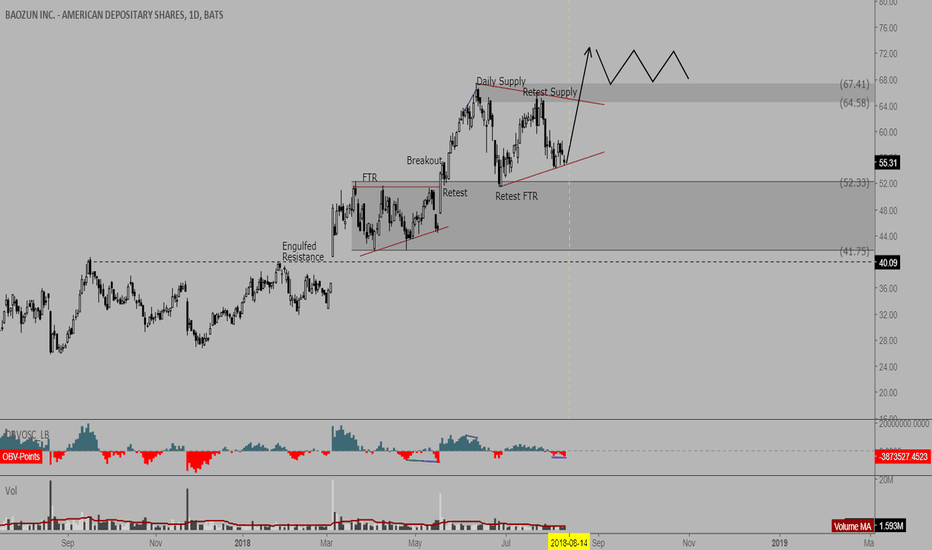

Hammered today but structurally still intact, staying in upper half of the breaker / above range EQ

A lot of fear over China stocks but this looks like an impulsive breakout, looking to retest white box before move higher

Overall bullish/neutral, spending much more time in this trade than I would've liked

Note

Forgot to mention, .618 fib on SHCOMP is untested SR flip + gap to fill, I'm looking lower after thatNote

Second weekly inside bar, I think it's pretty clear price wants higher given how much time we're spending in the upper half of this current range, should be a bigger move than my original target considering how long we've been ranging. Likely going to trail stops up instead of taking profit.Trade closed manually

Out under EQ of range this morning, price not acting constructivelyNote

Was right to get out, looking for a swing failure at this range low, huge absorptionNote

RIPNote

Missed a big move, gap fill + .5 fib + 89W EMA Weekly looks nice for a rally to .382 fib

Note

SHCOMP +4% LMAONote

Probably will stop out tomorrow, SHCOMP looks like breakdown of support, attempt to rally above, and rejection back downLet's see how the Asia session plays out...

Note

SHCOMP filled gap then reversed back up, good momentum to retest resistance especially on the back of rally in USNote

Just shy of T2, would lock in profits here if you followed alongTrade closed manually

This post is getting too long, will have a new idea for any significant move but should be thankful for juicing such a big move when everything's bearish :)Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.