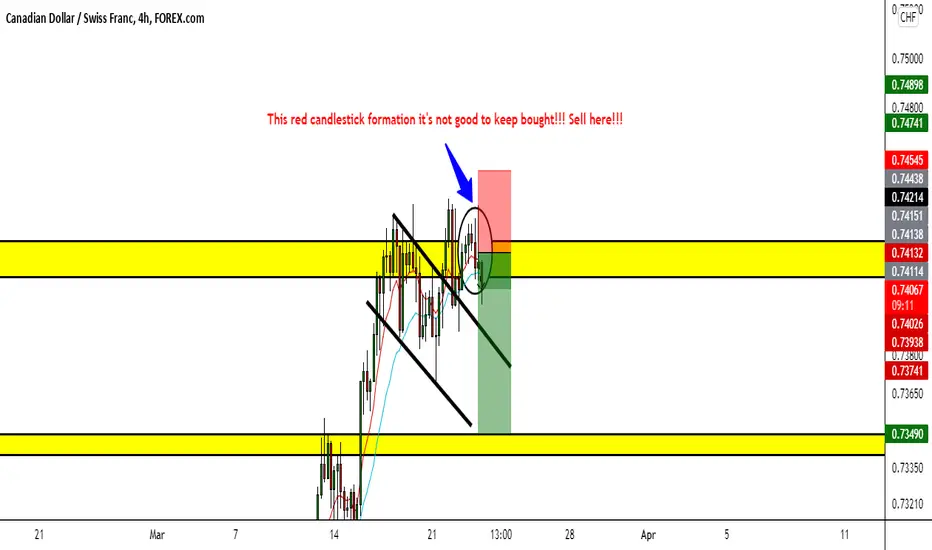

Canadian Dollar weak today as in H4, i show you the good moment to sell just if you follow my message that I send in the past analysis CAD/CHF in the comment box. So guys, I'm in short in that exactly moment when this red candlestick ending around 8:00 a.m. U.S. Eastern Time I put a sell order limit at $0.7122 CHF in the early and was activate my short posiiton around of 10 a.m. But I'm in short early at that price $0.7422 CHF and at the moment, I'm in profit. I closed up this short position because in H4 it's speak us the price action that we shouldneed to sell as we're in the key resistance zone by Daily timeframe and important zone of manipulation.

Also for my reference, I learned that when we're in that resistance zone and key resistance, we would need to be patience and hope when we look any break out of that strucutre to change our perspective, by the contrary, it's short.

I learn very well today it. But in H4 timeframe speaking me this sell.

Also for my reference, I learned that when we're in that resistance zone and key resistance, we would need to be patience and hope when we look any break out of that strucutre to change our perspective, by the contrary, it's short.

I learn very well today it. But in H4 timeframe speaking me this sell.

Trade closed: stop reached

Unfortunately, CAD/CHF hit my Stop Loss. As these days in H4 that has chance to become bearish. And also to udpate, we would need to know why Canadian Dollar got good news today. But to update, CADCHF forming a new bearish pattern a bearish rising wedge but the price action maybe in that lower price today at $0.7390 CHF and then up and that watch in H4 was an manipulation zone. Also, it's very important to discover what happen with Canadian Dollar and why this green candlestick goes bullish?Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.